EUA End of Year Rally, Daily Auctions Resume

2 Min. Read Time

EUA prices rose by 18% from December 17 and the first week of January, fueled by speculative investors amassing long positions in the new front-December futures contract and a 25% jump in natural gas prices.

The rally has come to a temporary pause as participants are now back at their desks after the winter break, and the supply of primary EUAs at daily auctions has resumed. December 2025 EUAs traded at a peak of €76.35/tonne on January 3 and are currently almost €3/tonne lower.

Some of this decline has been attributed to profit-taking by speculators, who enjoyed the €13/tonne rally since mid-December, but gas prices have also declined over the past week as traders factor in the milder weather forecast for the second half of January and into February.

Carbon’s historical price performance in January and the first quarter as a whole has been relatively flat. Data from ICE show that EUAs have ended Q1 around 4% lower than at the start of the year, with prices in March tending to cancel out monthly losses in January and February.

However, a longer-term view shows that the market has enjoyed an average 25% increase over the combined Q4 and Q1 period. In 2020, 2021, and 2022, prices surged by as much as 60% (in 2020-21), with only 2023-24 recording a decline of 23% over the six-month period.

It’s worth bearing in mind also that price action in the first quarter of previous years has reflected the annual compliance deadline in April; compliance buyers have often “telescoped” their buying into the first quarter of the year.

With the new compliance deadline falling in September, this Q1 buying rush is no longer a key factor. Nonetheless, open interest data show that the future contracts of March EUA still hold the second-highest open interest after December. This may reflect financial accounting priorities among some buyers and may well continue as corporate buyers look to bolster their carbon balances before the end of the accounting year.

Commitment of Traders data also shows a rosier picture for EUAs. Speculative investors flipped from net short to net long for the first time in 16 months in December and were net long by 4.5 million EUAs at the turn of the year. That’s a far cry from the nearly 17 million-tonne aggregate short position from the end of December 2023.

That net short position in early 2024 drove a €30 drop in EUA prices from €82 to €52 over the first two months of the year, but the market then rallied by 50% by the summer.

Much of carbon’s volatility remains due to substantial swings in natural gas prices, and the correlation between the two markets has remained strong over the past year. With the exception of two periods – over the peak summer months and in October, the 20-day rolling correlation between front-month TTF gas and front-December EUAs has remained above +0.5 and often higher than +0.75.

This relationship is unlikely to change in the near future, as Europe continues to fret over how to replace long-term gas supplies from Russia while storage is being drawn down at the fastest pace in four years.

Carbon Market Roundup

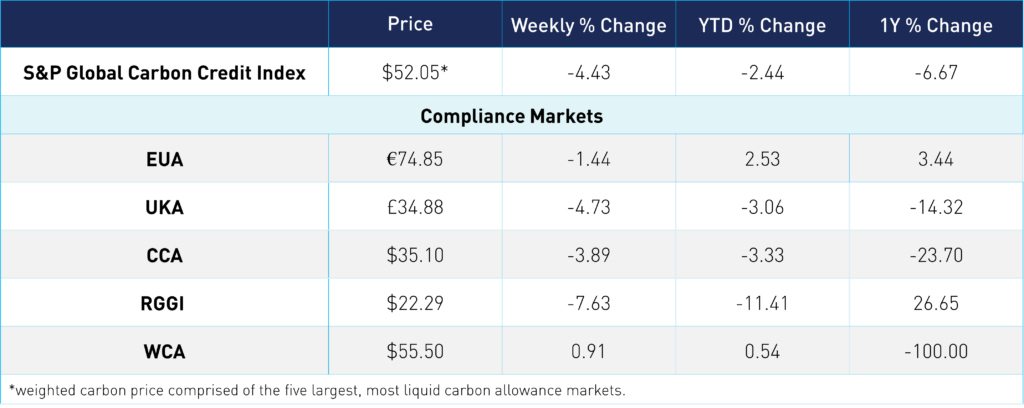

The weighted global price of carbon is $52.05, down 4.4% from the week prior. EUAs fell slightly by 1.4% for the week to €74.85. UKAs were down 4.7% at £34.88. Meanwhile, CCAs are down 3.1% for the week at $35.10. RGGI is down 7.6% at $22.29. WCA prices saw an increase of 0.9% to $55.50.