RGGI and Washington Q4 Auctions Clear at a Discount, UK Launches New ETS Consultation

3 Min. Read Time

RGGI Q4 Auction Clears at a Discount

The final RGGI allowance auction of the year cleared at $20.05/short ton, a significant discount to the secondary market and 22% lower than the previous sale held in September, according to data from the market regulator.

The sale offered the same total of 15.9 million RGAs as the September edition, and was 2.4 times oversubscribed, the lowest bid-to-cover ratio since September 2023.

In the run-up to the auction, December RGA futures had traded at around $22.40/ton but slumped to as low as $20.75 in the following week, before recovering to trade as high as $22.55 on Dec. 12, data from ICE Futures showed. The auction’s discount was thought to be related to lack of an update around the program reform.

Washington State Q4 Auction Surprises with Muted Bidding Activity

Washington State's last quarterly auction of the year sold all 7.99 million allowances offered at a settlement price of $40.26. This clearing price came in lower than the front-month futures price of $58.50, representing a 31% discount. The auction was largely expected to come in at the allowance price containment reserve (APCR) Tier 1 level of $56.16. Triggering the APCR Tier 1 would lead to the release of additional allowances for sale, which provide more supply in the currently tight market balance. Analysts may have gotten ahead of themselves with their price targets as enthusiasm was running high after Ballot I-2117 didn't pass at the November election (which would have shut down the cap and trade program).

Even though the sale came in below expectations, it was still the highest settlement price of the year and over $10 above the previous auction in Q3, which was stunted by uncertainty around the program's future ahead of the ballot initiative. Given the APCR wasn't triggered and additional allowances weren't introduced, the market could see accelerated upward price pressure heading into next year, considering it's already in a tight supply/demand balance.

Compliance entities showed lower participation this quarter, making up just 73% of the sale compared to the typical average of 88%. This more muted participation is partially attributed to less demand for allowances following the November 1 compliance obligation deadline, when entities had to submit allowances equivalent to a percentage of their full obligation for the year. With no immediate deadline to submit allowances post-compliance obligation, there tends to be less interest in buying—a phenomenon also common in California's market.

WCAs reacted sharply to the release of the auction results summary report on Wednesday, with the front-month futures prices falling roughly 18% from the day prior. The contract has since rebounded slightly, though it is still around $8 below pre-auction levels.

New Consultation Launches for UK ETS

Across the Atlantic, the UK government has launched new consultations on potential changes to the market’s scope and on the treatment of free allocations to plants that cease operations.

The inclusion of domestic maritime transport emissions would see vessels of more than 5,000 metric tonnes of displacement required to report their emissions and surrender a corresponding number of UKAs each year starting in 2026. The government’s consultation is seeking views on technical points of regulation and on potential partial exemption for voyages to and from Northern Ireland.

The Northern Ireland exemption would see voyages assessed on only 50% of the emissions that start and end in the region, because voyage to the neighbouring Republic of Ireland – which participates in the EU ETS - are only charged 50% of their emissions.

The UK is also considering whether to cover voyages to and from the European Economic Area (the EU plus Norway and Iceland). Including these voyages in the scope of the UK ETS would require shipowners to surrender UKAs covering 50% of all emissions, matching the EU ETS treatment for routes outside the market’s area.

The second consultation proposes to dynamically adjust free allocation to plants that cease operating during any year of the market’s operation. Current rules allow plants to retain any unused permits even if a plant ceases to emit greenhouse gases, and the government is planning to legislate to allow allocations to be adjusted to account for shutdowns.

The UK government conducted a key consultation on adjustments to the market cap and on introducing a supply adjustment mechanism at the end of 2023.

Carbon Market Roundup

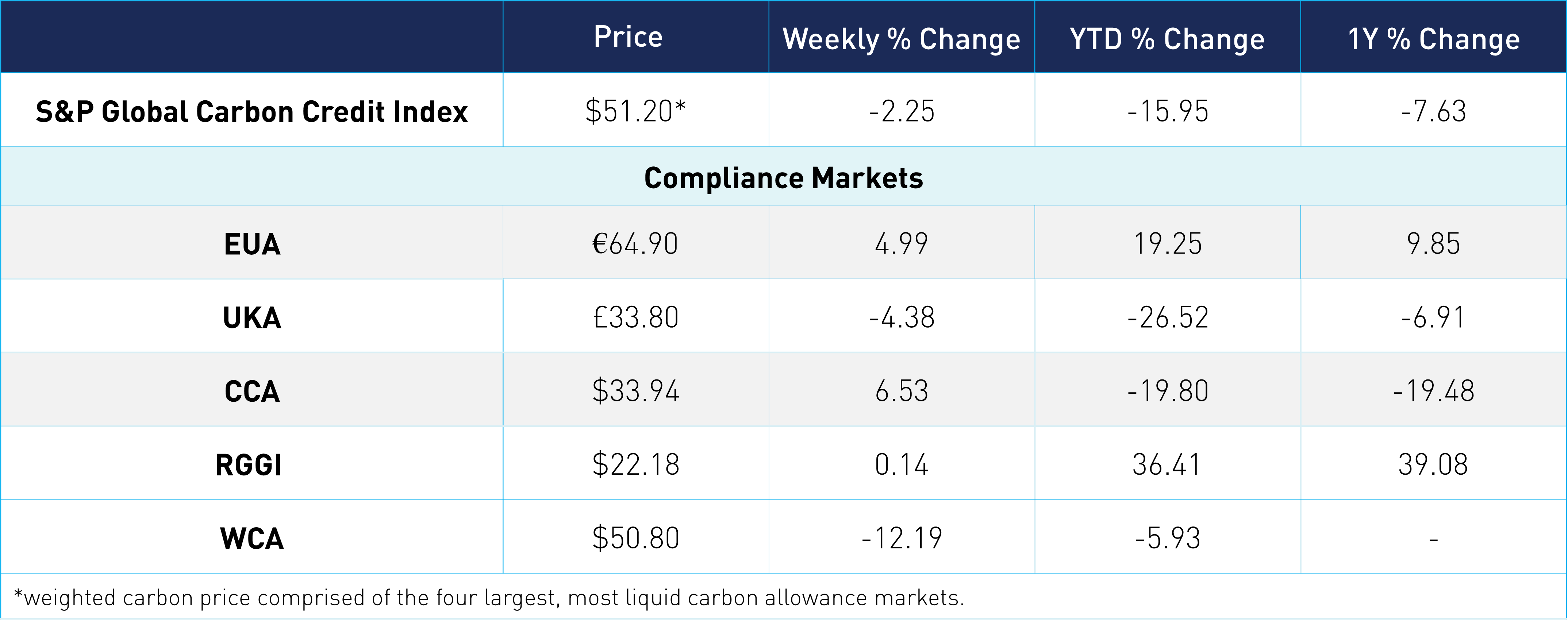

The global weighted price of carbon is $51.20, down 2.25% from the previous week. EUAs are up 4.99% for the week at €64,90, while UKAs are down 4.38% to £33.80. CCAs trended up 6.53% at $33.94. RGGI was up 0.14% at $22.18. WCAs fell 12.19% to $50.80.