Carbon Markets in 2025: Key Developments to Watch

2 Min. Read Time

As we move into 2025, the carbon markets are poised for significant changes that could redefine compliance carbon markets worldwide. Here's a look at five key developments:

Finalization of CCA Reform:

The California Cap-and-Trade Program is set to finalize comprehensive reforms this year. Market reform delays and uncertainty weighed heavily on CCAs in 2024. While the reform was delayed, the tightening is now accelerated under a shorter frame while providing the same end result. These reforms address the increased ambition following the passage of AB 1279, which aims for a dramatic reduction of greenhouse gases to 85% below 1990 levels by 2045. To align with these goals, the state plans to tighten emissions reductions for 2030 from 40% to 48%. For further details on the CCA market reform, see our blog here.

Increased Demand for EUAs from New Compliance Updates:

Changes in the EU Emissions Trading System (ETS) are expected to significantly impact the demand for EU Allowances (EUAs):

- Maritime Sector: In 2024, the maritime sector was required to surrender EUAs for 40% of its emissions. This requirement will increase to 70% in 2025 and 100% by 2026, introducing an additional demand of 80 million tonnes. The incorporation of 70% of maritime emissions into the ETS by 2025 is expected to significantly boost the demand for EUAs, as the industry adapts to meet new regulatory standards.

- Aviation Sector Adjustments: The removal of free EUA allocations to airlines will push the aviation industry towards greater market participation.

These two factors are a key driver behind ICE's launch of "mini-EUA" futures, which has so far been unsuccessful but may pick up in 2025 with the reforms. The mini futures include lots of 100 tons of EUAs versus the pre-existing EUA futures of 1000 tons of EUAs.

Discussions on Linkages and New Entrants:

- Washington and Western Climate Initiative (WCI): There is ongoing discussion about linking Washington's carbon market with the WCI. Washington's market, though smaller than the joint California-Quebec market, shows potential for substantial influence if linked. The integration could lead to a more unified and robust trading environment, potentially driving up prices across all three jurisdictions. in 2025, ECY will introduce regulations aimed to facilitate linkage between Washington and California-Quebec WCI will go into effect. Items such as: auction limit increased from 10% to 25%, and handling of electricity imports, offsets, schedule of future compliance periods, and other items were adjusted to match California-Quebec.

- Oregon's Cap-and-Trade Restart: Oregon is reconsidering its cap-and-trade program, aiming to enhance the regulatory reach across the U.S. West Coast and contribute to a more integrated North American carbon market.

CBAM's Influence on Global Carbon Markets:

The EU's Carbon Border Adjustment Mechanism (CBAM) is set to significantly impact global carbon markets. It reduces free allowances in the existing market and acts as a catalyst for the emergence of new markets. By aligning the carbon costs of imports with EU pricing, CBAM encourages other countries to create or enhance their own carbon markets to avoid paying EU/UK carbon tariffs.

This push for global alignment is anticipated to expand the coverage of emissions under trading systems from 18% to 28%, potentially tripling the investable carbon market to an estimated $2.5 trillion by 2030.

Kickstart of NY Cap and Invest:

New York State is developing a Cap-and-Invest Program (NYCI) aimed at reducing greenhouse gas emissions, setting the stage for the US' third biggest cap-and-invest market – possibly with a market size of $5.6 Billion. Program implementation could be postponed to 2026, as the timeline for a 2025 implementation is very tight, given an extended comment and review period.

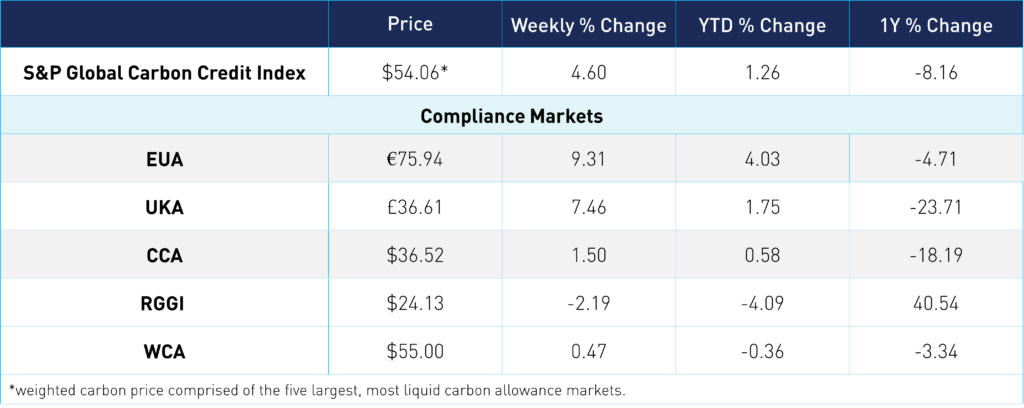

Carbon Market Roundup

The weighted global price of carbon is $54.06, up 4.6% from last week. EUAs are up 9.3% from the week prior at €75.94. UKAs trended up 7.5% for the week at £36.61. CCAs are up 1.5% at $36.52. RGGI is down 2.2% at $24.13. WCAs are 0.5% higher at $55.00.