UK General Election: Labour Party Victory Poised to Shape Climate Policy and Emissions Trading

2 Min. Read Time

The UK's General Election yesterday saw the Labour Party win by a landslide, shaking up fourteen years of more conservative rule. This change in party rule could lead to significant developments in the country’s climate policy. One major development on the horizon could be the potential linkage of the UK ETS to its continental neighbor.

To be sure, Labour made little mention of UK climate policy during the campaign, though its manifesto pledged to prioritize climate action across many realms of public policy:

- Doubling onshore wind capacity

- Trippling solar capacity

- Investment in carbon capture and energy storage

- No new coal licenses; a ban on fracking

- Introducing a Carbon Border Adjustment Mechanism (CBAM)

- Developing policies to enhance adaptation to climate change effects, and

- Boosting Britain’s role in climate diplomacy.

Despite the lack of any specific reference to emissions trading, numerous observers and writers have suggested that the most high-profile measure that an incoming Labour administration may take is to begin discussions to link the UK and EU ETS.

The last three years have seen an increasing divergence in allowance prices between the two markets. The UK ETS began life trading close to parity with the EU market, with the British price reaching a peak of £99 in the summer of 2022, a few months before the EU price topped out at above €101.

Since the summer of 2022, however, UKA prices have been on a long slide, as demand for permits to replace EUAs faded away and concerns grew that the government in London was not expediting key market reforms. The combination of steady over-allocation of free allowances and the lack of a market stability mechanism to remove the surplus means that the UK market is now oversupplied by the equivalent of around one year’s verified emissions.

Linking the UK and EU markets would likely require London to make a number of reforms to the British system to bring it into line with EU norms. Chief among these would be a supply adjustment mechanism, as well as matching the EU markets sectoral coverage and setting similar benchmarks for free allocation.

Having the two markets operate with similar parameters would make them more likely to generate similar prices, which would protect UK industrial exporters from the financial cost of the EU’s Carbon Border Adjustment Mechanism. To be sure, importers of UK goods into Europe would nevertheless be required to report the embedded carbon of their shipments, though similar (if not identical) carbon prices would mean there would be no financial cost. In turn, the UK’s ongoing initiative to set up its own CBAM would target imports from the EU as well as other regions of the world, but again, similar CO2 prices would mean no cost implications.

The UK’s power sector will close its final coal-fired electricity plant in September this year, leaving gas and small-scale diesel-fired generation parks as the only fossil fuel power sources. There is, therefore, less decarbonization potential from fuel switching than there is in Europe, which may mean that the future emissions trajectory will be led by industry to a much greater extent than in the EU.

Analysts have suggested that the anticipated Labour victory on July 4 will lead to an uptick in UKA prices as the market expresses relief that a more climate-oriented party is now in charge, but any rally will require firm commitments to improve the market and tighten its parameters to sustain it.

Carbon Market Roundup

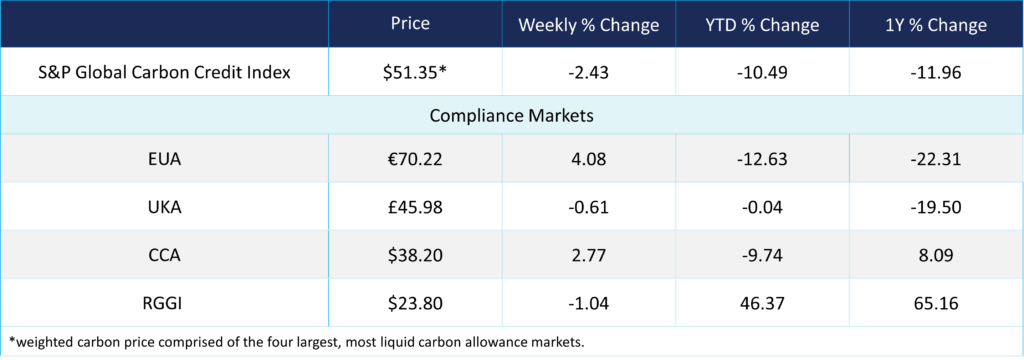

The weighted global price of carbon is $51.35, a decrease of 2.43% from the previous week. EUAs rose by 4.08% to €70.22, while UKAs decreased by 0.61% to £45.98. CCAs rose by 2.77% to $38.20. RGGI ended at $23.80, down 1.04% from the prior week.