COP27 Recap, Article 6 Advancements

3 Min. Read Time

COP27 wrapped up shortly after daybreak on Sunday, November 19, with some significant advances for the global carbon market but a relatively disappointing set of political decisions.

The headline agreement, known as the Sharm el-Sheikh Implementation Plan, establishes a fund to compensate vulnerable countries for the effects of climate change. The structure and size of the fund, as well as the donors, will be drafted out at future meetings.

Most of the high-level political text reiterates commitments agreed in Glasgow last year, including a renewed pledge to keep the global temperature increase to less than 2 degrees Celsius, and ideally 1.5 degrees.

The overall tone of the document suggests that countries are concerned that there should be no backsliding on commitments during this period of economic uncertainty and energy security issues.

For carbon markets, there were some advances: negotiators continued to assemble the structure of Article 6.2 and Article 6.4 market mechanisms, particularly the legal definition and eligibility of Article 6.4 emission reductions (A6ERs). These offsets will be traded in the new market.

Countries agreed that there will be two different classes of offsets: “authorized” A64ERs will be eligible for use by countries to meet their Nationally Determined Contributions (NDCs), while “mitigation contribution emission reductions” (MCERs) are specifically not eligible for international country-to-country trade to meet the buyer country’s NDC.

The decision is still to be officially ratified, but it suggests that MCERs would be available for non-Article 6 purposes such as domestic abatement, meeting the host country’s NDC, and, indeed, the voluntary market.

Issuances of non-eligible MCERs would still be required to pay a portion of their credits to help fund the operation of the Article 6 system and another portion into the UN’s Adaptation Fund.

Experts say the decisions remove some uncertainty around the relationship between the regulated Article 6 and unregulated voluntary markets by clarifying that countries cannot count MCERs towards their carbon targets if they are being sold abroad.

There is still some legal uncertainty around this issue, but these should be cleared up at future meetings of the system’s regulator.

One area that was left unresolved concerns the authorization of emission reductions. Some countries at COP wanted to retain the right to revoke the authorization of tradable emission reductions even after their issuance, which market stakeholders said would render the market untradable. The decision was referred back to technical bodies for more work next year.

There were many announcements on the sidelines of the formal negotiations.

- A multinational African Carbon Markets Initiative was launched to pursue a target of generating 500 million carbon credits a year by 2030 and 1.5 billion a year by 2050.

- Turkey, Saudi Arabia, and Nigeria made high-profile announcements in Sharm el-Sheikh.

- Senegal signed a deal with private sector participants to generate Internationally Transferable Mitigation Outcomes(ITMOs) under Article 6.2.

- Ghana and Switzerland also signed an Article 6.2 deal.

- Chinese officials said the country might look at sourcing credits from the Article 6 mechanisms for its national Emissions Trading System.

- The U.S. unveiled the Energy Transition Accelerator to mobilize private finance for developing countries in exchange for carbon credits that corporates could use to offset Scope 3 emissions.

- The UN High-Level Expert Group on the Net Zero Emissions Commitments of Non-State Entities issued guidance for corporates and called for regulation of net zero pledges and mandatory annual progress reporting.

- The International Standards Organisation also issued Net Zero Guidelines to provide a “global basis for harmonizing, understanding, and planning for net zero for actors at the state, regional, city and organizational level.”

- IOSCO, the International Organization of Securities Commissions, announced a consultation on “how to foster fair and functional markets and increase structural resilience” to ensure these markets achieve their environmental goal.

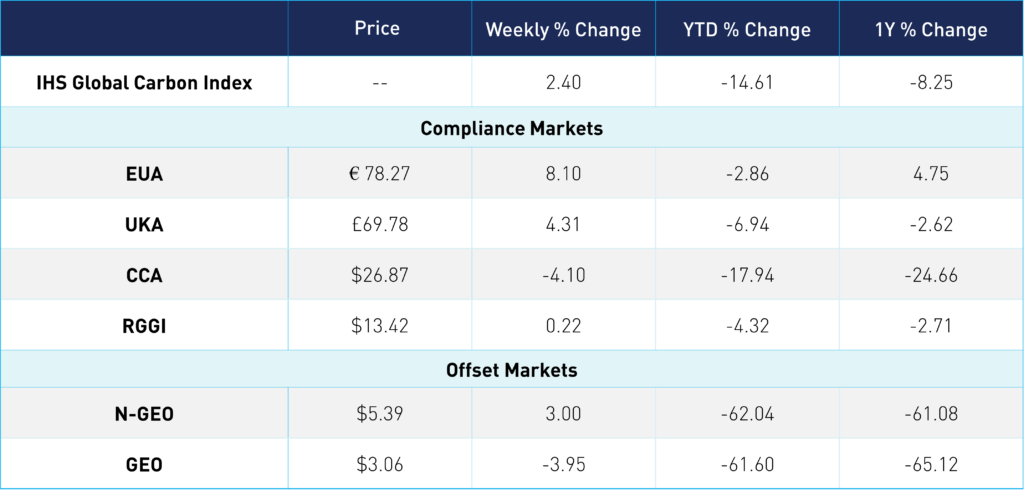

Carbon Market Roundup

EUAs recovered last week's losses, up 8.10% for the week to €78 per ton. UKAs followed a similar upward path, up 4.31%, reaching just under £70. Meanwhile, US markets were fairly flat due to less activity from the holiday. CCAs did slip down throughout the week, from $28 down to $26. Markets were reacting to the run-up and outcome of California's auction results posted Wednesday, which saw a clearing price of $26.80--the lowest level this year. We did see more investor interest, with financial participation up from 12.80% to 20%. RGGI barely moved, remaining at a low $13. N-GEOs and GEOs also saw little price movement for the week, both were in the $5 and $3 range, respectively.

Carbon Futures Prices