EUAs Close Lower Following Auto Import Tariff Announcement and France Reform Proposals

3 Min. Read Time

European allowance (EUA) carbon prices stabilized between €70-74/ton during the week, consolidating in a fairly narrow range set by key options strike prices in the run-up to the contract expiry on March 26. However, by Thursday, EUAs teetered at the €70 support level before slipping lower to €68 driven largely by the news that the US would place a 25% tariff on auto imports and new ETS reform proposals by France.

So far, the US has imposed tariffs on EU steel and aluminum. Starting this week, we could see a 25% tariff extended to EU passenger cars and light vehicles. Macquarie estimates the combined tariffs impact 1.1% of direct EU ETS emissions, equivalent to roughly 12 million tonnes (Mt) of CO₂e. They note that this is likely underestimated as it doesn't account for the emissions from the chemical and energy processes used in the manufacturing of automobiles.

At the EU Environment Council for Carbon Market Reforms meeting last week, France explained that while the EU ETS is "an effective instrument" for decarbonization, they would like to better address concerns around market volatility to further strengthen investor confidence and accelerate the energy transition. France proposed introducing a price corridor that aligns with the emissions reduction trajectory, which is more likely to apply to the ETS2 though it could also involve the ETS1. This corridor would set minimum and maximum EUA price thresholds. There was also a recommendation to review and potentially refine the Market Stability Reserve (MSR) to manage any deficiencies. The MSR is designed to help keep the market supply in balance by removing or adding allowances in circulation.

Prior to the news, the December 2025 EUA futures had been hemmed in by unrelenting options hedging, though the daily price moves were also reflecting the ebbs and flows in natural gas prices. The five- and ten-day rolling correlation between front-month TTF gas and EUAs has stayed solidly above +0.5, representing a fairly strong positive correlation for a week. This suggests that the pull of options strike prices is over for another three months, and EUA prices will revert to their now-customary shadowing of the TTF market.

Natural gas prices remain volatile as traders have focused on the prospects for a potential resumption in flows of Russian pipeline gas to Europe in the wake of a peace deal in Ukraine. Over the past week, there have been a number of reports that the US and Russia are discussing just such a move, and Total Energies CEO Patrick Pouyanne told an industry meeting on March 26 that “I would not be surprised if two out of the four [Nord Stream pipelines came] back on stream.”

A return of pipeline gas from Russia could replace a considerable volume of LNG that Europe currently buys, chiefly from the US. However, the reported discussions have yet to elicit a response from the European Union, and it may be that Europe is unwilling to take Russian gas after having committed to weaning itself off the fuel.

And indeed, the gas market is hesitant to price in much, if any, Russian gas into its summer or winter plans. Last weekend’s attack on the Sudzha transshipment point in western Russia knocked out one of the principal distribution stations for gas coming to Europe via Ukraine, and three of the four Nord Stream pipelines are presently unusable.

Yet, EU gas traders aren’t pricing in the full demand needed to refill the region’s storage before next winter, either. The on-again, off-again nature of headlines and negotiations over a ceasefire have robbed the market of any certainty, and this has translated into a comparatively narrow trading range for TTF over the last three weeks.

What this means for carbon prices is equally opaque. While fundamentals for demand remain gloomy – the bloc is expected to report a decline of roughly 5% in emissions in 2024 when data is released in just over a week – recent stimulus measures in Germany have lifted longer-term sentiment.

Germany’s incoming coalition government recently agreed to exempt military spending from the country’s debt limit, and will embark on a €500 billion infrastructure spending program as well as a further €100 billion in climate investment. The agreement was immediately reflected in the country’s IFO business sentiment index, which rose to 86.7 for the month of March, the highest since July last year. Industrial output also rose by 2% in March, the biggest month-on-month gain since last August. Traders hope Germany’s and other EU-wide measures will kick-start a faster economic recovery in the bloc, which has been struggling to climb out of the depression that set in after Russia invaded Ukraine in 2022.

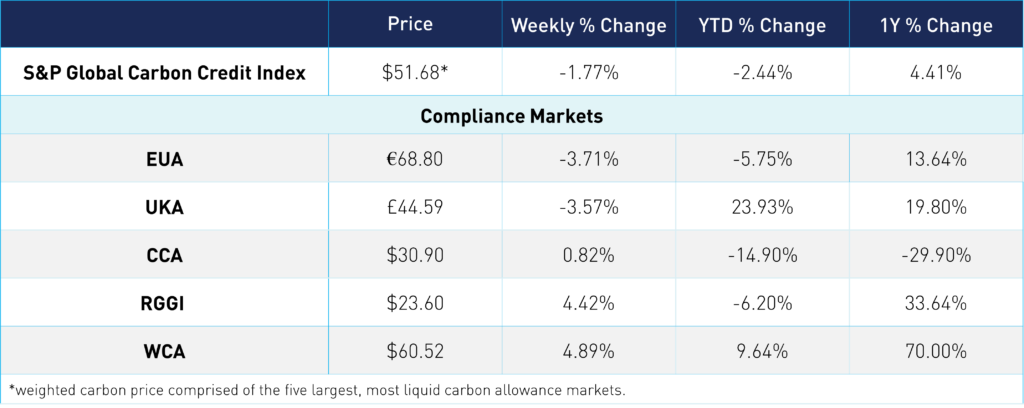

Carbon Market Roundup

The weighted global price of carbon was $51.68, down 1.8% for the week. EUAs were down 3.7% at €68.80. UKAs were down 3.6% at £44.59. CCAs slipped below the 50-day moving average of $31.19 Thursday, ending the week at $30.90, up 0.8%. The North American Carbon World (NACW) conference held March 25-27 in Los Angeles mostly reiterated the same message around the ongoing delays to the policy reform and the cap and trade extension process. RGGI prices trended higher, up 4.4% at $23.60. WCAs also rose 4.9% to close at $60.52.