CCAs Rebound After Flash Drop on Technical Sell-Off

2 Min. Read Time

Carbon allowance prices in California's cap-and-trade program have recovered quickly from a flash drop last week that saw CCA prices tumble by almost 8% in one day. December 2024 CCA prices dropped from $40.84/tonne on March 12 to a low of $37.78 the following day and extended those losses to $35.00 on March 14. Trading was particularly heavy on both days, with ICE Futures hosting trading of nearly 14 million tonnes on March 13.

Since then, however, the market has rallied, with the Dec-24 contract settling on March 20 at $40.75, wiping out the losses.

So what happened?

In our view, it was purely a technical sell-off. The March option expiry (and hedging by put sellers) led to forced selling, which was then exacerbated by a “long squeeze.” Traders bought put options on CCAs at strikes (prices) of $30 and $25, which made them synthetically short CCAs. The banks that sold those options to traders were, therefore, synthetically long CCAs. In the final 7-10 days prior to the options expiring, the value and size of the synthetic position deteriorate to zero as it becomes clear that those options will expire worthless. This has the effect of forcing the banks to reduce their long position (which was their hedge to the synthetic long position the options created). This meant institutional selling. By the end of the week, this pressure was alleviated; post-option expiry, the market recovered as we expected.

The fundamental story remains intact. There was little mention of any regulatory development to trigger the price swing. There have been many retro-fitted theories afterward, such as hedge funds selling or traders selling to come back closer to the program regulator's (California Air Resource Board) reform policy announcements. Whatever the cause, we believe this is a key entry point to position ahead of the program's upcoming market-tightening reform.

Bloomberg New Energy Finance sees prices hitting up to $93 by 2030 based on the market aligning with the Scoping Plan's target of 48% emissions reduction below 1990 levels. That's more than double the current price of roughly $40. There is also the $24 downside protection floor price that raises CPI+5%.

On the other side of the country, the recent quarterly auction in the RGGI market cleared at a record high of $16.00/short ton, a level that also triggered the market's Cost Containment Reserve, releasing a further 8.4 million permits into the market.

Secondary market prices in the RGGI system were above the auction price on March 13, with the front-month at $16.00/ton and the December 2024 future at $16.60/ton.

Since then the market has raced to new record levels, with the March future reaching $19.10/ton and the December 2024 hitting $19.95 on March 20. Traders are pricing in the lack of any Cost Containment Reserve supply for the rest of the year, as well as prospects for a bullish reform to the market for its next compliance period.

Carbon Market Roundup

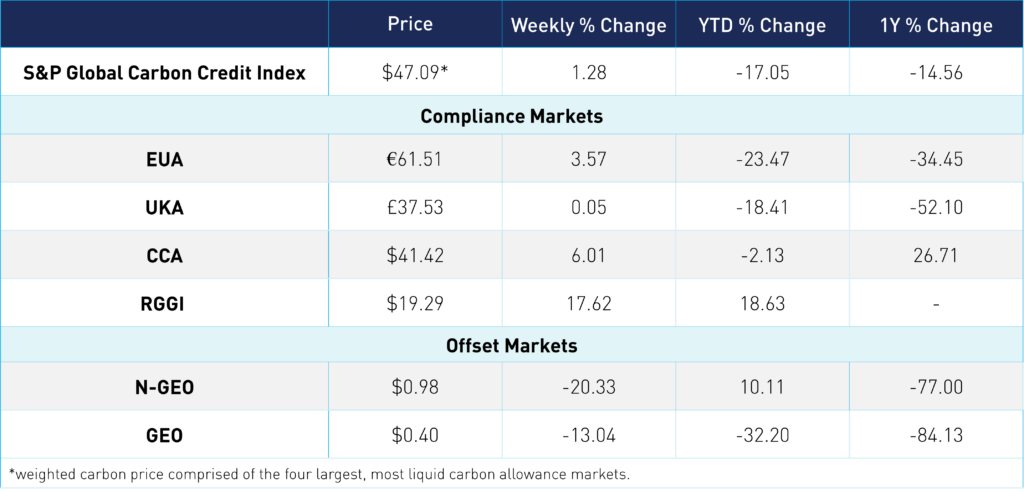

The S&P Global Carbon Credit Index is up 1.3% for the week at $47.09. EUAs are up 3.6% at €61.51. UKAs are flat for the week at £37.53. CCAs are up 6% at $41.42. RGGI is up an impressive 17.6% at $19.29.

To learn more about our carbon credit ETFs, click here.