Big Themes in Commodities

3 Min. Read Time

On a commodity insights panel for the Bloomberg "ETFs in Depth" conference yesterday, Luke Oliver, who previously managed $16bn of commodity futures assets and today leads the Climate investing platform at KraneShares, provided his views on a range of commodity and currency themes. Below is a recap of his main points from the panel.

First, commodities worked in 2022, in the sense that they maintained historical correlations with inflation. When inflation surprised this year, commodities offered both diversification and protection.

However, what was interesting is that the historically observed negative correlation of commodities to the US dollar was broken, as we’ve seen commodities AND the US dollar both rally. This doesn’t mean a new normal, but it means that any USD weakness could give commodities a further boost, which is another positive note for the space.

Second, let's pick this apart a bit more. Broad commodities are up around 24% in the last 12 months; however, that was substantially just an energy trade. The energy basket was up something like 38%; precious and base metals were all within an +/-2% or so, which is still a lot better than other asset classes.

What also changed--and is a huge development that seems to be running under the radar--is that most commodities have materially moved into backwardation, meaning that you earn a positive carry or that futures essentially allow you to buy at a discount to the price of the physical commodity. Why is that so interesting? Well, historically, commodities have had a negative roll yield, known as contango, of 8-10%! That means that typically you had to pay a premium for the diversification benefits of holding commodities. However, you are not "paid" to hold them, which makes this asset class suddenly very palatable. That positive effect is around 6% today, and even if that normalizes a little (6% is incredible!), investors could still pick up 2-3% over and above the price returns of a commodity basket.

So, commodities are ticking a lot of boxes here: diversification, performance, inflation hedge, positive carry, etc. Looking ahead, where are they going from here?

We believe energy still has legs. There has been an underinvestment in energy companies, due in part to environmentally conscious investing over the past 5-10 years, but also largely because energy companies, and their shareholders, have focused on making more money instead of supplying more fuel. There has been an observed reduction in capital expenditure, which subsequently results in the supply squeeze we’ve seen.

Oil has been trending down since the June peak, now around $74 per barrel. Despite this trend, we could see $90-95 per barrel in the short to medium term.

However, the big statement is that fossil fuels are ultimately going away as we continue to transition to cleaner energy. Moreover, this new "energy" will be largely contingent on metals—the kind of metals that are needed for solar and wind, updating the global grid, and essentially electrifying everything. Metals like Lithium, Copper, Zinc, Aluminum, Nickel, and Cobalt. Over the long term, metals should gain ground on energy, and both sectors will reprice. And remember, this isn't about ethics/morals but rather is simply what is going to happen.

Additionally, carbon credits will continue to grow, now covering 40% of global emissions. Outside of the compliance markets, carbon offsets will also fill in and overlap that number. These markets will be a leading futures exposure in years ahead as they will not have the self-correcting supply/price mechanism and are set to continually tighten. With Europe planning to front-load auctions to fund REPowerEU, we should see steepening years ahead and accelerating action. California's new scoping plans create at least 20% of additional tightening of targets, and Washington's market launched recently. This market is no longer new or niche, market volumes topped $700bn this year.

For investors, these electrification metals and carbon markets offer a changing supply and demand outlook that shouldn't be ignored.

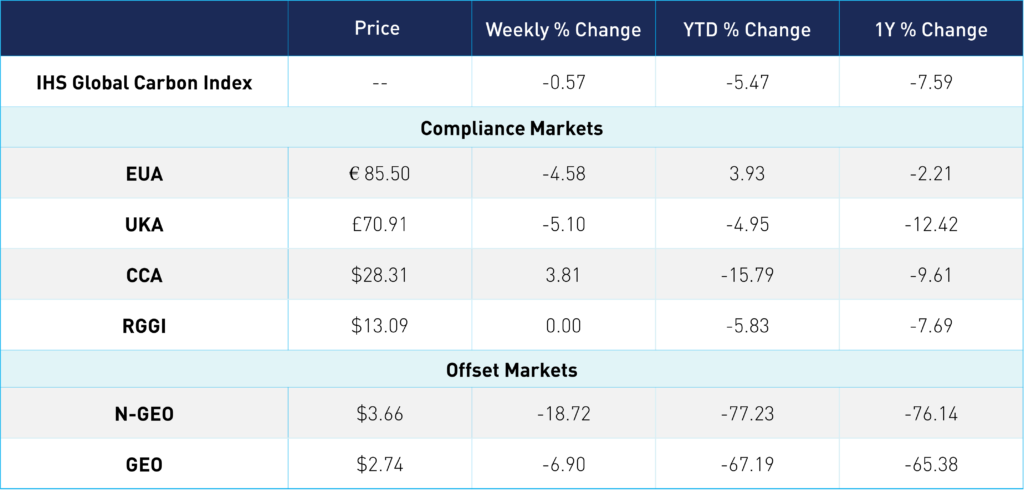

Carbon Market Roundup

EUAs fell from their high of €90.17 on Monday to end at €85.50 yesterday, down -4.58% week-over-week. UKEs also moved lower to £70, down -5.10% over the week. CCAs have trended up this week, over $28 for the first time in about a month. RGGI prices remained relatively flat, within the $13 range. N-GEOs trended down, dropping into the $3 range, while GEOs traded within a narrow range.