RGGI Prices Hit All-time High Following Program Workshop

2 Min. Read Time

The northeastern U.S. RGGI market hit an all-time high of $14.90 on Tuesday as regulators met for a public workshop to discuss potential changes to the program's rules and market cap for the next compliance period.

The headline proposal was to change the compliance cycle from three years to one. Until now, covered installations were required to surrender permits covering 50% of their emissions in years 1 and 2 of each three-year period and the remainder in the final year. The market administrator said that the three-year cycle was initially employed to give power generators flexibility in managing their compliance purchases. However, shifting to annual compliance would lower the risk of any generators falling out of compliance (e.g., through bankruptcy), a benefit that outweighs the flexibility consideration.

The meeting also covered modeling future RGGI market emissions, with initial analysis suggesting that covered emissions would continue to fall "significantly," even under the least ambitious market cap, due to federal policies that incentivize clean energy and to state adoption of similar mandates. The RGGI member states will now consider the detailed findings of the modeling as part of their discussions on the market cap for the next compliance period.

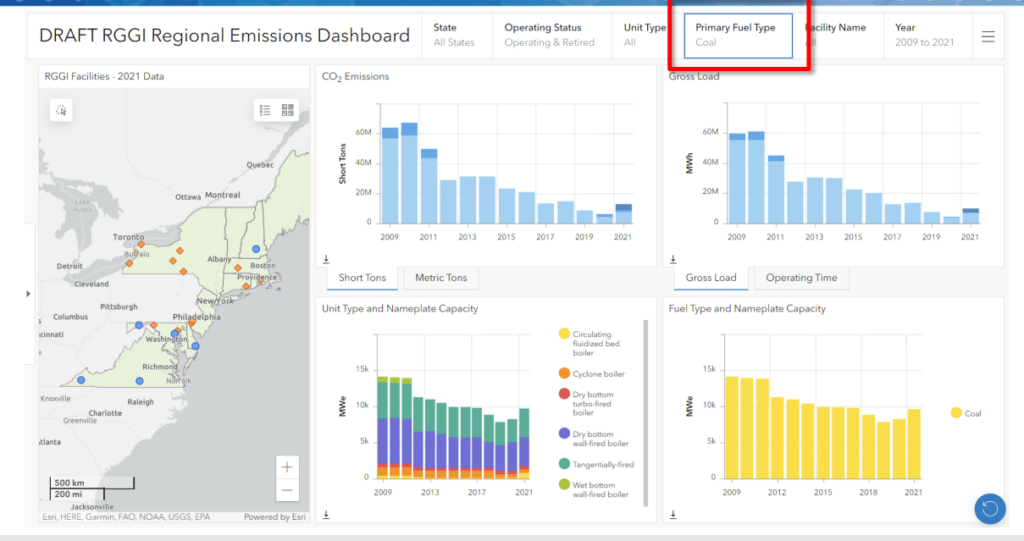

Additionally, new data resource called the "RGGI Dashboard," will soon be rolled out. Modeled after New Jersey's platform, the RGGI-wide dashboard will provide information on all present and former power generation facilities covered by the market mechanism, including aggregate emissions levels, fuel type, gross load, and operating time.

RGGI market prices rose in the days leading up to the meeting, climbing from $14.50/short ton last Wednesday to an all-time high of $14.90/ton on Tuesday when the meeting took place. The $14.90 price is significant since it takes the market above the $14.88 price level that would trigger the sale of additional allowances from the market's Cost Containment Reserve (CCR) if repeated in an auction.

The price rise reflects a broadening bullish sentiment among traders regarding the market cap for the next phase of the market, even though key elements of the program, such as the trigger prices for the cost containment and emissions containment reserves, will not be decided as part of the program review process.

The process of finalizing the updated market rules should conclude by the end of this year, with new legislation for these changes expected by early next year. To view the meeting presentation, click here.

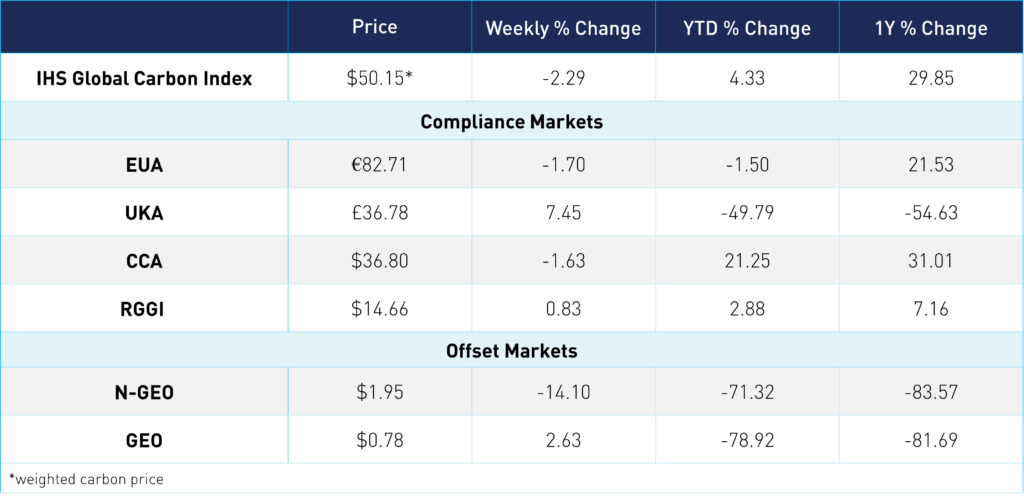

Carbon Market Roundup

The global price of carbon is $50.15, down 2.3% week over week. EUAs were down 1.7% for the week, at €82.71. UKAs regained some of last week's losses, up 7.5% at £36.78. CCAs were down 1.6% at $36.80. RGGI closed just 0.8% higher, at $14.66. After pushing above the CCR price, RGGI prices came down slightly and traded in a tight range. N-GEOs fell 14.1%, at $1.95. GEOs posted a 2.6% gain, at $0.78.