Nat Gas Volatility Impacts EUA Market

2 Min. Read Time

European carbon prices have swung in a €17 range over the last five weeks as the region’s natural gas market has experienced disruptions related to the ebbing and flowing prospects of a peace deal in Ukraine as well as EU efforts to ensure stockpiles of the fuel are refiled in time for next winter.

Front-month Title Transfer Facility (TTF) natural gas futures, the benchmark for European gas, reached a multi-month peak of more than €110.00/MWh on January 31 but have been in retreat ever since, as President Trump suggested that a ceasefire and peace agreement between Russia and Ukraine was coming closer.

The onset of the so-called shoulder season, when demand for natural gas begins to decline ahead of the summer season, also dampened prices, while data showed that Europe had bought 82% of all US LNG exports in February, while demand from Asia appeared to stagnate.

April TTF settled on March 6 at €38.240/MWh, representing a drop of as much as 14% in just two days and more than 65% since its year-to-date high. Over the same period, December 2025, EUAs have slid from a year-to-date high of €84.50/tonne to €66.84/tonne, a drop of 21% and the lowest intraday price since December 19 last year.

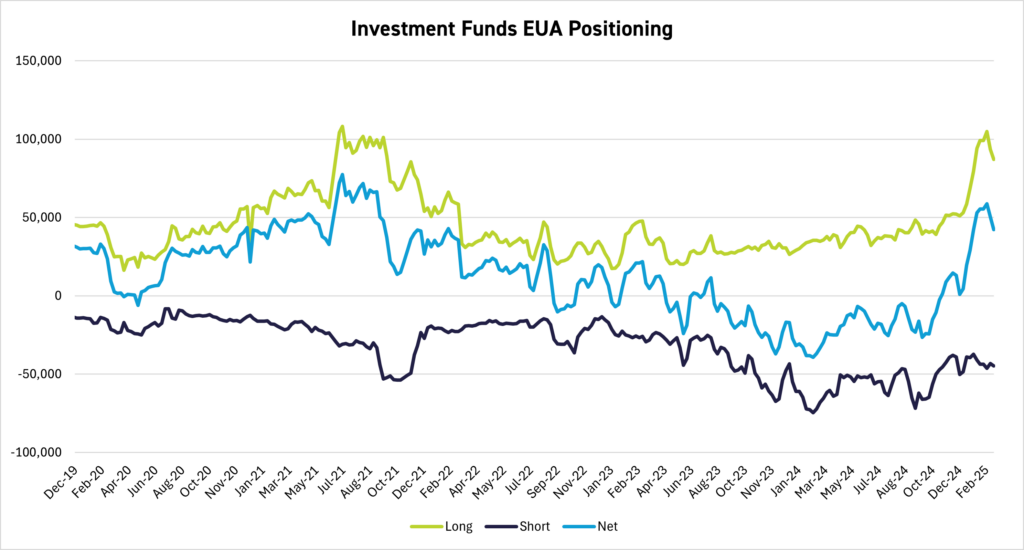

The fall has been driven chiefly by a steady reduction in investment funds' net long positions. Data from the ICE Endex and EEX exchanges show that on February 7, investment funds held a maximum net long position of 60.5 million EUAs, but this has since fallen to 42.3 million EUAs. Funds have cut their total long exposure to 87 million allowances from a peak of 104.8 million, the biggest long position since July 2021.

Traders are confident that the steep decline in EUAs over the past few days represents the liquidation of a portion of investment funds’ length, but they have warned that this length has been particularly “sticky” and has largely resisted previous steep price falls.

Funds flipped from net short to net long in November last year, when EUA prices were around €68.00/tonne, and steadily built their positions as prices rose to a high of €84.50/tonne last month. Since then, prices have been in near-constant retreat, and funds have cut their net long positions by one-third, with similar liquidations observed in the natural gas market.

Numerous traders have complained that the gas market, in particular, is experiencing unusually high volatility, pulled one way and the other by a succession of news headlines relating to the conflict in Ukraine, the imposition of US import tariffs, and efforts by the European Commission to update its gas storage mandate rules in an effort to reduce price spikes. These headlines are leading to a cocktail of volatility that is persuading many traders to adopt a risk-off position across commodity markets.

On the bullish side, data from the EU’s grid operator agency show that fossil fuels’ share of power generation rose strongly in February. Data showed gas-fired power jumped 111% on a year earlier, hard coal-based electricity production was 39% higher than a year earlier and lignite-based electricity was up 24%.

Renewable output represented 34% of power generation, which experts attributed to a lack of wind last month. Wind supplied 14% of all power, around 10 percentage points lower than in February 2024, the data showed.

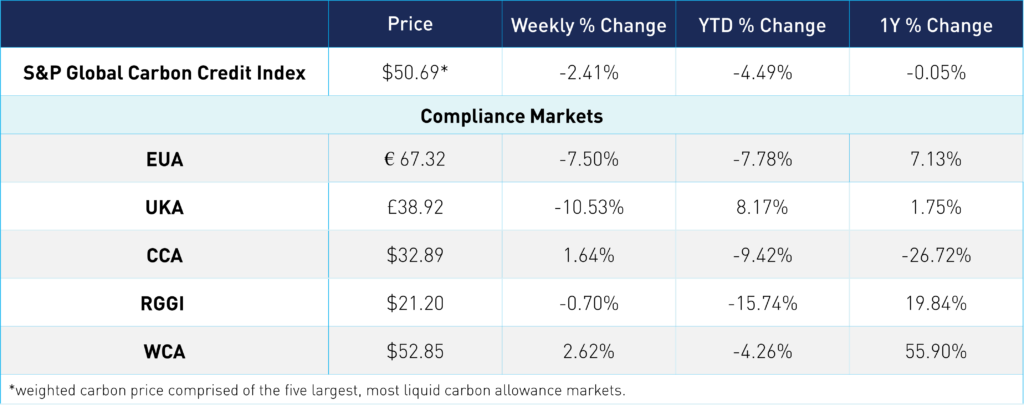

Carbon Market Roundup

The weighted global price of carbon is $50.69, down 2.5% for the week. EUAs fell 7.5% week over week to €67.32. UKAs are down 10.5% at £38.92. CCAs moved 1.6% higher at $32.89. RGGI prices were down a slight 0.7% at $21.20. WCAs were up 2.6% at $52.85.