Belém’s Big Stage: Article 6 Technicals and the Compliance Carbon Coalition in Focus at COP30

2 Min. Read Time

This year’s UNFCCC climate summit is taking place in Belém, Brazil. For the first time in a decade, there are no political negotiations over carbon markets scheduled to take place, since the final decisions on the architecture and guidelines for so-called Article 6 markets were agreed at COP29 in Baku last year.

Instead, delegates will be debating more technical and process-related issues to do with registering carbon credit projects, and the most controversial topic relates to a methodology standard dealing with non-permanence and reversals from carbon credit-generating activities.

The standard was adopted earlier this year by the Supervisory Body of the Article 6.4 market, referred to as the SBM - Supervisory Body of the Mechanism. The SBM’s report on its activities this year needs to be formally adopted by the COP in order for all its decisions to take effect.

In short, the standard requires project owners to monitor their projects – even after they have ceased to generate credits – to ensure none of the emissions reduced or removed “leak” back into the atmosphere.

Market stakeholders, investors and project developers have opposed the standard from the very start, warning that it could make some project types uninvestable, or at least significantly reduce the volume of credits they can generate.

Elsewhere in Belem, the Brazilian presidency of this year’s COP kickstarted the event by introducing the “Open Coalition on Compliance Carbon Markets”, aiming to build opportunities for countries to collaborate and coordinate the development of their own national markets.

Brazil is among a growing number of countries that is in the process of setting up a compliance carbon market, though most if not all of these new markets will be “baseline and credit” systems rather than the “cap and trade” markets that operate in developed countries.

“Baseline and credit” sets a baseline emissions level for each participant to meet, and requires them to buy and retire carbon credits to cover any emissions over that baseline. “Cap-and-trade” sets an absolute system-wide cap on emissions and requires companies to buy allowances matching their total emissions.

The Coalition on Compliance Carbon Markets sets out a short list of proposed goals, mainly in encouraging ambitious markets that operate with integrity. Some 10 other countries endorsed the Coalition, including the EU, China, the UK, Canada and Germany.

The Coalition joins other initiatives all working in broadly the same territory, such as the Coalition to Grow Carbon Markets, set up by the UK, Kenya and Singapore and launched during London Climate Action Week this year, and the ASEAN Alliance on Carbon Markets, a private sector-led group that was set up in 2023.

Carbon Market Roundup

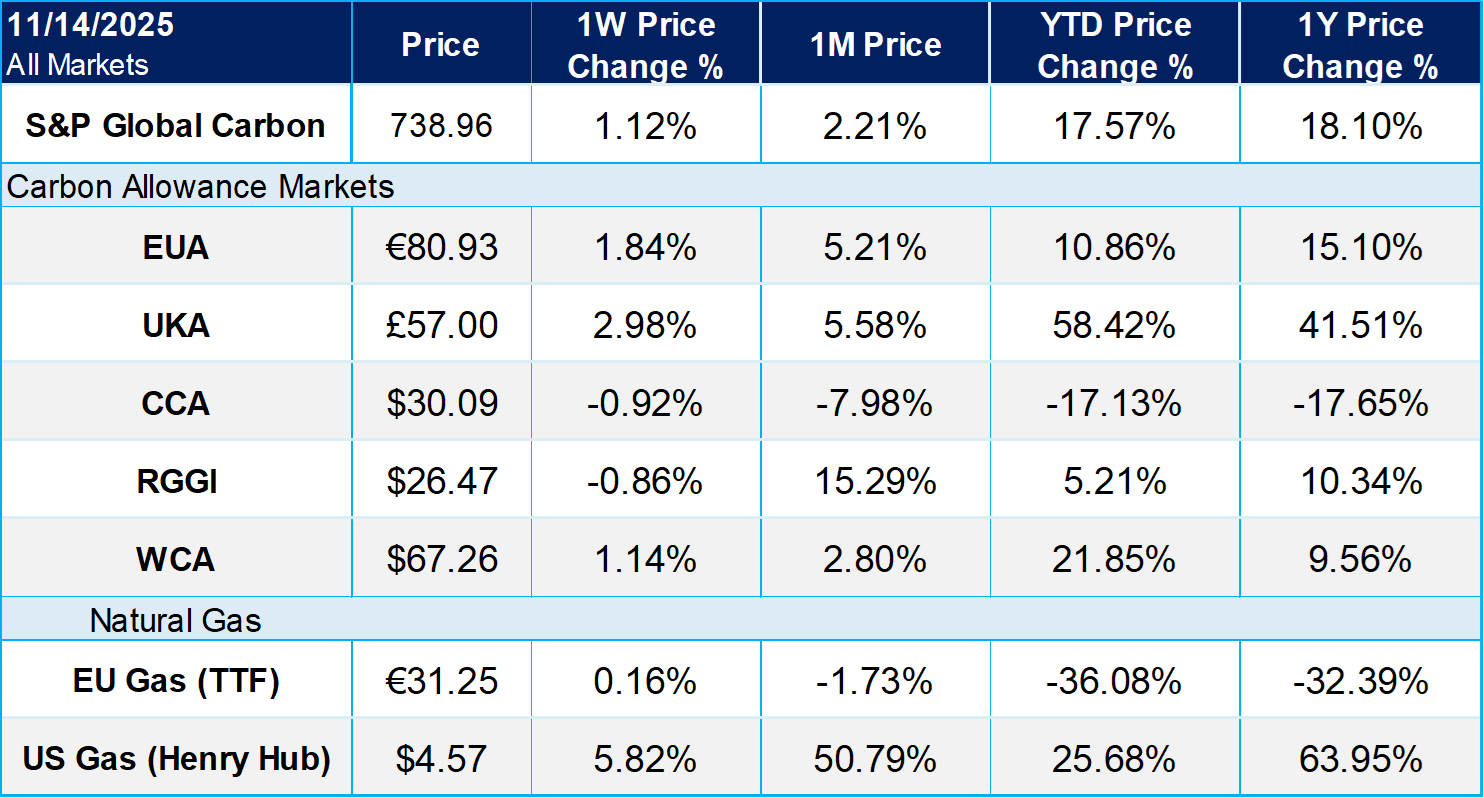

The weighted global price of carbon was $55.91, up 1.1% week over week. EUAs were up 1.8% over the week, closing at €80.93 on Friday. UKAs were up 3.0% at £57.00. CCAs and RGGI were both down 0.9% at $30.09 and $26.47, respectively. WCAs posted a 1.1% gain for the week at $67.26.