EUAs Boosted by Compliance Buying, UKAs Eye Upcoming Policy Announcements

2 Min. Read Time

| Live Webinar for Europe / UK investors |

| Join us Wednesday, October 30th at 3:00 GMT for: Carbon Investing - The Case for a Global Approach Please click here to register |

European carbon prices have recovered strongly in the last few days after briefly falling below €60.00/tonne on October 9. The market is now trading in the mid-€66.00s, and stakeholders are beginning to conclude that the market may have formed a bottom at €60.00.

The recent dip encouraged compliance buying as industrials sought to build up their portfolios of (relatively) cheap EUAs for future use, with one eye on an ever-tightening market supply and on new demand sources like maritime shipping companies and airlines who are set to lose their free allocation of EU Allowance from next year.

Compliance buyers generally try to buy below the market’s annual average price. This number currently stands at €66.45 and goes some way to explain their recent enthusiasm. However, the emergence of that compliance buying also demonstrated that there is a floor level at which the market clears in the longer term, and speculative participants, including algorithmic traders, began to trim their short-term bearish positions at the same time.

This helped amplify the upward momentum, culminating in a 10% jump over three sessions this week. Market participants are now watching for signs that the rally might extend to the upper €60s. Based on current fundamentals, this would be more of a technical rally, which could potentially see some profit-taking. Investment funds continue to hold a sizeable net short futures position of more than 24 million EUAs, and the daily price action demonstrates that they are willing to wait for their moment to reassert themselves.

Across the Channel, the UK ETS has also seen a robust rally, with prices advancing from £35.50 at the start of October to reach as high as £40.65.

This rise has been fuelled by investment funds building a record long position, anticipating that the Labour government may make some announcements in the coming weeks that point towards ambitious reforms to the market.

Most eyes are focused on the autumn budget statement scheduled for October 30, which has received a lot of media attention. However, market sources are not confident that much will be said about the UK ETS, and UKA prices have indeed begun to drift below £40 again in the last couple of days.

The government published on Thursday the proposed text of updated regulations that would finalize a series of changes first announced in July 2023. These include the inclusion of flights from Northern Ireland to Switzerland in the scope of the market, the updating of the market cap for the rest of the current phase ending in 2030, and adjustments to the “flexible reserve” that can be used to top up free allocations to industrial plants in the event that a cross-sectoral correction factor needs to be applied.

As already stated, these changed were first announced more than 15 months ago, but can only now be put into law by all the regional governments of the UK, after the Northern Ireland government was reconstituted earlier this year.

The northeastern US RGGI market has seen prices rally slightly after dropping below $20/short ton in the last couple of weeks. December 2024 futures closed on Thursday at $20.65/short ton as utilities were seen to be picking up comparatively cheap volumes in the preceding days.

RGA prices have slid from recent highs of $27.00/ton as traders have lost some confidence in the ongoing review process. States have had difficulty in reaching a consensus over some of the elements of the reforms, and some proposals, such as the tripling of the cost containment reserve, have had a sharp impact on prices.

The market is now hugging the $20/ton mark at an important psychological level and waiting for more developments from the rule-making process.

Carbon Market Roundup

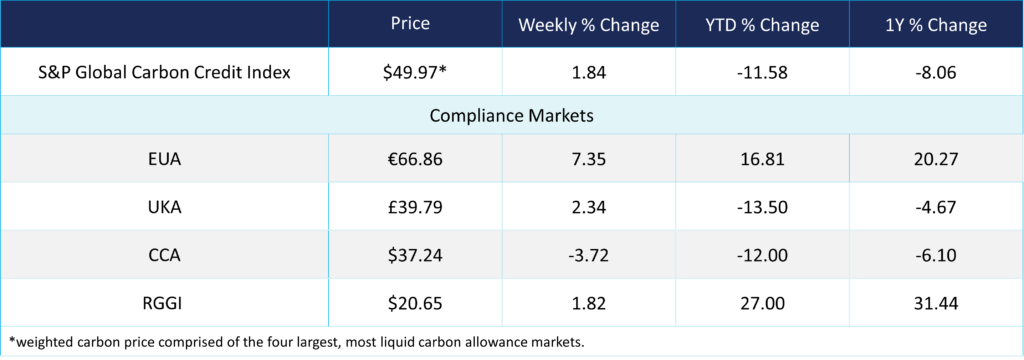

The global weighted price of carbon is $49.97, up 1.84% from the previous week. EUAs are up 7.35% for the week at €66.86, while UKAs are up 2.34% to £39.79. CCAs trended down 3.72% at $37.24. RGGI was up 1.82% at $20.65.