What’s Driving the UKA Discount to EUAs

3 Min. Read Time

In the last six months, we have seen a shift in the relationship between UK allowance (UKA) prices and their EU counterpart (EUAs). British prices have fallen to a discount of around €20-€25 to EUAs after having traded at a premium of as much as €32 last year.

The UK ETS launched in May 2021 after the United Kingdom completed its withdrawal from the European Union and left the EU ETS. Most of the UK market parameters were closely aligned with the EU ETS rules, though the new market lacked a Market Stability Reserve (MSR) mechanism. The cap for the first year in 2021 was widely seen as rather tight, particularly given that utilities were expected to drive strong demand for the first few years as they swapped their stock of EUAs bought against future power generation hedging for UKAs.

After trading mostly at the same level as EUAs in 2021, British permits rose higher than their EU counterparts in early 2022. The daily settlement price for UKA futures on ICE climbed steadily, reaching a premium of around €15 in mid-2022 and eventually reaching a peak of €32.77 on September 5, 2022.

Since September last year, however, the UKA premium to EUAs unwound and has maintained a discount to the EU market. Just earlier this week, UKA were trading roughly €25 cheaper than EUAs. One of the main drivers of this reversal is the completion of the EUA-for-UKA swap among utilities. Power generators sell generation up to three years in advance, and utilities hedge these sales by buying fuel and carbon permits to cover that generation. Since EUAs are not eligible for compliance use in the UK ETS, utilities and any other industrials that held EUAs at the launch of the UK ETS in 2021 needed to replace those EUA hedges with UKAs. This was seen as partly responsible for the buoyant UKA market in 2021-22 and the development of the significant price premium to EUAs. The reversal in the premium that began in September last year reflected what many traders saw as the end of the swapping period.

A second key factor behind the discount of UKAs is a shift in power supply. Between 1998 and 2021, the UK was a net importer of electricity from France, buying an average of 9.5 GWh each year from its neighbor. However, in 2022 the UK exported a net 10 GWh of electricity to France, implying higher utilization rates at UK power plants and a higher demand for UKAs, which likely also contributed to the increased premium of UKAs over EUAs. In the first quarter of 2023, the UK reverted to importing power from the Continent, thereby reducing the call on domestic generation. Data show that UK net imports totaled more than 7 TWh of power in the first three months of 2023, as UK generation from conventional (fossil) sources was the lowest since the first quarter of 2021, and renewable generation neared 50%.

A third driver is the lack of regulatory clarity in the UK. While the EU completed its “For for 55” ETS reforms earlier this year, the UK reform process has stalled since the UK government launched a consultation on reforms to the market in early 2022. The consultation led to some immediate changes to technical regulations, but we are currently still waiting on proposals regarding the main parameters of the market. The current annual cap on emissions declines from around 160 million tonnes in 2021 to 120 million in 2030 – the government’s own analysis suggests that a cut to around 50 million tonnes in 2030 is required to reach net zero by 2050.

The government has said that it anticipates bringing forward a set of reform proposals in time to complete the process by the end of 2023. Stakeholders have expressed confidence that the government will likely propose including a market stability reserve in the UK ETS, which they say would support prices in the same way that the EU ETS’s stability reserve led to a surge in the EUA market from 2018 to 2022. The market stability reserve serves as a mechanism that removes surplus allowances from the market if supply exceeds demand. The EU ETS market stability reserve has taken more than a billion EUAs out of circulation since it was introduced in 2018.

Looking ahead, the UK market should see more bullish fundamental support with greater clarity on policy reform expected to come this year. Both European markets have been impacted by macro sentiment, but the EU market's strong tightening policies have structurally supported higher prices. Addressing the current oversupply in the market with the addition of a market stability reserve mechanism will be a key improvement by helping to correct imbalances in the market.

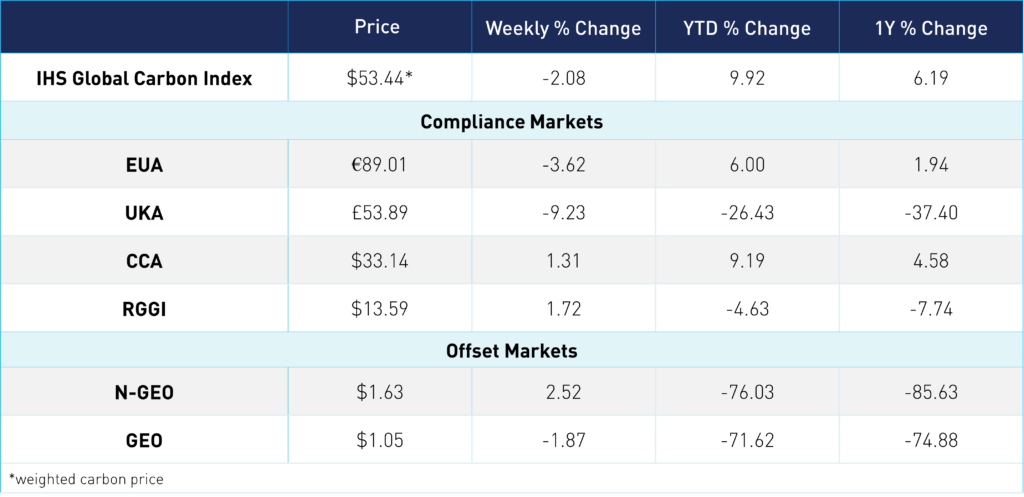

Carbon Market Roundup

The global price of carbon is $53.44, down 2.1% for the week. EUAs are down 3.6% for the week, at €89.01. The EU market closed nearly 3% higher on Tuesday, though remained around the 90 level for most of the week. However, today EUAs slipped below this support level as the market absorbs more bearish macroeconomic sentiment. UKAs saw a sharper decline, down 9.2% at £53.89. The California market is up 1.3% for the week, currently trading at $33.14. RGGI continues to trade in a narrow range of $13.36-13.59 on relatively low volume. N-GEOs traded within the $1.50-$1.72. GEOs were flat around the $1.05-1.07 range.