RGGI Rallies While Macro Picture Boosts EUAs

<1 Min. Read Time

The Northeast US Regional Greenhouse Gas Initiative (RGGI) allowance prices have surged by around 5% over the past week to new record highs after data released by the market administrator showed that emissions in the first quarter of 2024 rose by more than 8% from a year earlier.

Prices in the regional market jumped to a high of $22.74/short for the December 2024 contract on ICE Futures, compared to $20.50/ton a week earlier. Trading volume was also particularly robust.

The power sector cap-and-trade market reported increases in emissions from six states.

RGGI’s rally complements a sharp increase in the price of EU allowances (EUA) this week; EUA levels have soared from a low of €65.01/tonne on Monday to as much as €74.42 on Friday morning, as a combination of short covering and speculative buying in anticipation of improved economic conditions appeared to dampen the bearish sentiment in recent months.

The rally in carbon closely tracked the sharp jump in the price of TTF natural gas, and traders continued to highlight the strong correlation between the two markets.

Nevertheless, analysts at Commerzbank ticked off a list of improving macroeconomic indicators.

“The PMI for the service sector in the eurozone, the most important indicator of economic development according to our economists, has recovered; the German Ifo index has risen three times in a row, and, last but not least, production in the energy-intensive sectors appears to be picking up, at least in Germany,” they wrote in a report this week.

“In our opinion, all of this justifies a recovery in carbon prices.”

However, they cautioned that the increase in demand for power will likely be met by growth in renewables.

“The advance of renewable energies in electricity generation is continuing at a rapid pace: according to figures from the ISE Fraunhofer Institute, a good 21% more green power was generated in the EU in April than in the previous year, while at the same time, almost 29% less electricity was produced from fossil fuels.”

Carbon Market Roundup

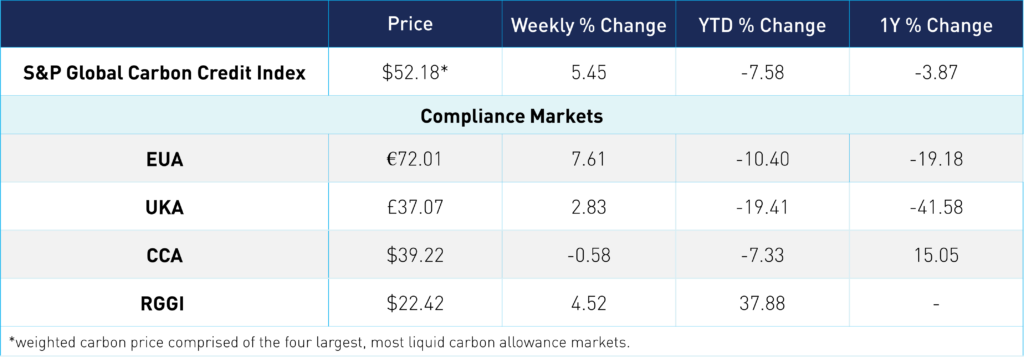

The weighted global price of carbon is $52.18, up 5.5% from the week prior. EUAs are up 7.6% for the week at €72.01. UKAs trended up 2.8% at £37.07. CCAs are down 0.6% at $39.22. RGGI is up 4.5% at $22.42.