EUAs Rally, Closely Tracking Natural Gas

2 Min. Read Time

European carbon permit prices have rallied by as much as 37% in the last six weeks, climbing from a 30-month low of €51.08 at the end of February to touch just over €70.00, a week after the European Commission published verified emissions data for 2023 that showed a bigger-than-expected 16% drop in emissions.

Many carbon traders maintain that the short-term fundamentals remain unchanged, with renewables continuing to eat into thermal generation’s share of power production and industrial demand also lagging. That said, it’s becoming increasingly clear that carbon prices are tracking natural gas closely and, as such, are exposed to the volatility of that market.

Since moving away from pipeline gas from Russia, the region has relied more than ever on shipments of liquefied natural gas, much of it from the US. At the same time, the EU has embarked on initiatives to speed up the transition to renewable energy, driven largely by their REPowerEU, and this is bearing fruit.

The rally in carbon came as natural gas prices rose by 17% between late February and this week. Carbon and natural gas have shown a very high correlation in the last couple of months, with the rolling 10-day correlation currently at more than 0.9.

Verified emissions data for last year also showed that thermal power emissions dropped 24%, while industrial emissions fell 7%. Data from the European grid agency ENTSO-E show that in the first quarter of this year, total EU power generation from thermal sources (coal, lignite, and natural gas) fell 17.5% from Q1 2023. At the same time renewables output rose 14.5%.

The drop in demand last year means that the market’s overall surplus should increase, even after adjusting for a slight drop in supply for 2024 and factoring in the frontloaded permits being sold under the REPowerEU program. However, that increase in supply should also mean that the market stability reserve (MSR) will remove more allowances from the market between September 2024 and August 2025 than it did in 2023-24.

This combination of both bearish and bullish factors has left the market largely unchanged in terms of fundamental expectations. Traders still point to lower demand from the power sector and are waiting for signs of a revival in industrial production.

In the meantime, we're closely watching the natural gas market. Following a spike in natural gas prices, EUA prices jumped 8% this past Thursday, which triggered a significant amount of short-covering. Market players are now waiting to see if the rally can extend as more short-positioned traders are squeezed.

Longer-term, with the end of the REPowerEU sales in sight, analysts expect prices to start rising sharply as the market begins to absorb the impact of significantly tighter EUA supply. The most recent analyst forecast calls for prices to average €115/tonne in 2026.

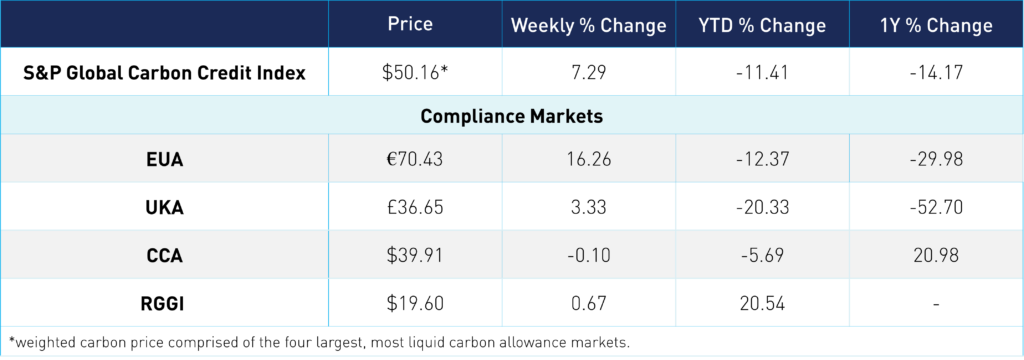

Carbon Market Roundup

The S&P Global Carbon Credit Index is up 7.3% for the week at $50.16. EUAs are up 16.3% at €70.43. UKAs moved 3.3% higher from the week prior to £36.65. Meanwhile, the CCA market was fairly choppy this week, ending down 0.1% at $39.91. CARB, the market regulator, released a Standardized Regulatory Impact Analysis (SRIA) report with California's Department of Finance (DOF) favoring the increased 48% emissions reduction target, seemingly rejecting the other alternative proposals (including the statutory 40% target). California's cap and trade market reform is still ongoing and expected to be completed by year-end, but positive updates such as this provide encouraging progress and bring greater clarity and confidence in the market. RGGI is up 0.7% at $19.60.