Are You Overlooking a Strategic Asymmetric Opportunity in California Carbon?

<1 Min. Read Time

2025 is off to an interesting start, with EUAs up 9% YTD and 24% since mid-December, with prices hovering around €80—a level that hints at the possibility of reaching €100 within the year. The UK market has also shown strong performance, up 30% YTD. In contrast, California Carbon Allowances (CCAs) have experienced a downturn, sliding 14% YTD. This divergence presents a strategic entry point into global carbon markets, particularly as European markets capture momentum and still have a long way before testing previous highs, while California enters a crucial phase for pricing.

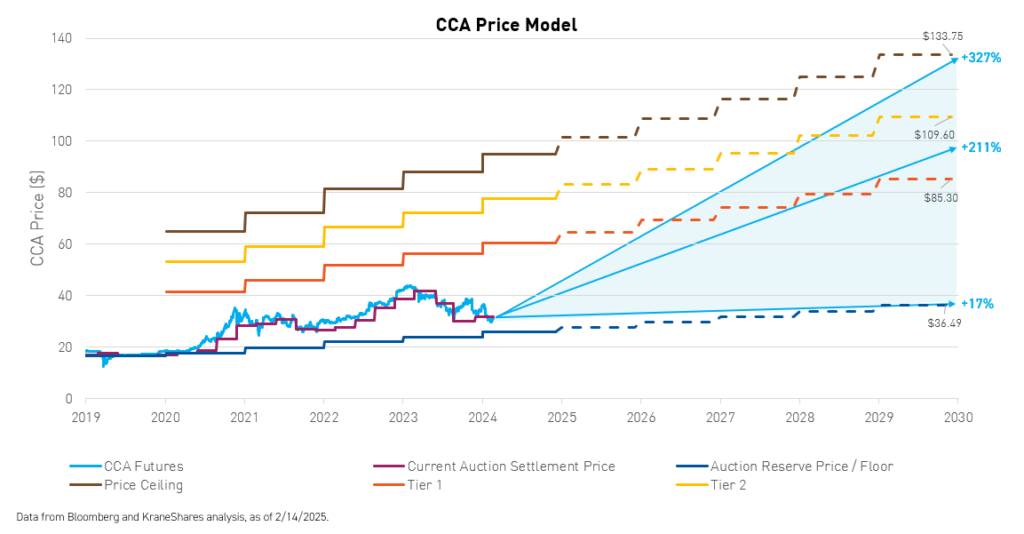

The sell-off in California carbon has opened an unusual asymmetric opportunity. The design of the market’s price floor and ceiling provides the potential for downside protection and significant upside appreciation.

Prices have been suppressed due to policy delays in 2024 and a one-year postponement in implementing stricter supply constraints. However, with policy updates expected by Q1/Q2 of this year, pivotal changes are expected to be introduced, including stricter supply reductions with the annual cap decrease adjusted to 10-14% from the current ~4%.

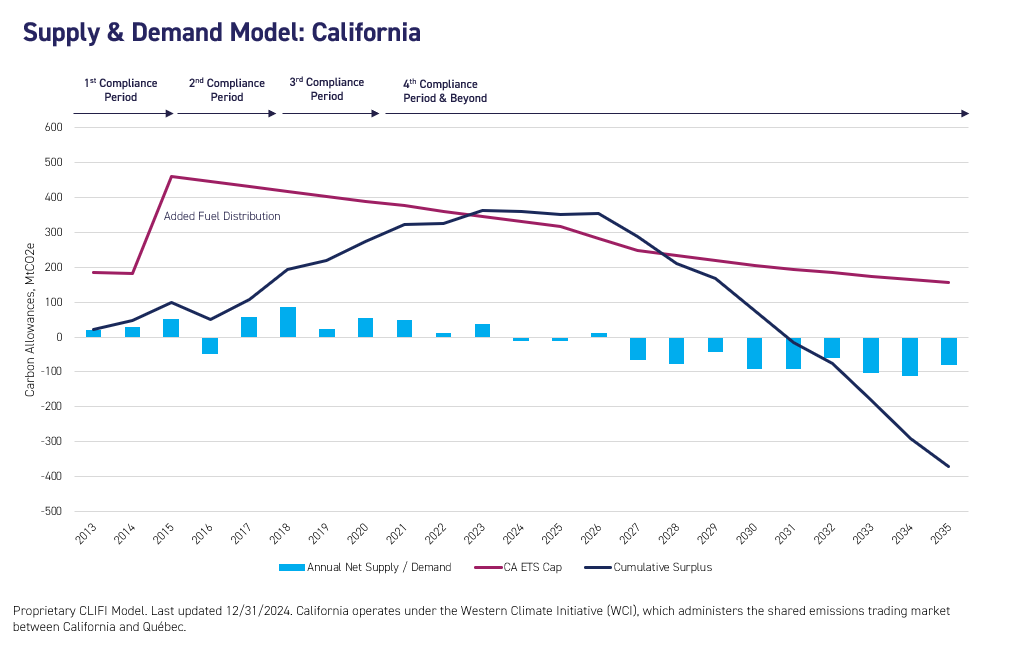

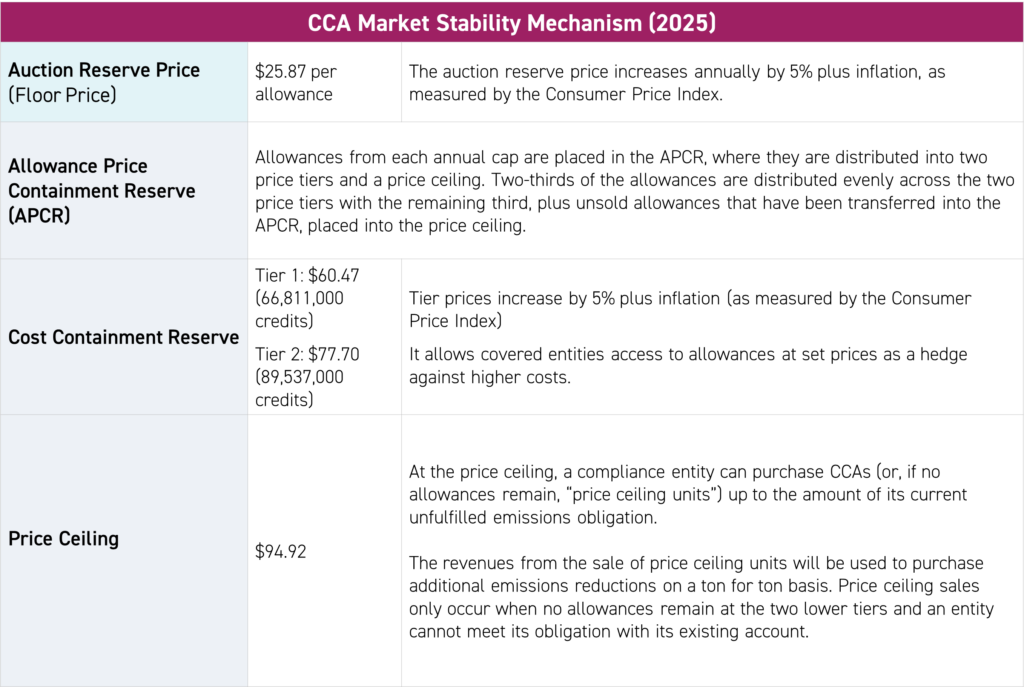

The regulator also announced plans to increase the Cost Containment Reserve (CCR), a mechanism that serves as speed bumps to help stabilize the market and prevent prices from spiking too quickly by unlocking additional allowance reserves at two predefined tier price levels and a price ceiling. The additional supply softens prices in the interim as the market has to first absorb the added allowances before prices can materially rise higher (see chart at the end). With expectations of a roughly 20% increase in these CCR levels by 2026 and a transition to steeply falling surpluses in 2027, the market is set for a potential resurgence in long positions. A full rundown of the reform updates can be found in our recent article here.

Looking ahead to 2026, the market is expected to reach a balance, followed by substantial annual deficits into the end of the decade. Under these conditions, prices are forecasted to align with the tier 1 reserve level by 2029 and continue to rise above $100 by 2030.

The CCA market’s structure also incorporates a floor price that escalates by 5% plus the Consumer Price Index (CPI), providing potential downside protection and an inflation hedge.

Stay tuned for a more in-depth article on CCA market dynamics to be published on our main site in the coming days.

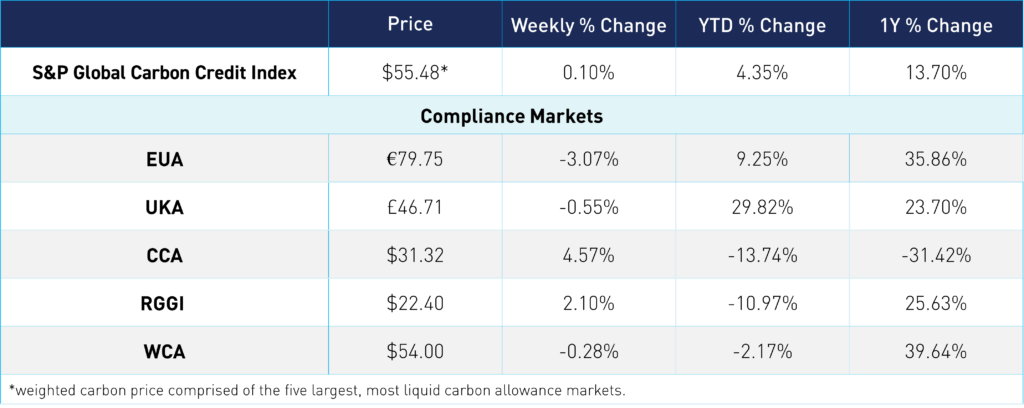

Carbon Market Roundup

The weighted global price of carbon is $55.48, up 0.1% from the week prior. EUAs slipped 3.1% lower for the week to €79.75. UKAs ended relatively flat, down 0.6% at £46.71. CCAs moved 4.6% higher to $31.32. RGGI was up 2.1% at $22.40. WCA moved 0.3% lower to $54.00.