EUA Price Action Update, Early End to Compliance Season

3 Min. Read Time

European carbon prices have fallen by almost €12 in the last 11 days as traders saw an early end to the annual compliance season, which is when industrial companies top up their accounts with EUAs before surrendering them to the European Commission.

EUAs settled on April 26 at €85.64, compared to €95.92 two weeks earlier. The recent performance over the last two weeks reflects the strains on European economies over the past year, with soaring energy prices forcing cutbacks in production and hence lower demand for carbon allowances.

EU carbon prices typically get a boost in March and April from annual purchasing by factories making products ranging from bricks to beer, and this year was no exception. During January and February, the EUA price averaged €88.73, but between March 1 and April 11, it was €92.84. But verified emissions data published at the start of the month showed a 1.2% decline in overall emissions last year, surprising experts and analysts who had, without exception, forecasted a modest increase. For the last two weeks, levels have slid steadily, bottoming out on April 26 at €85.15 as traders anticipated the early end to the compliance period and began to look at the broader regulatory and macroeconomic picture.

European ministers signed off this week on the Fit for 55 reform package, a wide-ranging set of changes to the EU ETS that will set a 62% reduction target for the market by 2030 as part of the bloc’s economy-wide 55% goal. These reforms have been detailed in previous blogs, but in short, they include a one-off adjustment to the cap, a steeper annual cut in the supply of EUAs, the gradual addition of maritime emissions from 2024, the extension of the market stability reserves 24% surplus withdrawal each year to 2030, and, perhaps most importantly, the creation of the Carbon Border Adjustment Mechanism (CBAM).

CBAM will introduce a carbon levy on all imported materials, requiring importers to pay the difference between carbon prices in the country of origin and the EU’s carbon price. For many importers, this will mean adding the entire EU price to the cost of their materials.

The CBAM levy will be priced against the average auction price of EUAs, which firstly means it will be dynamic, and secondly that it will be hedgeable. Most stakeholders in the market expect importers to develop hedging strategies for their CBAM exposure, which are likely to be building positions in EUA futures. This hedging will undoubtedly add to the demand in the secondary derivatives market, though it’s important to bear in mind that EUAs will not be eligible to pay CBAM. Importers will need to buy special CBAM certificates, which will not be tradable.

The other main regulatory development is the REPowerEU initiative, a funding plan to help industries in the EU transition away from fossil fuels – particularly Russian energy. The €200 billion fund will be partly generated by the sale of €20 billion in EUAs over the next three years. These EUAs are being brought forward from member state auction reserves for the 2027-2030 period, as well as from the Innovation Fund, a separate pool of allowances that is funding new technologies.

So far, the European Commission has confirmed that 16.5 million EUAs from member state auction reserves will be sold this year, starting in the summer, but there are still no details on how many Innovation Fund EUAs will be auctioned. The recent addition EUAs over the next three years, equivalent to around 230-250 million allowances, has created a bearish sentiment in the market. This addition comes at a time when there has been a decline in demand for EUAs in 2022.

However, the market sentiment is expected to change when more details of the REPowerEU volumes are made public. Additionally, the market is likely to look forward to the annual 50% reduction in auction supply in August, which could lead to a more bullish outlook for EUAs.

Carbon Markets Roundup

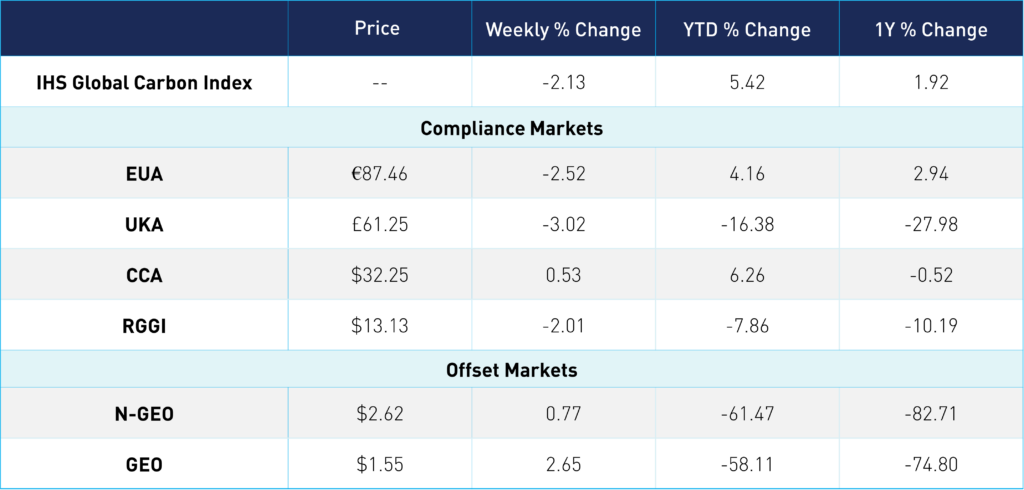

The global price of carbon ended the week at $49.96. EUA prices fell 2.52% for the week, currently at €87.46. The market recovered some losses from its midweek low of €85.64. UKAs steadily drifted down throughout the week, down 3.02% at £61.25. CCAs traded within a range of $31.87-$32.25, up 0.53% overall for the week. Meanwhile, RGGI slid down 2.01% for the week, currently at $13.13. Both offsets markets saw modest gains for the week, with N-GEOs up 0.77% and GEOs up 2.65%.

To learn more about our carbon credit ETFs, click here.