UK Carbon Sees Strong Reversal from Recent Lows

2 Min. Read Time

UK allowance prices have risen by nearly 50% in the past three weeks after hitting a record low of £33.50, as traders appear to be betting that the British government will introduce a supply management mechanism similar to the European Union’s Market Stability Reserve (MSR) in the coming years.

The UK market regulator last week issued its auction calendar for 2024, in which a total of 69 million UKAs will be sold – a cut of 10 million, or 13% from the 2023 auction supply.

In comments accompanying the auction calendar announcement, the UK ETS Authority said it had “committed to exploring measures for the future of the carbon allowances market, including examining the merits of a supply adjustment mechanism. This would provide a means of amending the supply of carbon allowances in response to market conditions.”

The EU’s decision to introduce a market stability reserve (MSR) triggered a tripling of EUA prices in 2018, followed by year-on-year rises of 33% in 2020 and 150% in 2021. The MSR is calibrated to remove 24% of the market surplus each year until the total supply of permits falls to 833 million tonnes of CO2, which represents the supply needed to meet forward hedging needs as well as annual demand, according to European Commission calculations.

UKA prices tumbled from a high of £99.00 in August 2022 to their record low a little over one year later as demand faded amid falling industrial output and power generation, leaving the market well-supplied with allowances. At the same time, demand for UKAs to replace EU Allowances after the UK exit from the EU ETS also diminished as compliance buyers completed their swapping activity. Afterward, UK prices fell to as little as 47% of the corresponding price of EUAs.

In the first half of the year, the British government consulted with stakeholders on changes to the UK ETS market cap and decided to adjust the cap for the 2021-2030 period to 936 million tonnes of CO2, compared to the original 1.36 billion tonnes – a cut of 31%. The updated cap will mean a sharp cut to free allocations and auctions from 2024, as evidenced in the auction calendar for next year. To ease this transition, the government also announced in June that it would sell an additional 53 million UKAs from its reserves at auction from 2024 to 2026.

While the initial reaction to this announcement was mixed, with prices continuing to weaken on the back of this additional supply, sentiment has slowly improved. Repeated statements highlighting the government’s intention to consult on a supply control mechanism have also helped boost confidence in the market recently.

However, data suggest that the market is not yet wholly convinced. The Commitment of Traders reports show that investment funds, who had held a net long position during the UKA price’s drop from the summer of 2022 through to the start of 2023, now have a net short position, reflecting a bet on lower prices to come. More surprisingly, however, UK compliance operators with futures positions, who admittedly number just a small handful, have turned a net long position of nearly 1 million UKAs early this year into a net short position of more than 500,000 tonnes.

Most recently, however, funds’ net short positions have begun to shrink, suggesting that the price rally of the last three weeks is beginning to persuade speculative investors that the worst of the price decline may be over.

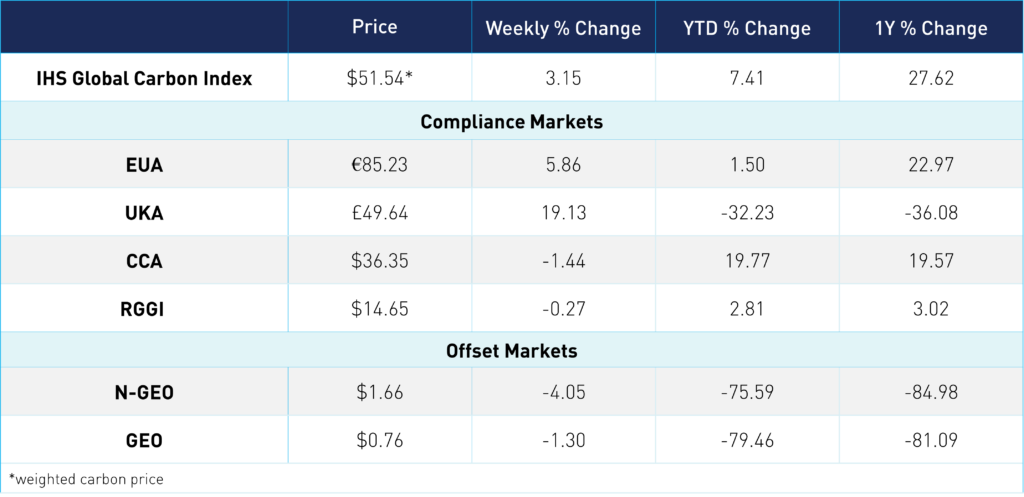

Carbon Market Roundup

The global price of carbon is $51.54, up 3.2% for the week. EUAs are up 5.9% at €85.23. UKAs jumped 19.2%, at £49.64. CCAs trended down a slight 1.4% at $36.35. The California market was quiet at the start of the week due to the holiday and slipped lower on small-volume trades. RGGI traded mostly sideways for the week, down 0.3% at $14.65. The offsets markets were both down for the week, with N-GEOs down 4.1% at $1.66 and GEOs down 1.3% at $0.76.