Nat Gas Drives EUA Rally, Impact of California Wildfires on CCAs

3 Min. Read Time

EUAs rally higher, amassing largest total length since December 2021

European carbon prices have been on a speculator-fuelled tear. December 2025 EUA futures have risen by as much as 23% in the last month as investment funds flipped from a net short to a net long position starting in November and went on to amass their largest total length since December 2021.

Much of this bullish move has been driven by continuing volatility in natural gas, where prices have also rallied by as much as 25% since the middle of December. Traders continue to fret over drawdowns in the region’s storages, which are now at 64% full, compared to 78.9% on the same time last year and 81.7% on January 14, 2022.

The volatility also applies to the state of talks among EU member states over how to replace lost volumes of gas now that the transshipment of Russian gas through Ukraine has come to an end. Some eastern EU states are pushing for a resumption of flows through Ukraine, while more recently, another group of ten countries called for more wide-ranging bans on Russian LNG and gas.

The recent rally has also shown that carbon and gas prices remain very closely linked: the rolling short-term correlation between the two markets is still in excess of +0.8, and as long as gas supply remains in question, the volatility in TTF gas is likely to drive volatility in EUAs.

Some analysts have flagged an improvement in industrial demand, as well as from power generators, who are increasingly burning coal. However, the hedging activity appears to be taking place on a more short-term basis rather than wholesale year-long hedging, as has happened in the past. This suggests that utilities expect gas to eventually return to the top of the merit order and are unwilling to assume coal’s primacy for long.

Once EUA supply starts to tighten after 2026, the outlook for EUA prices brightens considerably, and the most recent forecasts still predict prices of €100/tonne by 2027-28.

Impact of California wildfires on CCA cap and trade

We have received some questions about the impact of the tragic California wildfires on the state's cap and trade program. Although the regulator, the California Air Resources Board (CARB), does play a role in the response to fire mitigation, the teams responsible for the efforts are separate from the policymakers behind the carbon market. The fires are, therefore, not expected to directly affect the state’s policymaking on climate and the cap-and-trade program. It should be noted that CCA revenues directly fund wildfire mitigation, so they are part of the solution package. The increased frequency and severity of wildfires should lead to greater support for and importance of these programs.

Having said that, CARB has announced a short delay to the rollout of the 45-day package, which is the next step in the reform process and provides long-awaited specifics on the final provisions of the reform. The market reacted sharply to the news, though its our understanding that the package should be issued later in the quarter after the first auction of the year, which is on Feb 19th, with results published the following week.

Potential US carbon tariffs

President-elect Donald Trump's U.S. Treasury Secretary nominee, Scott Bessent, discussed interest in potentially enacting tariffs on carbon emissions when addressing the US Senate on Thursday. He explained that "it’s a very interesting idea that could be part of an entire tariff program," according to a Reuters article.

We called this in our November article, 5 Reasons Why Trump’s Administration Could Strengthen Carbon Allowance Demand. In our view, it's a potential opportunity for the US to introduce a carbon tariff similar to the EU and UK Carbon Border Adjustment Mechanism (CBAM). A CBAM-type tariff could boost US industry in the sectors that President Trump has already highlighted, including steel and aluminum, by discouraging foreign imports while also keeping the country competitive with other nations that have or plan to implement CBAM.

Carbon Market Roundup

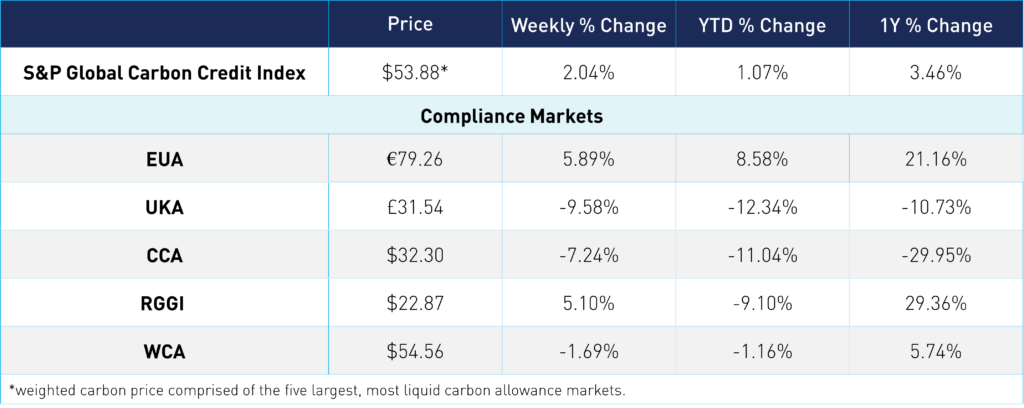

The weighted global price of carbon is $53.88, up 2.0% from the week prior. EUAs are up 5.9% for the week to €79.26. UKAs trended down 9.6% to £31.54. CCAs are down 7.2% at $32.30. RGGI ended the week up 5.1% at $22.87. WCA is down 1.7% at $54.56.