California Market Workshop Recap

2 Min. Read Time

On Tuesday, the California Air Resource Board (CARB) held a workshop to discuss potential changes to the cap-and-trade market, mostly regarding rules on holding limits, corporate disclosures, and offset use. CARB didn't provide much clarity on adjustments to the overall cap and reserve levels and the free allocation of allowances despite being key points of interest. However, these measures will be addressed in further stakeholder consultations. The full slide deck from the workshop can be found here.

To account for the reduced allowance budget under the accelerated 48% emissions target, CARB is considering lowering the holding limit for corporations. Holding limits are the maximum number of allowances that may be held by an entity or a group of affiliated entities in a corporate association group, and are based on the annual allowance budgets. For example, an entity can hold a maximum of 10.2 Mt allowances in 2024. With a decline in holding limits, companies may need to offload some allowances back into the market to comply with the new limit, which could cause short-term price volatility from the temporary added supply. However, CARB is looking into ways to spread out this added supply. Based on CARB's proposal, potential holding limits could drop from 9.82 million tonnes to 9.3 Mt in 2025 and from 7.99 Mt to 6.38 Mt in 2030.

The state has proposed a target of cutting emissions by 48% from 1990 levels by 2030, which would involve a cut of around 265 million allowances from its 2021-2030 cap, leaving a total allocation of CCAs for the period of 2.34 billion. The 2045 cap would be 30.3 million tonnes. The state released an impact assessment showing that the 48% target would achieve reductions totaling 981 million tonnes.

The webinar also showed potential market cap trajectories under the 48% target that would include a slight increase in the cap of around 25 million tonnes between 2030 and 2031, though CARB staff said this one-year increase was still consistent with a trajectory that reaches the overall 2045 goal.

The regulator is also considering changes to the compliance period schedule to align the market with climate deadlines in 2030, 2040, and 2045. One option is to extend the 2027-2029 period to four years (2027-2030) and to set subsequent compliance periods at five years. The other is to have two shorter periods in 2027-2028 and 2029-2030 before embarking on five-year periods.

CARB may introduce new disclosure rules for commodity pool operators (CPO) and commodity trading advisors (CTA), explaining that under current regulations, a CTA could potentially control investment strategies and allowance holdings of multiple registered entities in a coordinated manner.

Carbon Market Roundup

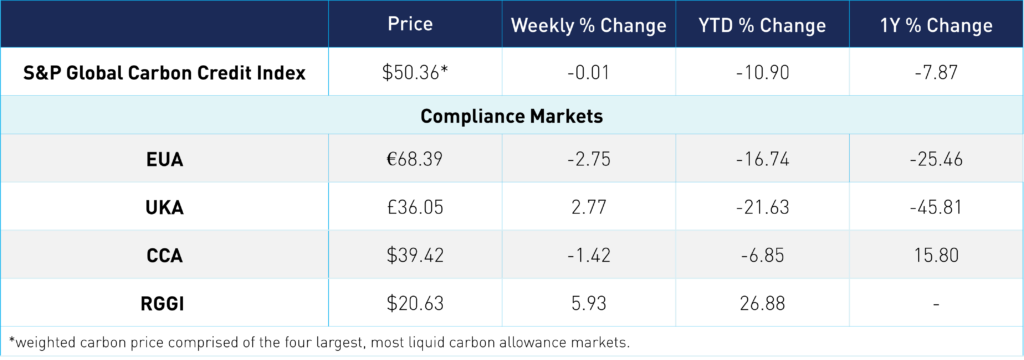

The weighted global carbon price saw little change from last week, ending at $50.36. EUAs are down 2.8% at €68.39. UKAs trended up 2.8% for the week at £36.05. CCAs are down 1.4% at $39.42. RGGI prices are up 5.9% at $20.63.