Diving into the EUA & Nat Gas Relationship

2 Min. Read Time

Europe’s carbon market continues to be driven by the region’s natural gas price, as the dominance of gas-fired power generation in the region’s energy balance sets the tone for carbon allowance demand.

With coal-fired power being uncompetitive compared to gas and renewables, emissions from industrial plants consuming solid fuels continue to drop. Data from the European grid operator’s agency ENTSO-E show that hard coal generation fell 34% year-on-year in the first quarter, while lignite output dropped 14%. Natural gas generation also fell by 18% in the first quarter.

The Q1 declines follow a very weak 2023, which saw hard coal, lignite, and gas power generation drop by 26%, 24%, and 17%, respectively.

While EUA carbon prices have fallen by as much as 30% in the first three months of 2024, the market is more closely tracking gas prices. Data analysis shows that the correlation between TTF front-month gas and the front-December EUA futures contract is extremely high on a variety of time frames, while market participants acknowledge that gas is the main driver for carbon at the moment.

The main reason, many participants believe, is the declining influence of utilities. As the scale of fossil-based generation declines, the demand for EUAs from the power sector shrinks, and any long-term hedges that may have been in place for 2023 and 2024 have been sold back into the market as margins for fossil-fired plants flip into negative territory.

For the last 19 years, utilities have been the price setter for the EU ETS since fuel switching has been the main source of emissions reductions in the market. But with fossil output now falling sharply, the role of utilities has diminished, and instead, the price is being increasingly driven by non-utility players, and in particular, speculative investors.

The logic adopted by these participants dictates that if gas prices rise, then coal becomes comparatively more competitive, which in turn may drive an increase in coal generation, and therefore demand for EUAs will also rise. Conversely, a drop in gas prices merely reinforces natural gas’ position at the top of the merit order and dampens any additional demand for carbon permits.

For some investors, this means that positions in carbon and natural gas can be aligned and managed in tandem, and it has led to an increasingly tight correlation between the two.

Extending this analysis further, carbon prices are increasingly exposed to the same geopolitical and fundamental influences that affect gas. Most recently, gas prices jumped on April 16 after interruptions to North Sea production, cuts in feed gas supply to the Freeport LNG export terminal in the US Gulf, and persisting concerns over the conflict in the Middle East combined to boost the TTF price by more than 6%. Comparatively, EUAs jumped by 4.4%, even though there was no specific news that could be interpreted as bullish for carbon. Data show that in April, carbon matched both the directional move and the scale of the move in front-month TTF on two-thirds of the trading sessions.

Carbon Market Roundup

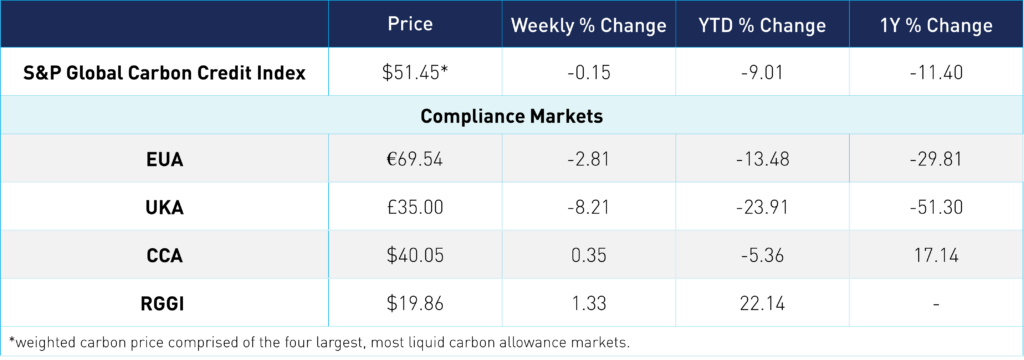

The S&P Global Carbon Credit Index is priced at $51.45, down 0.2 % for the week. EUAs are down 2.8% from the week prior, at €69.54. The market continued to rally at the start of the week but saw a reversal on Wednesday, and prices remained volatile into the remainder of the week. UKAs fell 8.2% at £35.00. CCAs are up 0.4% at $40.05. Volumes have been light in the CCAs, the market is waiting for the next CARB (program regulator) workshop next week. RGGI is up 1.3% at $19.86.