What the Latest Executive Order on State Climate Policy Means for Cap-and-Trade

2 Min. Read Time

Last Tuesday, President Trump issued an Executive Order (EO) targeting state-level climate policy, albeit with little actionable content.

The Order, entitled Protecting American Energy From State Overreach, requires the Attorney General to identify “all State laws…burdening the…use of domestic energy resources that are or may be unconstitutional, preempted by Federal law, or otherwise unenforceable” and to “take all appropriate action to stop the enforcement of State laws” that are determined to be illegal. The Executive Order singled out California’s cap-and-trade program for particular criticism, saying that it “forces businesses to pay large sums to ‘trade’ carbon credits to meet [the state’s] radical requirements.”

The reaction from California has been swift and unequivocal. Air Resources Board chair Liane Randolph said, “California will stand our ground and fight to maintain our authority to reduce harmful pollution to the fullest extent possible.” And Governor Gavin Newsom was even more blunt. Calling the Executive Order a “glorified press release," Newsom pointed out that “greenhouse gas emissions in California are down 20% since 2000 – even as the state’s GDP increased 78% in that same time period.”

This is not the first time President Trump has taken aim at carbon markets. In 2019, under the first Trump administration, the Justice Department sued the state and the non-profit administrator of the market, the Western Climate Initiative (WCI), for engaging in a cross-border treaty with the province of Quebec, whose market is linked to California. Under the US Constitution, agreements with foreign countries are under the purview of the federal government, but numerous experts have pointed out that many US states have entered into hundreds of bilateral agreements with neighboring foreign jurisdictions, such as the 1985 Great Lakes Charter. The Justice Department suit was dismissed by a federal judge who ruled that Washington had “failed to show that California’s program impermissibly intrudes on the federal government’s foreign affairs power,” while experts pointed out that the suit had not targeted the cap-and-trade market itself, but rather the linkage with Quebec.

Taken at face value, this latest Executive Order, therefore, seems to be more posturing than anything else. We note that state governments are responsible for climate matters within their jurisdictions, though policies that extend to multiple states, such as the RGGI market, could be more vulnerable simply due to their interstate nature. That said, RGGI was not explicitly mentioned in the EO.

Washington D.C.'s attack on cap-and-trade markets is in its early days, and the Attorney General has 60 days to conduct a review and report back. This battle will likely be fought in court, with the proceedings taking several months.

December 2025 California carbon futures prices dropped from $29.83 at the settlement on April 8 to a low of $22.50 on April 9 in the wake of the White House announcement. That’s $3.37 below the reserve price (floor price) for allowance auctions in 2025. Prices quickly rallied, though, and the market settled higher on April 9, with the front-December contract closing at $27.36.

Our view is that California’s cap-and-trade program is well protected and has already withstood one attack by the federal government. With prices having briefly dropped below the auction reserve, i.e., the market’s price floor, and trading near this level, we see this as an opportunity to add to positions that could benefit from the bounce when the market rationalizes. The CCA floor is $25.87, and by 2026, we estimate $28 by factoring in a 3% inflation rate, which could come in higher with tariffs or lower with economic impact (i.e., 1% = 26 cents). Even in the short-term bear case scenario, there is still the potential upside of at least 5% plus inflation from the annual floor price rate increase.

Carbon Market Roundup

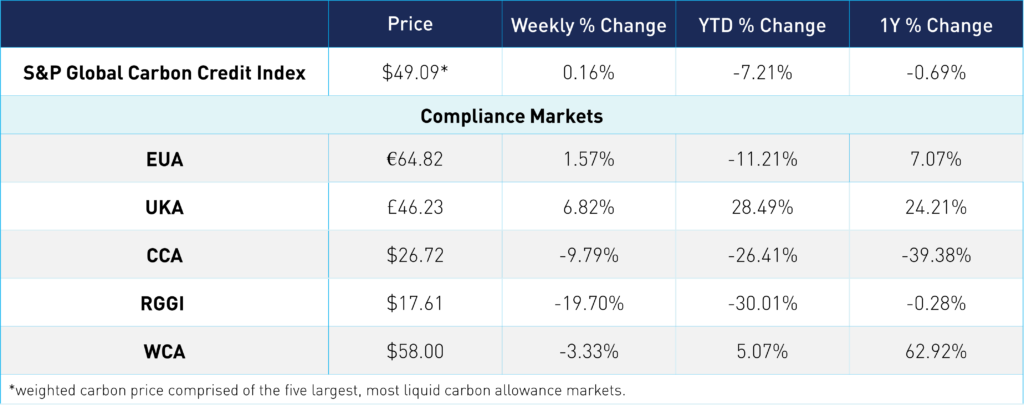

The weighted global price of carbon was $49.09, up 0.2% for the week. Carbon was along for the ride in the global market volatility seen this past week due to the tariff turmoil. EUAs were up 1.6% at €64.82. UKAs were up 6.8% at £46.23. CCAs were down 9.8% at $26.72. RGGI took the biggest hit, down 19.7% at $17.61. WCAs fell 3.3% at $58.00.