Falling Gas Not Seen as Risk to EUA Demand

3 Min. Read Time

The decline in natural gas and power prices over the last two weeks has brought European carbon within range of fuel switching levels. Still, market participants are hesitant to predict that utilities will be incentivized to switch from using coal to burning gas in the near future. This trend may maintain the current demand for EUAs as coal remains the more profitable fuel.

Two major indicators for the profitability of coal and natural gas have come down significantly. Front-month TTF natural gas prices (primary gas pricing hub for the European gas market) are presently at €58-€59/MWh, down 24% year to date and nearing prices not seen since December 2021. Over the same period, German baseload power prices have tumbled by around 25% to €165/MWh on the European Energy Exchange (EEX) for calendar year 2024 contracts. Comparatively, Dec-23 EUAs are at €81.67, a drop of just over 5% since December 31.

Calculations of operating margins for coal- and gas-fired power plants selling power for next year show that the clean dark spread – the margin for coal units – has fallen from €77.86/MWh on December 31 to €36.17/MWh as of January 24. The clean spark spread for gas-fired plants has declined by even more, losing two-thirds to just €10.79/MWh.

EUA prices have declined as the market has speculated that the fall in gas prices would bring gas-fired power back into profit, potentially replacing coal and depressing demand for EUAs. However, this has not yet happened. Not to mention, Europe’s gas crisis is not over – storage capacity is currently around 80% full mid-way through the winter season.

Yet, analysts are still warning that it may be more problematic to refill and maintain storage ahead of the 2023-2024 winter season since Russia is expected to halt all remaining gas shipments to Europe at some point. As a result, analysts predict that the market won’t allow gas prices to fall far enough for the fuel to become more attractive for electricity generation. Politicians, too, are unlikely to want to see significant gas burn from the power sector.

The alternative is for coal prices to rise substantially, increasing the burden on coal-fired generation, but this looks equally unlikely. Europe currently has adequate coal supplies, and its temporarily higher demand is being comfortably met by suppliers in Colombia and elsewhere.

The carbon price level required to force switching from coal to gas is still more than €100/tonne at current energy prices, which most participants acknowledge is unlikely in the current market. However, carbon prices may be sustained by a delay in issuing free allowances for industrial plants.

The process of calculating individual plant allocations for 2022 is not yet complete. As of December 1, France handed out little over half its expected EUAs, while Ireland had issued just 70,000 out of a total of 3.8 million. The delays are due to new rules that went into force in 2021. Industrial plants are required to submit so-called activity level reports each year detailing their production levels. These reports are then used to calculate the free allocation of EUAs. If a plant’s output changes by an average of more than 15% over two successive years, its allocation is adjusted. These calculations have caused headaches in numerous EU capitals in the last two years.

Free EUAs are expected to be handed out before the end of February each year. Companies often use their new issuance to pay for the previous year’s compliance obligations – a practice known as borrowing. But with issuance being delayed well past the April 30 deadline for surrendering permits last year, a number of industrial buyers were forced into the market to make up their shortfall, boosting prices in the first quarter. In 2021, EUA prices rose 25% in the first three months of the year. And last year, the market was up 15% for most of Q1, though ended down -9% due to implications from the Russian-Ukraine conflict.

Carbon Market Roundup

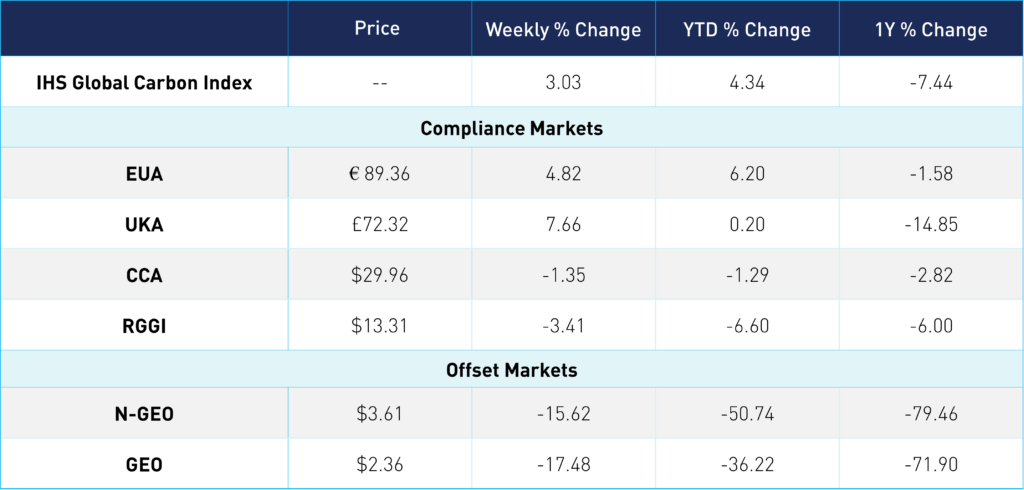

At the start of the week, EUAs fell roughly 4% to €81.67. However, prices rebounded on Thursday, jumping 6% to €89.36, making up for earlier losses. UKAs saw an even stronger comeback, up 10% from Tuesday's low to end at £72.32. Both EUAs and UKAs have maintained these levels into today, with UKAs pushing over £73. CCAs have traded in a fairly narrow range, around $29-30. Meanwhile, RGGI has maintained the $13.30 level so far this week, though is down -3.41% week-over-week. N-GEOs and GEOs trended down this week, ending at $3.61 and $2.36, respectively.

A key update on Virginia's participation in RGGI came Tuesday when the Virginia senate committee voted down a bill backed by Glenn Youngkin (R) that would have withdrawn the state from the program. Last year, Younkin signed an executive order calling on the state's Air Pollution Control Board to have Virginia exit RGGI, on the basis that its participation in the program comes with an increased burden on energy costs for residents. Yet, the democratic-controlled Senate has made it clear that withdrawal would require a vote by the entire General Assembly. Even with this win, the state will still have to defend the program from the Youngkin Administration’s continued attempts at exiting RGGI.