What is Europe’s New Carbon Market, Breaking Down the EU ETS2

2 Min. Read Time

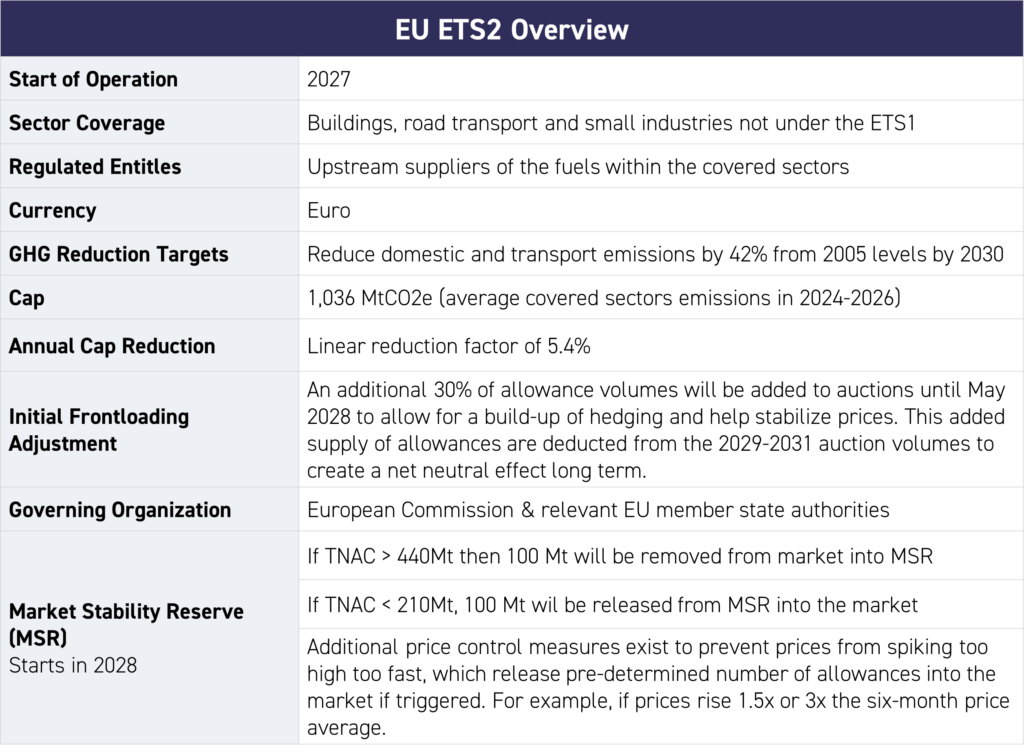

The European Union is preparing to extend its carbon market coverage to include emissions from fuels used in the transport and domestic sectors with the launch of a separate EU ETS2, the first time that carbon pricing could more directly impact European consumers.

“EU ETS 2” will be a cap-and-trade system much like the existing ETS that covers emissions from industrial plants across 27 member states. However, instead of regulating at the point of emissions – such as the power stations and oil refineries that emit greenhouse gases – ETS2 will regulate upstream suppliers of coal, gas, and oil products used by households, businesses, and vehicles.

The goal of ETS2 is to cut domestic and transport emissions by 42% from 2005 levels by 2030.

ETS2 is set to come into force in 2027, with a cap on emissions totaling nearly 1.04 billion tonnes. These permits will only be issued at auction, meaning that a price signal will be generated through auctions from the start. Other carbon markets offer some free allowances for certain industries until transitioning to full auctioning to help maintain their competitiveness and prevent carbon leakage.

Auctions will be “front-loaded”—that is, around 30% more permits will be sold in the first year to provide sufficient liquidity for the market to generate a proper price signal and allow some larger businesses to hedge forward commitments. This frontloading is typical at the start of a cap-and-trade program.

This initial surplus will be held in check by a Market Stability Reserve (MSR), which will be tasked with maintaining market supply between 210 million and 440 million tonnes after each compliance cycle is completed. The MSR is also configured to inject additional ETS2 permits if prices stay above €45/tonne for two consecutive months.

Analysts point out that this initial front-loading surplus will also lead to a tighter market later as the front-loading is followed by a period of annual deficits. This shortfall could reach 190 million tonnes in 2029 and 136 million tonnes in 2030, according to Macquarie.

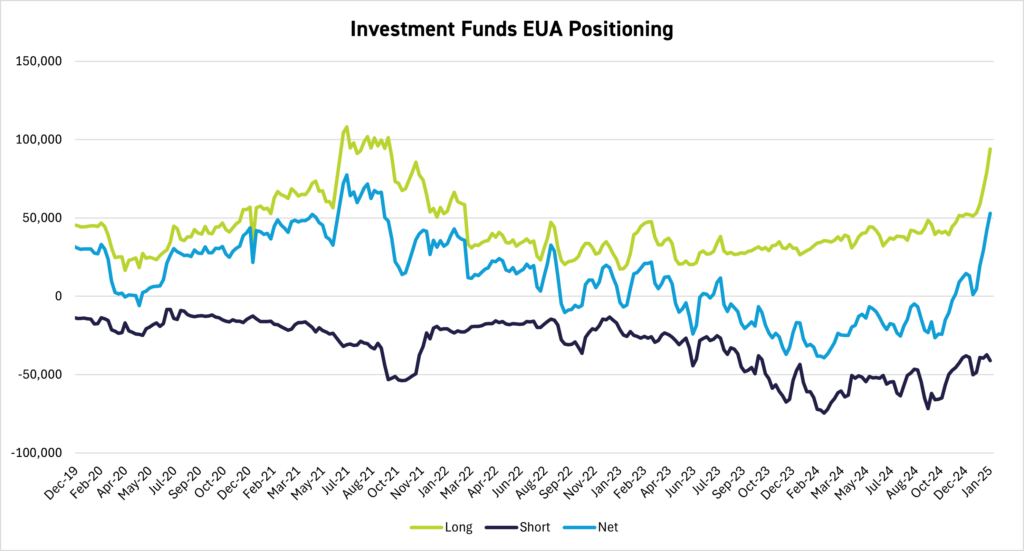

The expectation is that domestic fuel suppliers (typically utilities) will be more active hedgers of forward commitments. Macquarie estimates year-ahead hedging requirements could total 250Mt in hedging requirements.

EUA2 futures are expected to trade at a premium to EU ETS1 prices when the futures market starts, but liquidity will likely be low.

Numerous stakeholders, including member states such as Poland, have called for ETS2 to be postponed as current energy prices remain well above historical averages, but so far, the new market is on course for launch in just under two years.

Carbon Market Roundup

The weighted global price of carbon is $56.13, up 2.9% from the week prior. EUAs are up 2.4% for the week at €82.66. UKAs rallied 31.3%, ending the week at £44.25. CCAs are down 0.9% at $30.92. RGGI trended down $22.02. WCA ended the week flat, down 0.2% at $54.05.