EUAs Near €100 Threshold, REPowerEU Moves Forward

2 Min. Read Time

This week, the European Parliament approved the REPowerEU initiative, which funds investment that supports the bloc's transition away from Russian fossil fuels and accelerates the adoption of renewable technology. This key vote brings the bill one step closer to implementation, which will come after the EU Commission's vote in April.

To raise the €20 billion budgeted for REPowerEU, legislators agreed to draw from multiple sources. Roughly €8 billion, or 40%, will come from the "frontloading" of EU allowances from auctions scheduled for 2027-2030, meaning allowances set aside for future auctions will be sold earlier. The remaining 60% will come from the Innovation Fund, which was set up to finance projects aimed at developing innovative technologies that significantly reduce emissions.

Long term, frontloading allowances will lead to a tighter supply in the market than originally planned for the years 2027-2030, potentially boosting EUA prices toward the end of the decade. However, in the short term, adding roughly 60 million EUAs to the annual supply between 2023 and 2026 might depress EUA prices. That said, we think the market has already factored in most of this extra supply.

In fact, EUA prices climbed to a six-month high on Thursday, with the December 2023 futures contract settling at €97.54—proving that legislators' focus on REPowerEU this week had little impact on the market. The rally appears to be based more on technical moves than news. At these current levels, the key 100 threshold, which the market has been eyeing for some time, appears more reachable now than ever.

Delays in the issuance of free allowances to compliance entities adds a short-term bullish picture for EUA prices. As we explained in a previous post, at the beginning of the annual compliance cycle, industrial plants around Europe are required to surrender EUAs equivalent to their 2022 verified emissions. Often these entities "borrow" their new allowance issuance to pay for the previous year's compliance obligation. However, these delays mean that more industrials will likely be forced to buy EUAs to meet their requirement, which has historically pushed prices higher in the first quarter.

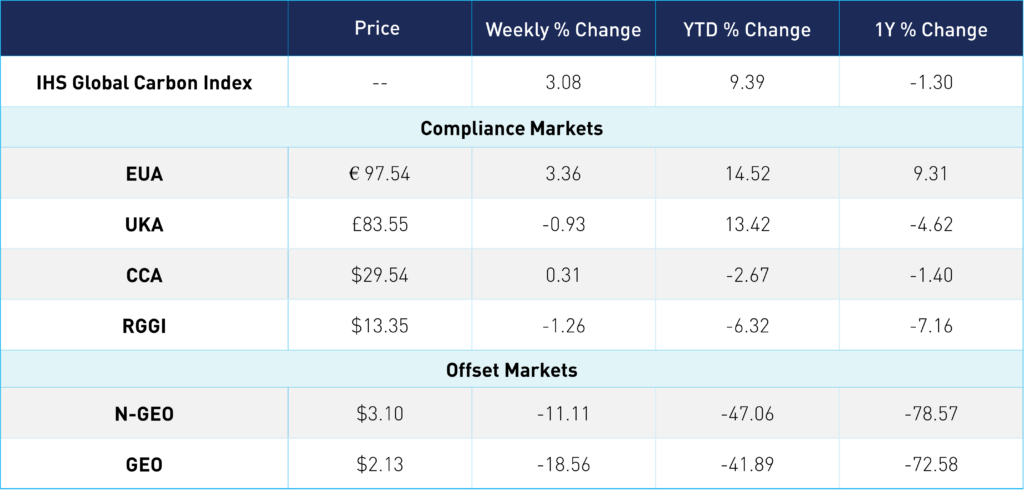

Carbon Market Roundup

EUAs climbed higher throughout the week, hitting near record levels on Thursday at €97.54. Today, EUAs have hovered around €96, though we could see prices continue to push higher toward €100 level. UKAs maintained the £83 level for most of the week, though saw a slight dip Tuesday down to £81.96 but rebounded to close at £83.55. CCAs traded within a narrow range, with prices relatively unchanged and closed at $29.54. RGGI prices fell slightly from last week, though remain at the mid-$13 level. N-GEOs started the week up 12% on Monday at $4.55 but have since fallen to $3.10. Meanwhile, GEOs continue to trade at the mid-low $2 range.