Joining Forces: Facilitating Washington Linkage with California and Quebec Carbon

3 Min. Read Time

The highly anticipated legislation (Senate Bill 6058) facilitating the linkage of Washington’s carbon allowance (WCA) market with California and Québec's markets was signed into law last Friday. For the past decade, California and Quebec have operated under a joint program called the Western Climate Initiative (WCI). This new law support revisions to Washington's market to help it align with the WCI markets.

What are the benefits of market linkage?

Linking these programs creates a larger, more liquid market that leads to greater price stability and market efficiency. It would also mitigate potential carbon leakage issues, helping prevent Washington's industries from being at a competitive disadvantage due to higher carbon prices compared to other programs and entities not subject carbon pricing. Since launching its market, Washington's carbon prices have been marked by volatility, first soaring above California's prices to now dropping close to the program's floor price level. Much of the recent price action is due to the uncertainty around the status of Washington's program.

A repeal initiative led by hedge fund executive Brian Heywood, has placed Washington's Climate Commitment Act, including the state's carbon market, on the November ballot. This initiative comes as California market regulator, Air and Resource Board, and the state legislature have backed Washington's linkage and long-time climate advocate governor Inslee continues to push for Washington carbon market.

Washington's market on the ballot

The burgeoning Washington State cap-and-trade market will undergo its first political test during this November's election. Initiative 2117, sponsored by Heywood's Let's Go Washington campaign, gathered sufficient support to place the Washington carbon market repeal vote on the state ballot.

Under Washington state law, a so-called "initiative to the legislature" may be adopted by lawmakers, in which cases it becomes law without a vote of electors. However, if legislators decline to act on the initiative, then it is placed on the ballot at the next state general election. Additionally, the legislature can approve an alternative to the proposed initiative, in which case both the original proposal and the legislative alternative are placed on the ballot at the next state general election. In this case, the legislature said they wouldn't take action and are leaving the decision for the November election.

The initiative, as proposed for the ballot, "would prohibit state agencies from imposing any type of carbon tax credit trading, including 'cap and trade' or 'cap and tax' programs, regardless of whether the resulting increased costs are imposed on fuel recipients or fuel suppliers," according to documents published by Ballotpedia. "It would repeal sections of the 2021 Washington Climate Commitment Act as amended, including repealing the creation and modification of a 'cap-and-invest' program to reduce greenhouse gas emissions by specific entities."

What does the vote mean for the future of Washington's market?

As it stands, Washington will continue implementing the program, which includes all scheduled auctions for the remainder of the year. The passage of the Washington linkage bill was partly intended to strengthen support for the state's market and help bolster public perception of the program. Greater price efficiency and stability will also help address some of the main concerns that prompted the repeal initiative, i.e., lowering the impact of carbon pricing on gas and energy prices for consumers. Further coverage and progress on this linkage as well as program support by corporations, would provide additional awareness and strength to the WCA market.

Washington's market regulator, the Department of Ecology (ECY), issued a statement in early March on the subject, in which it acknowledged that if Initiative 2117 is passed into law, "Chapter 70A.65 RCW would be repealed, and the Department of Ecology would no longer have authority provided under the repealed provisions." The ECY statement did not offer any insight into what might happen to existing carbon allowances or to compliance obligations for 2023 and 2024 if the measure becomes law, but it did say that a fiscal impact statement would be issued prior to the election date.

Prices for Washington state allowances have dropped sharply since the initiative was made public, and prices have fallen from $52.50/ton at the start of 2024 to as little as $30.00/ton last week. Much of the weakness is due to uncertainty about the program's long-term future, with traders said to be particularly concerned at the possible loss in value of substantial holdings if the initiative is passed.

According to Governor Jay Inslee, a robust defense of the cap-and-invest system is being marshaled by multinational corporations, including Microsoft and BP. Proponents of the program have raised more funding so far compared to those in favor of the repeal.

Carbon Market Roundup

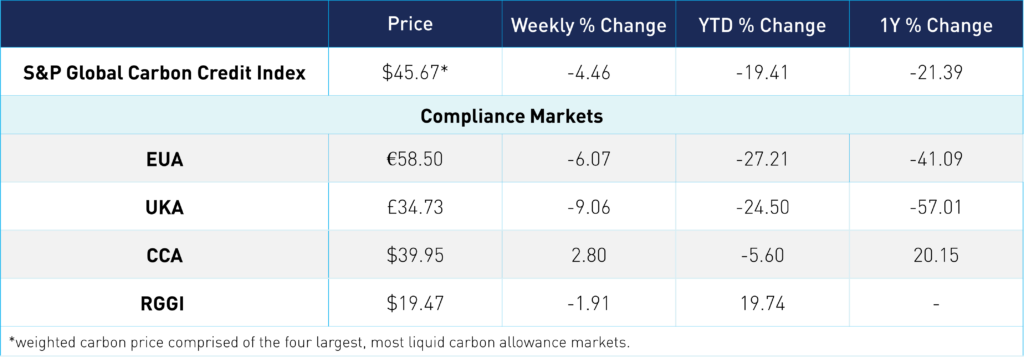

The S&P Global Carbon Credit Index is $45.67, down 4.5% from the week prior. EUAs are down 6.1% for the week at €58.50, slipping lower in anticipation of the EU's 2023 emissions data release. On the day of the release, the market reaction was muted despite the drop in emissions being lower than expected. UKAs are down 9.1% at £34.73. CCAs are up 2.8% at $39.95. RGGI prices are down 1.9% at $19.47, showing a slight pullback after popping above the $20 level for the first time last week.