CCA & RGGI Price Forecasts, EUAs Give Up Tuesday’s Gains

3 Min. Read Time

EUAs Take Back Gains From Tuesday's Rally

EU carbon prices spiked briefly on Tuesday after reports emerged that the European Commission would not be bringing additional EUAs to market in 2023 beyond the already confirmed 16.5 million permits to help fund the REPowerEU initiative.

Some stakeholders had been expecting an additional 20-30 million allowances to be brought forward from Innovation Fund sales scheduled for later in the decade, but the Commission reported that changes to the auctioning regulations would not be completed in time to sell any of these EUAs in 2023. For context, the REPowerEU initiative was set up to help industries in the EU transition away from fossil fuels – particularly Russian energy. The initiative will be partially funded by the Innovation Fund, which was set up to finance projects aimed at developing innovative technologies that significantly reduce emissions.

Prices jumped as much as €5.50 on Tuesday, reaching a high of €90.85, but by the close on Thursday, the market had sold back earlier gains, and prices dipped below the 200-day moving average of €85.20 to reach €83.25.

California Price Forecast, $100/tonne by 2029

According to a recent report published by Energy Aspects, price forecasts show a steadily increasing trend for CCAs, with levels reaching around $34/tonne in early 2024 and nearly $40/tonne by the start of 2025. Prices are expected to reach $100/tonne by 2029.

The firm predicted the market would report total emissions of 290 million tonnes in 2023, citing a 1 million tonne rise in emissions due to increased use of in-state gas-fired power generation. Energy Aspects predicted that fuel supplier emissions would drop by 2 million tonnes to 136 million tonnes for the year as weakening consumer sentiment depresses haulage demand.

The firm’s longer-term forecast shows that the market remains oversupplied on an annual basis in 2023 but that demand steadily outpaces supply from 2024 through to 2030. Assuming a 48% reduction target for 2030, the annual shortfall in supply will soak up the existing inventory of permits, leaving a balance of just 17 million tonnes (excluding hedging demand) by 2030. The report suggested that investors will increase their holdings steadily over the 2024-2027 period as the expected tightness in supply is gradually priced into the market.

RGGI Surplus Shrinks by 22% in 2022

Meanwhile, a report by market monitor Potomac Economics indicated that the northeastern RGGI cap-and-trade system’s surplus supply of allowances diminished to 68 million short tons in 2022 from 87 million tons a year before. Almost all of the banked permits were held by covered entities ahead of their obligation to surrender allowances covering their 2022 emissions, according to the report.

Secondary market futures prices for RGAs moved largely between $13-$14 last year. Currently, the December 2023 futures contract is at $13.35/ton as of close on Wednesday. Energy Aspects said prices are likely to remain stable in 2023, though the expected tightening of supply should begin to drive the market higher next year. The firm predicted prices may reach $17/ton by 2025 when the current surplus is completely absorbed. Market regulators are presently working on updating the market cap for the period after 2025, and the price outlook should respond to decisions taken by the end of this year.

Energy Aspects also noted that call options open interest is rising, particularly for options with a strike price of $15/ton, where positions have nearly quadrupled since the start of the year. This activity points to increasing confidence that prices will rise towards the current cost containment reserve price of $14.88/ton, a level at which the regulators will offer additional allowances in the quarterly auction.

Carbon Market Roundup

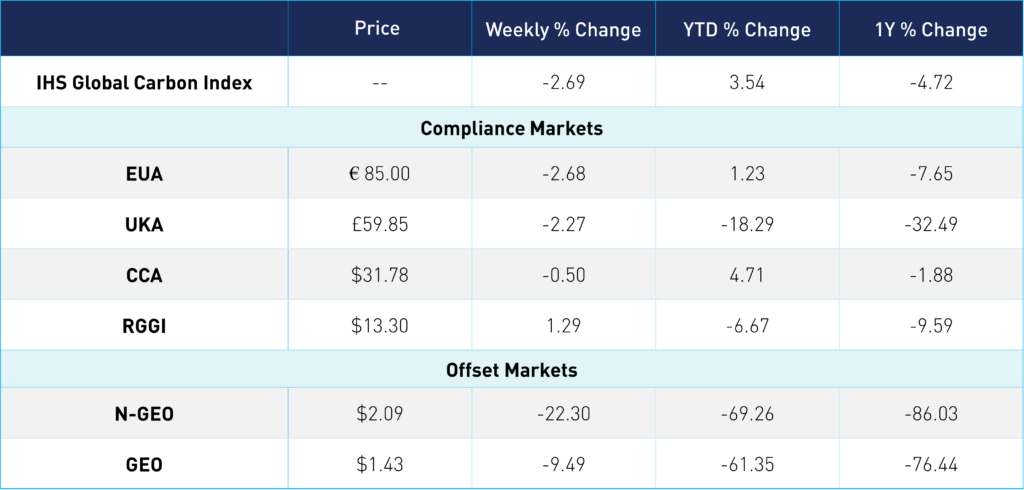

The global price of carbon ended the week at $49.03. EUAs prices are trading at €85, down 2.68% for the week. UKA prices dipped below £60 on Wednesday, though moved slightly higher to reach £59.85 by Friday, down an overall 2.27% for the week. CCAs were down 0.50%, trading at $31.78. Prices trading similarly Monday and Tuesday. By Thursday, the Dec23 contract broke through the $31.60 support level and traded down to a 3-week low of $31.36; however, prices rallied slightly to close higher. RGGI traded in a tight range, with prices between $13.30-13.35 since Monday. Overall, the RGGI market was up 1.29%, at $13.30. The offsets markets opened higher on Monday, though both trended down throughout the week, with N-GEOs and GEOs currently trading at $2.09 and $1.43, respectively.

To learn more about our carbon credit ETFs, click here.