How the EU ETS’ New Compliance Cycle May Impact the Market, CCA Update

3 Min. Read Time

This year, the EU ETS is inaugurating a new compliance cycle for covered installations, which means that summer, rather than spring, represents the height of industry activity.

Following the reform changes to how the European Commission calculates the allocation of free EUAs for industry, officials found that the workload became too difficult to complete in the short period between the publication of verified emissions (formerly in April) and the issuance of free EUAs, which formerly took place in the spring. This is because allocation has become more dynamic. Handouts are subject to immediate revision – either upwards or downwards – if a plant’s activity rises or falls by more than 15% over the previous two years.

To give member state governments more time to carry out the calculations, the EU decided that as of 2024, EUAs would be distributed by the end of June each year. Last week, data from the Commission showed that as of July 11, around 76% of all budgeted free EUAs had been issued to industrial plants.

Similarly, the Commission has changed the annual compliance deadline – when industrials must surrender EUAs matching their prior-year emissions – from April 30 to September 30, starting this year. Until this year, the compliance “season” meant an uptick in demand from covered installations in the first quarter as they hastened to top up their balances ahead of the April 30 deadline. However, with the shift in 2024, companies will have had 17 months in which to amass the required EUAs, reducing the likelihood of any surge in demand as the September 30 deadline approaches.

Additionally, anecdotal information from the market suggests that many industrials will have completed their buying before the start of the summer to avoid having to buy in a comparatively illiquid market and to avoid cutting short the summer holiday season. Already, traders are reporting that compliance demand is muted, with many buyers absent. In many countries, July and August are traditionally a period when many businesses shut down.

Another important change made by the Commission involves the historical reduction in auction supply in August. As part of the adjustments to the compliance cycle, there will no longer be a 50% cut in auction supply in an effort to ensure there is sufficient supply to meet any last-minute buying. Traders expect a combination of low demand and higher-than-usual supply to mean that the market may see a dip in prices during the month.

However, stakeholders also expect the Commission to reveal in the next two weeks the annual changes to the auction program for the period from September to next August. In May, the Commission announced that the market stability reserve (MSR) would take 266 million EUAs out of circulation by cutting the number of permits sold at auction. According to the data, the reduction is very similar to the 258 million cut that was generated in 2023 (for the period September 2023 to August 2024), so it’s likely that the new daily auction total might resemble the daily volume that we’ve seen this year.

The change to the program is complicated by the REPowerEU program, which is adding even more EUAs to the auction pot to raise funds for the EU’s Recovery and Resilience Fund. So far, REPowerEU has sold more than 82 million additional EUAs and raised €5.8 billion out of a planned total of €20 billion by August 2026. The Commission's initial plan was to sell 250 million EUAs at an average €75/tonne to raise the funds. But as prices have averaged much less than that since REPowerEU began in July 2023 (€63.24 to date), the fund-raising is now some €375 million behind target.

As a result, most sources confidently expect the Commission will increase the volume of REPowerEU permits sold each day starting in September. Rough estimates suggest that something around 160,000 more EUAs could be sold daily. To bring REPowerEU revenues back on track at the market current price would require around 45 million more EUAs to be sold over the next two years.

CCA Update

CCAs dipped lower this week following the regulator's reform update last Wednesday. While the public workshop brought more clarity on the highly anticipated adjustments to the annual cap, market participants have been focusing more on the shift in the implementation timeline of these changes from 2025 to 2026. California is committed to its climate goals and the success of its cap-and-trade program, and the regulator is just being cautious to ensure that the reform aligns the program with the state's emissions goals while maintaining stability and efficiency in the market. Remember, the shifted timeline doesn't change the long-term picture; the cap adjustments presented by CARB show aggressive cuts to supply in the coming years. If anything, it extends the growth opportunity out another year.

Carbon Market Roundup

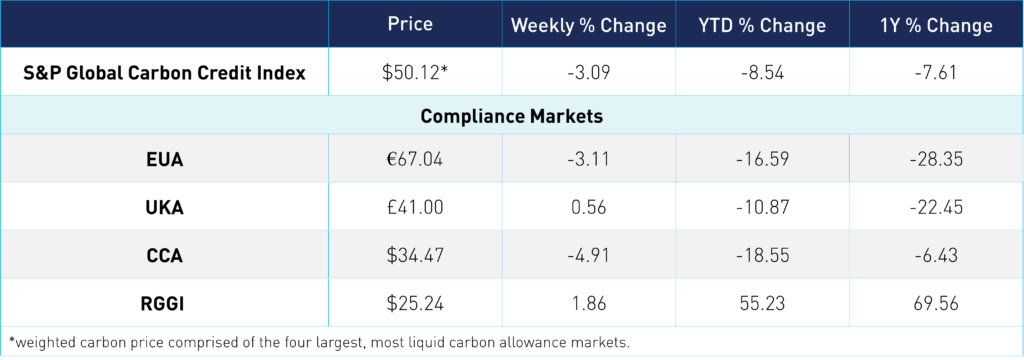

The weighted global price of carbon is $50.12, a decrease of 3.09% from the previous week. EUAs decreased by 3.11% to €67.04, while UKAs increased by 0.56% to £41.00. CCAs declined 4.91% to $34.47. RGGI ended at $25.24, up 1.86% from the prior week--marking an all-time high on Wednesday as it closed above the $25 level for the first time.