Potential Outcomes of the Executive Order, Impact of Nationwide Power Outages in Spain & Portugal

4 Min. Read Time

California EO Update

President Trump’s executive order targeting state-level climate policy faces a challenging legal landscape in its effort to halt emissions trading. Experts have identified three main avenues that the Attorney General might use in relation to California’s cap-and-trade program.

The first, which we discussed two weeks ago, is what is known as the “Compact clause” of the constitution, which prohibits states from entering into “any Agreement or Compact with another State” or with a foreign government without the consent of Congress. President Trump used this justification in his first attempt to derail the California market, accusing Sacramento of breaching the constitution by agreeing to a cross-border market with Quebec. The challenge was thrown out by a district court judge, but the Department of Justice’s subsequent appeal had not been heard before President Biden was elected, and the appeal was withdrawn.

If this strategy were to be eventually successful, California might be forced to cut its ties with Quebec, halting joint auctions and the eligibility of all allowances for compliance in either jurisdiction. It might also lead to the Californian market being in surplus for longer, but since Quebec’s market is just 20% of the size of its partner, this might not be a significant challenge.

The second possible line of attack may be through the “Commerce clause” of the Constitution, which gives Congress the power to regulate commerce with foreign nations and among the states. Since California’s market covers emissions generated by out-of-state utilities that sell electricity to California, the courts might view this as interstate commerce and declare it unconstitutional. However, out-of-state emissions represent just 4% of total emissions covered by the state’s market: again, a relatively small adjustment if out-of-state carbon emissions had to be excluded from the cap.

Lastly, the Federal Energy Regulatory Commission (FERC) may be ordered to file suit against California’s market using its emergency power provision, which allows the agency to take action during energy crises to ensure adequate service and protect the public. President Trump issued an Executive Order on January 20 declaring that the country’s energy capabilities “are all far too inadequate to meet our Nation’s needs.” The Order appears to be aimed primarily at easing the process of approving resource extraction, refining, transportation, and supply to all parts of the country. Still, the declaration of an emergency may be legally sufficient to allow FERC to exercise its emergency powers.

It’s unclear what justification FERC might use and how it might address California’s market. Still, any legal arguments and cases would likely take several years, potentially extending into the next presidential term. And if a Democratic candidate were elected, the FERC powers might well be revoked by Trump’s successor.

*****

Nationwide Blackouts in Spain & Portugal

Spain and Portugal were rocked last week by a nationwide power cut that disrupted the country’s entire economy, stranding trains in tunnels and shutting down cell phone networks. Authorities in both Spain and neighboring Portugal have not yet reported on the cause of the blackout. However, some sources suggested the high proportion of renewable generation operating at the time meant that there was insufficient fossil-fired capacity available to provide backup generation when supply was lost from the southwestern region of Spain.

Fossil plants operate turbines that spin to generate power; even when their fuel is cut, the turbines continue to spin and generate electricity, a process called “inertia." However, with so few fossil plants operating at the time, there was relatively little inertia output.

Spanish power generation fell shortly after midday on April 28 from around 35 MW – of which nearly 30 MW was renewable – to less than 10 MW in a matter of minutes. Fossil plants were brought online but were only generating an appreciable volume of electricity by the evening. At midnight on April 28, total generation was still only around 18 MW.

Despite its widespread social and economic impact, the outage is expected to have a minimal effect on carbon emissions in Spain. The country has generated 64% of its electricity from renewable sources year to date, while Portugal’s share of wind and solar is even higher at 78.4%. Only Norway and Sweden, which have immense hydro resources, get more of their power from zero-carbon sources.

Spain operates a total of 2,115 MW of coal-fired capacity and just over 28,000 MW of gas-fired plants. In 2024, these plants emitted 31 million tonnes of CO2, according to data from the European Commission, down nearly 12% from a year earlier. A 24-hour halt to generation from these plants might represent the loss of as much as 80-100,000 tonnes of CO2, though this does not take into account variations between working day and weekend load or unusual variations in renewable generation.

The blackout has underscored the necessity of modernizing grid infrastructure to accommodate the increasing share of renewables. There is no indication that Spain or Portugal plans to reconsider their energy mix. Both countries remain committed to their renewable energy targets. Spain aims for 81% of its electricity to come from renewables by 2030, while Portugal targets 85% by the same year. The European Union estimates that over $2 trillion in upgrades are needed by 2050 to handle the growing share of renewable energy and prevent future blackouts. Increasing storage capacity should also help to provide flexibility and stability to the grid, with Spain already planning to develop 20 GW of storage capacity by 2030, and at least 30 GW by 2050.

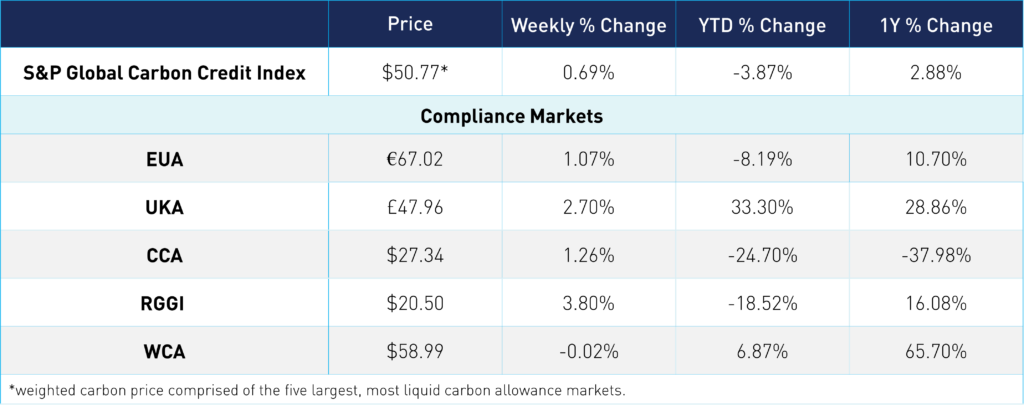

Carbon Market Roundup

The weighted global price of carbon is $50.77, up 0.7% for the week. EUAs were up 1.1% at €67.02. UKAs were 2.7% higher at £47.96. CCAs were up 1.3% at $27.34. RGGI was 3.8% higher to close at $20.50, while WCAs ended the week flat at $58.99.