CCA Auction Clears In Line With Expectations, Lawmakers Introduce Two Bills to Extend the Program

2 Min. Read Time

The first quarterly auction for California Carbon Allowances (CCAs) of 2025 cleared at $29.27/tonne on February 19, the lowest in two years though sub-$30 was largely expected. CCA Dec25 futures hit a high of $32.59 following the auction results release, seeing a boost from the recently filed bills to extend the program beyond 2030.

The clearing price was $2.64 below the previous sale in November and $3.40 above the reserve price. It also marked a 30% drop from the record high achieved 12 months ago.

The sale saw bids totaling 1.74 times the 51.4 million current-vintage CCAs on offer. Compliance companies accounted for more than 83% of the total volume of current-vintage permits purchased and 59.5% of the forward vintage sale.

The results reflected market participants' continued frustration around delays in finalizing the updated market regulations for the period starting in 2026. Regulators at California's Air Resources Board (CARB) have delayed the publication of the Initial Statement of Reasons (ISOR), the next step in the rule-making process after the December wildfires took up many of the agency's resources and lawsuits seeking to overturn changes to the state's Low-Carbon Fuel Standard delayed work. Although there is no specific date set yet, the ISOR is expected to be issued for public comment in the next few months.

Bringing more positive momentum, lawmakers introduced two preliminary bills in both the state's Senate (SB-840) and Assembly (AB-1207), notifying their intention "to enact subsequent legislation to reauthorize the California Greenhouse Gas Cap-and-Trade Program" beyond 2030. While CARB has been drawing up plans to adjust the market parameters to meet the state's updated 2040 goal of a 70% cut in greenhouse gas emissions, any extension of the market after 2030 still requires an overarching legislative decision. Neither bill contains any details of likely changes to the market but has nonetheless been filed in order to earn a place on the legislative schedule before the February filing deadline.

The program was already extended once before in 2017 beyond its initial 2020 timeline. Since then, the program has also generated an increasing amount of revenue for the state, providing over $8 billion in 2024 alone. Beyond just its role in helping meet the state's emissions targets, the market is of substantial value, especially compared to other climate-related initiatives, for funding purposes. Although it is a bit nuanced, CARB still would have implicit authority to implement the cap-and-trade program after 2030, even if its officially extended, as the regulator has permission to follow what ever tools they deem are best for achieving the emissions reduction goals.

The submission of this intent to legislate gave the CCA market a boost after the weak auction outcome. Secondary market prices had slumped to long-term lows of less than $30/tonne ahead of the sale but have since recovered to nearly $34/tonne.

Carbon Market Roundup

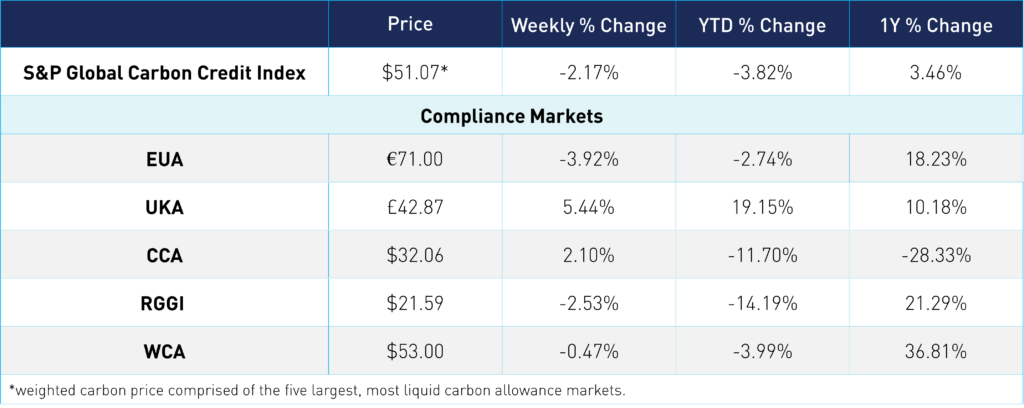

The weighted global price of carbon is $51.07, down 2.2% for the week. EUAs are down 3.9% at €71.00, closely tracking the nat gas market. UKAs are up 5.4% at £42.87. CCAs are up 2.1% to close at $32.06. RGGI was down 2.5% at $21.59. WCAs trended down 0.5% to $53.00.