Surging Carbon Prices: CA & New Zealand React to Climate Targets/Reforms

2 Min. Read Time

Prices for California Carbon Allowances (CCAs) rose by around 8% last week as the market digested the outcome of the latest public workshop on potential changes to the cap-and-trade market in line with the state’s uprated climate targets for 2030 and later. Prices for December 2023 CCA futures rose to $37.49/tonne on ICE on Friday, a 9.8% jump compared to $34.15 just one week earlier.

The workshop outlined the three scenarios being modeled as the basis for reforms: emission cuts of 40%, which is the current target in legislation, and reductions of 48% and 55% by 2030. State officials highlighted in the workshop that these targets are to be considered cumulative goals, meaning that the state would set a total limit on emissions from 2021 to 2030 and adjust the cap for the remaining years to 2030 to keep within the decade-long “budget.” This implies that whichever target is chosen will entail a sharp downward adjustment to the number of permits available for the rest of the decade.

While there is a surplus of allowances in the market, experts believe that the adjustment will lead this surplus to be absorbed by compliance buying within a few years, and prices will rise sharply. The state may choose to mitigate the impact of such an adjustment by reducing the size of the Allowance Price Containment Reserve and bringing some permits out of the reserve and into the market through allocation or auction. However, analysts suggest that even the least ambitious option would lead CCA prices to double by 2028.

Meanwhile, carbon allowance prices in New Zealand’s emissions trading system jumped by more than 25% last week after the government announced it would cut the number of allowances offered at auction and tighten the cap on the market from this year. The government has conducted a series of consultations on market reforms and trailed some of the changes in previous reports. Still, the latest set of amendments to the market parameters is the most aggressive yet seen.

The overall cap on emissions in the market from 2023 to 2027 will be lowered from 142.1 million tonnes to 127.1 million tonnes, a cut of 15 million tonnes or 11%. The government will sell 61.6 million NZUs at auction between 2023 and 2027, 10% fewer than the scheduled 68.5 million in the current plan. The reserve price in these auctions will rise from NZ$33.06 to NZ$60.00 annually to reach NZ$75/tonne by 2027.

The trigger price to release additional permits into the market will be more than doubled, to NZ$173/tonne from the current NZ$80.64/tonne. The trigger price will rise yearly, reaching NZ$215/tonne by 2027. A second trigger price will also be introduced, starting at NZ$216/tonne and rising to NZ$269/tonne in 2027. The market has already reacted strongly to the proposals, with the secondary market price of NZUs rising from just over NZ$50/tonne in mid-July to around NZ$65/tonne last week.

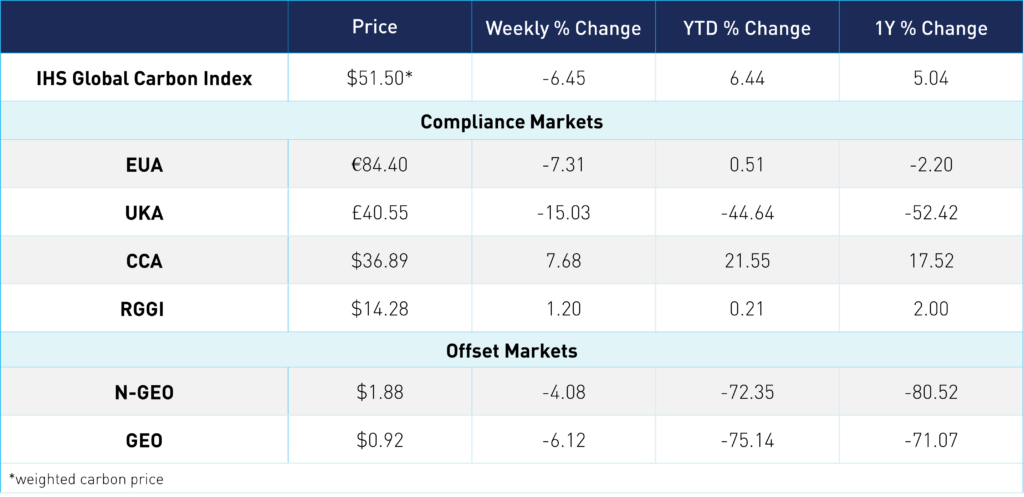

Carbon Market Roundup

The global price of carbon ended the week at $51.50. EUAs closed at €84.40 for the week, while UKAs closed at £40.55. CCAs closed at $36.89, up 7.6% week over week, while RGGI prices closed at $14.28, up 1.2% week over week. The offset markets both trended down for the week, with N-GEOs at $1.88 and GEOs at $0.92.