UK Weighs Overhaul of Free Emissions Allowances, Carbon Border Tax

2 Min. Read Time

The UK government has concluded a consultation on potential changes to free allocation in the country’s Emissions Trading System, with the goal of implementing any changes by 2026.

This most recent consultation covered potential changes to the methodology for distributing free allowances, including whether a free allocation is compatible with the country’s 2050 net zero targets, as well as the introduction of a carbon border adjustment mechanism (CBAM) similar to the European system that launched this year.

In 2022, the government consulted with stakeholders on ensuring that the UK ETS free allocation policy is “working effectively in the UK context to both incentivize emissions reduction and protect energy intensive, trade-exposed industries from the risk of carbon leakage.”

Further consultations have also been held over potential changes to the market structure, including whether to introduce a supply adjustment mechanism (similar to the EU ETS’ market stability reserve) and whether to retain the auction reserve price and cost containment mechanism.

Europe’s CBAM explicitly states that as charges for the carbon content of imported materials increase, the free allocation of allowances to domestic producers will decline. The end goal is to ensure that all producers of goods consumed in Europe – foreign and domestic – pay the same carbon price for the emissions generated by the production of those materials.

Clearly, a UK CBAM would need to develop along the same lines, and the latest consultation covers the likely changes in how the allocation of free UK Allowances would be calculated.

“Any adjustment to free allocation would need to consider risks specific to individual sectors to ensure that the risk of carbon leakage is mitigated effectively and would be subject to policy development and consultation. A methodology to determine the rate of free allocation phase-out if this were the preferred policy option going forward, would need to be determined depending on the technical detail of UK CBAM policy design,” the government document explained.

The consultation suggests various ways in which free allocation could be calculated, altering sectoral benchmarks, changing the list of sectors that are vulnerable to carbon leakage, a “cross-sectoral correction factor,” and how calculating a “carbon leakage exposure factor” to adjust allocation.

Macquarie Bank analysis suggests that the likeliest outcome of the consultation would be that overall free allocation volume would decline, based on a drop in UK industrial activity in the last four years.

The bank also highlighted that the UK allocation methodology currently uses data collected when the country participated in the EU ETS and that a “UK-only” methodology might also reduce the overall free allocation.

Likewise, a more tiered approach to calculating the exposure of industrial sectors to carbon leakage risks could lead to lower allocations for some sectors, though much depends on the categorization of industries.

“The changes to free allocation rules are likely to result in a significant cut to the amount of UKA supply coming to market over the 2026-30 period,” the Macquarie study concludes. “The exact amount will depend on the outcome of the ongoing consultation.”

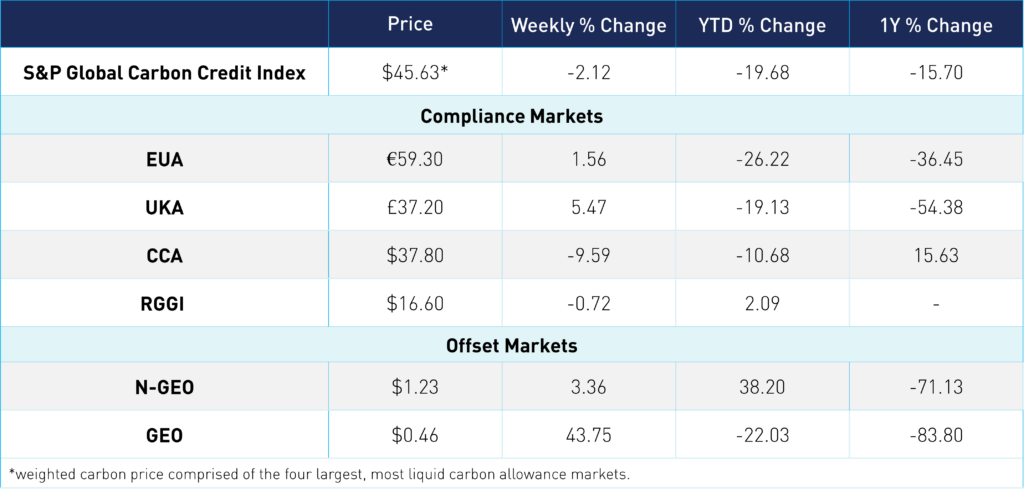

Carbon Market Roundup

The S&P Global Carbon Credit Index is priced at $45.63, down -2.12% for the week. EUAs are up 1.56% for the week at €59.30. UKAs are up 5.47% at £37.20. UK ETS regulatory consultations on free allocation and supply adjustment mechanisms closed on March 11. CCAs are down 9.6% at $37.80, while RGGI is down 0.72% at $16.60. N-GEOs are up 3.36% at $1.23, and GEOs are up 43.75% at $0.46.