US Tariff Announcement and Global Market Sell-off Trickles into Carbon Markets

<1 Min. Read Time

Carbon markets tumbled alongside the global market sell-off following President Trump's tariff announcement last Thursday. The weighted global carbon benchmark fell 5% last week, with EUAs most affected, posting a decline of over 7%. The wider energy market mirrored the same sentiment, with the front-month TTF futures, the benchmark for European natural gas, falling 11% for the week.

Uncertainty around potential tariff retaliation and the broader economic outlook will likely continue to drive carbon prices. Colder weather and reduced output from renewables expected in the near term could provide some upside pressure, though it may not be enough to provide substantial support.

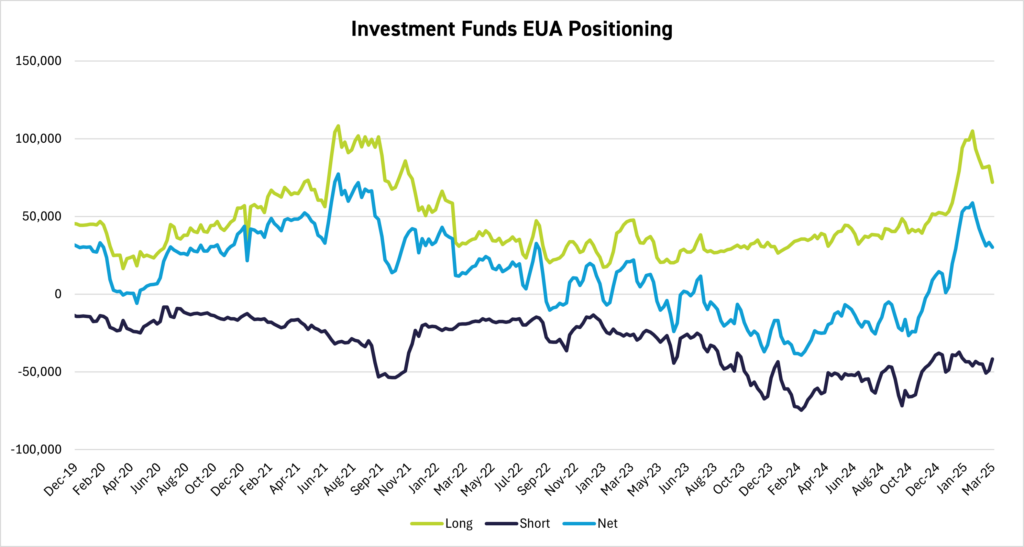

That said, we are seeing an increase in compliance buying at current levels, considering prices are now below the year-to-date average, which has historically been a buy signal for industrials. Investment funds, on the other hand, have reduced their net length slightly to just over 30 million EUAs as prices have retreated, according to the Commitment of Traders report from last Wednesday. We'll have to wait to see this week's report for the post-tariff sentiment.

Bloomberg had an interesting article on how the tariffs could spur the linkage of the EU and UK carbon markets. The two markets have been in early discussions around a possible linkage, though with Trump's levies, it could be beneficial now more than ever to help simplify trade and promote stronger commerce ties. The linkage was initially considered to be more beneficial for the smaller UK market, though this has potentially changed now in light of the tariffs. The 20% tariff imposed on the EU is twice that of the UK.

The price disparity between the two markets has decreased since the start of the year. Following the latest announcement, the gap has narrowed to just €12.6, compared to the €20 average in 2024. We'll likely hear more details on the potential linkage during the EU-UK Summit scheduled for May 19.

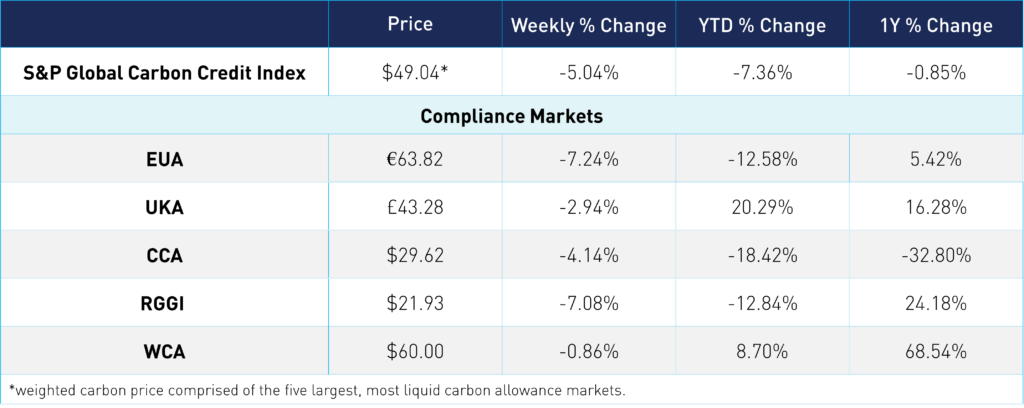

Carbon Market Roundup

The weighted global price of carbon is $49.04, down 5.0% for the week. EUAs were down 7.2% at €63.82. UKAs were less affected, down 3.0% to end at £43.28. CCAs were down 4.1% at $29.62. RGGI fell 7.1% to $21.93, while WCAs saw the least impact at just a 0.9% drop to $60.00.