The Knock-on Effects of Peace Talks with Russia for Carbon

3 Min. Read Time

Last week marked a major diplomatic shift as the US and Russia began discussions around ending the war in Ukraine and improving economic cooperation between the two nations. The summit is ongoing, with a second official meeting scheduled for this Tuesday in Riyadh, Saudi Arabia. With a potential end to hostilities in Ukraine, we should see a normalization of energy prices and the removal of uncertainty, which would be powerful for carbon allowances. The sell-off in EUAs over the last 18 months is largely due to policy shifts that Europe had to engage in as a result of reduced Russian gas. In the short term, we may see some volatility as gas prices come down, but ultimately, normalcy will lead to a return to fundamentals taking the driver's seat. Pre-invasion, EUAs were in the €90-100 range, while today's prices are at the low €70 level. Looking ahead, forecasts for 2030 show EUAs averaging over €145.1

So far this week, we've seen a sharp decline in the price of natural gas in Europe as concerns over the bloc’s supply shortfall have started to ease. In turn, carbon allowances have fallen by more than 7%, holding true to the correlation between the two markets that has driven EUA prices for many months, but a decline in energy costs could eventually lead to a renewed upturn in carbon as fundamental supply and demand shift the initiative back from speculative trading.

Front-December EUA prices fell from their all-time high of more than €101.00 in early 2023 to as low as €55.00 a year later as Europe’s response to the Russian invasion of Ukraine became clear.

Brussels set out to wean the bloc off Russian fossil fuels as rapidly as possible under the REPowerEU initiative, which funded an acceleration in the transition towards renewable energy and diversification its sources of natural gas. While the former has been bearish for EUA demand, the latter has become a defining feature of Europe’s energy market over the last year.

The drop in fossil fuel use in the region’s power sector is worth noting: natural gas use in electricity generation has fallen every year since 2020 – a drop of 26% by 2024. Similarly, hard coal-fired generation has declined by 30%, and lignite use has dropped by 16%. Over the same four-year period, renewables output has risen by 21%.

If the peace talks in Saudi Arabia are successful, they will likely do little to change the course of European policy to boost renewables generation since that forms part of the bloc’s long-term climate policy. But lower natural gas prices will certainly assist regional industry in a recovery from the slump that saw industrial output drop by more than 6% between 2022 and 2024. And that, in turn, is good news for EUA demand.

A more positive outlook for compliance EUA demand could come at the same time as the carbon market supply tightens significantly. The REPowerEU initiative is bringing forward the sale of around 250 million EUAs from the 2027-2030 period to help finance the EU’s energy transition, and while the “front-loading” of these permits into current supply is widely seen as damping EUA prices, the loss of this supply from 2027 is equally forecast to drive a steep recovery in EUA prices, perhaps as soon as next year.

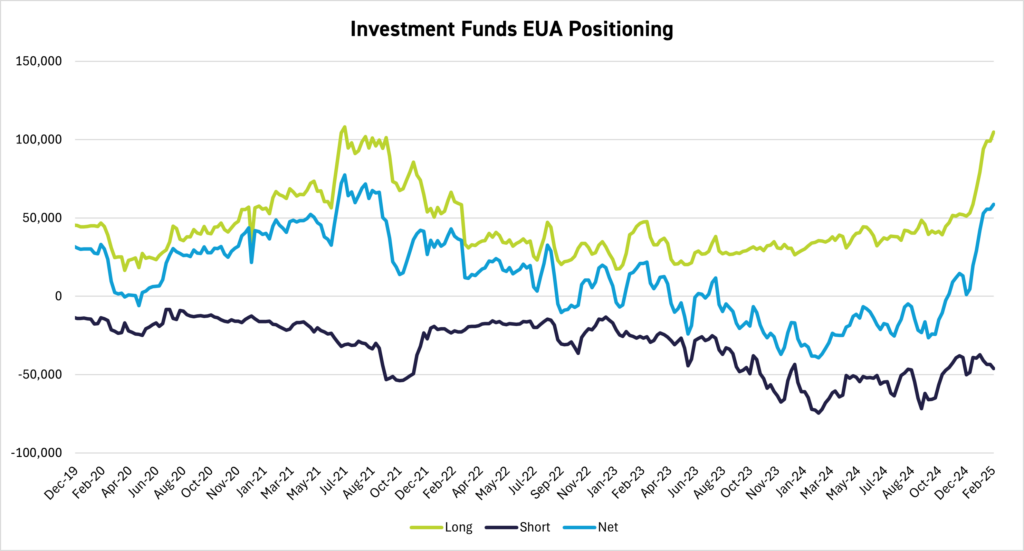

Indeed, some experienced traders are speculating that the current build-up of significant length in EUAs by investors may be anticipation of a long-term recovery in prices. Data from ICE Endex shows that investment funds have amassed their largest volume of long positions in three and a half years, and their net positioning is also the longest since mid-2021.

To be sure, the 12% drop in EUA prices over the last three weeks will likely have triggered some caution among speculative participants, but it’s worth noting that funds’ bias has been growing steadily less short at first and now more long since early last year when the market hit its post-invasion low.

It’s also possible that the moves toward peace in Ukraine may have a similar knock-on effect on California’s carbon market. With TTF natural gas prices drifting lower amid calming worries over gas supply and geopolitical instability, gas prices in the US—a key supplier to Europe—may also see a weakening trend, which could trigger an uptick in industrial demand in the state.

Cheaper energy would trigger a cascade of industrial and economic impacts that would likely lead to higher demand for CCAs, and higher allowance prices.

Carbon Market Roundup

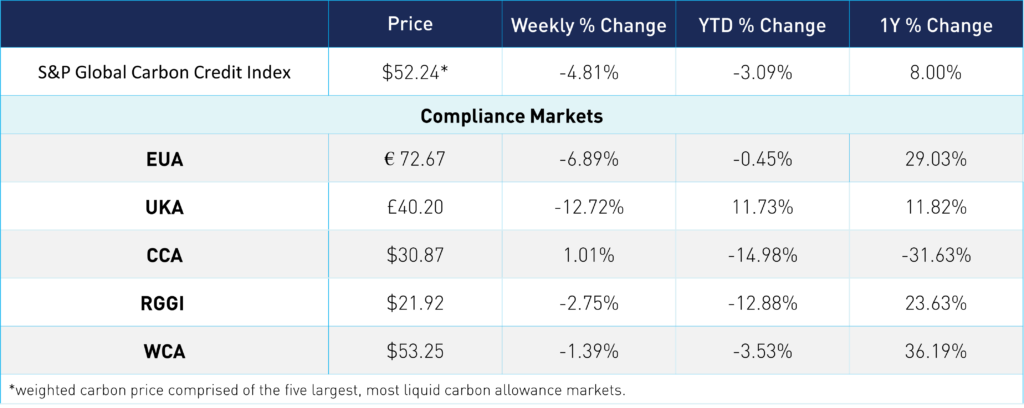

The weighted global price of carbon is $52.24, down 4.8% for the week. EUAs are down 6.9% at €72.67. UKAs are down 12.7% at £40.20. CCAs are up 1.0% at $30.87. RGGI fell 2.8% at $21.92. WCAs are down 1.4% at $53.25.

- Forecasts from Macquarie, Veyt, BNEF retrieved 2/24/2025. Prices are annual average, in nominal terms.