EU’s CBAM Carbon Tariff to Level the Playing Field for Trade

4 Min. Read Time

Europe's Carbon Border Adjustment Mechanism (CBAM) entered law earlier this month, setting the bloc on a path of imposing a cost on the carbon intensity of imported materials from countries that lack an equivalent carbon price.

Until now, the EU's trading partners have not had to pay carbon costs associated with the emissions of their products relative to that paid within the bloc. Without this accountability, non-EU producers have arguably had more of a competitive advantage cost-wise and less incentive to reduce the carbon intensity of their operations. CBAM, therefore, intends to address this cost disparity and level the playing field for EU producers.

CBAM will cover iron & steel, cement, fertilizer, aluminum, and electricity generation in the first phase. Policymakers have proposed expanding the mechanism down the line to include organic chemicals, plastics, hydrogen, and ammonia.

Crucially, CBAM will allow an exemption for any exporting country that imposes an "equivalent" carbon price on producers within its own jurisdiction. This provision encourages exporting countries to establish their own versions of the EU's carbon market, and if the price is similar, then their exports to the EU won't be subject to CBAM.

CBAM Details

CBAM's implementation will begin in 2024 when importers of the covered materials will be required to start reporting on the carbon emissions embedded in their shipments.

By 2026, importers will be required to purchase CBAM certificates matching the total carbon content of their imports and surrender these to the European Commission every year.

The certificates are sold at an equivalent price to the rolling weekly average price of the daily EU Allowances (EUAs) auctions held within the EU ETS, which ensures that importers' costs are identical to that paid by European industrials. Since the compliance market operates on an annual cycle, importers can choose when to purchase their certificates.

CBAM certificates will be non-tradeable among importers, so any unused certificates can be sold back to the EU Commission after the compliance period ends.

Numerous experts have suggested that importers may hedge their exposure to CBAM certificate prices by taking positions in EUA futures, thereby driving demand higher and raising the price of EUAs for European buyers.

Impact on Europe

The introduction of CBAM also brings significant changes for European industrial companies. Previously, EU producers of energy-intensive and trade-exposed products were given assistance under the EU ETS in the form of an allocation of free EUAs to ensure that a rising price of carbon does not force them to relocate their production abroad. Note not all sectors are receiving free allowances, and for those that do, the amount provided is based on a carbon intensity benchmark. Power generators, for example, have not received free EUAs since 2012 and instead have had to buy their allowances from daily auctions or in the secondary markets.

The annual issuance of free EUAs has reduced the incentive for industrials to cut their greenhouse gas emissions, and this has meant that the lion's share of the reduction achievement in the EU ETS has come from the power sector, which has relatively little exposure to cheaper generation from outside the bloc.

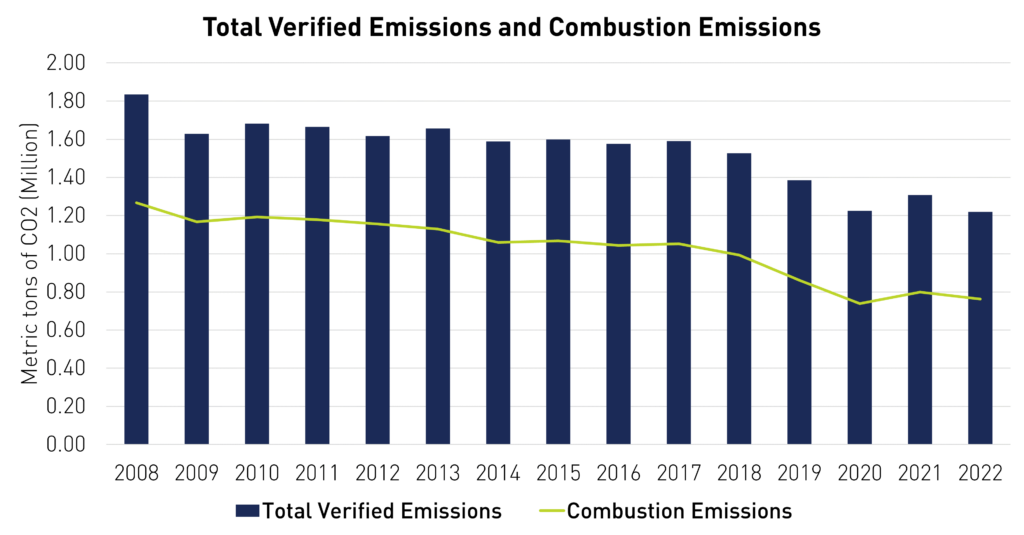

Data from the European Commission shows that the annual changes in verified emissions reported under the EU ETS have a strong correlation with changes reported by combustion installations (a proxy for power and some other sectors), which implies that the reductions have so far been largely due to decarbonization of electricity rather than a more widespread cut.

The introduction of the CBAM effectively means the EU can now address the lack of abatement from other industrial sectors. As the mechanism is gradually introduced, handouts of free EUAs to the industry will steadily diminish, with the goal of ending free allocation by 2032.

This phase-out of free allowances will also boost demand for EUAs as industrials, especially SMEs that have little experience of the market to date, familiarize themselves with the primary and secondary markets and develop the capability to fulfill their compliance obligations. It will also bring an end to the historical "borrow" trade, in which industrials often used freely issued EUAs from their current year allocation to help pay for prior year compliance.

Impact on Trading Partners

So far, attention has focused on the CBAM's impact on other countries. The general view is that major industrial exporters such as India, China, Russia, and the US will be hardest hit since they are major global exporters of iron and steel, cement, fertilizer, and aluminum.

When the CBAM legislation was under development, Europe's trade partners raised concerns that the mechanism could represent a barrier to trade. Ministers of some nations have suggested the measure is discriminatory against lower-income countries that lack the resources to set an internal carbon price, and India has even pledged to challenge CBAM at the WTO. For their part, EU lawmakers have been careful to craft the regulation as a climate instrument rather than a trade-based measure and are confident it will survive scrutiny.

Several countries, including the US, Canada, the UK, and Australia, have announced they are investigating whether to implement an equivalent of the EU's CBAM in their jurisdictions. While a similar mechanism has yet to progress to a formal proposal, the UK, Canada, and Australia have nationwide carbon pricing systems that would at least make their markets more comparable to the EU model.

Carbon Market Roundup

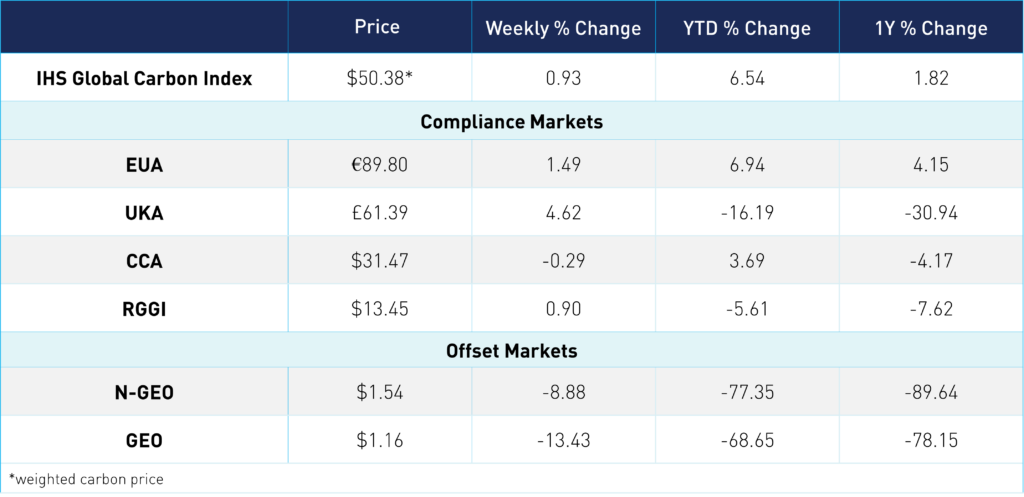

The global price of carbon ended the week up 0.48% at $50.38. EUAs traded in a narrow range this week primarily due to fewer auctions with the holiday. Prices trended down a slight 1.70% on Monday to €86.97 but since recovered to end the week back up an overall 1.49% at €89.80. UKAs had a strong week, up 4.62% at £61.39, following a record high at the latest auction. CCAs traded in a narrow range of $0.14, ending at $31.47. Similarly, RGGI prices remained in a tight range of $0.12, ending at $13.45. The offsets market continues to maintain the $1 range, with N-GEOs at $1.54 and GEOs at $1.16.

To learn more about our carbon credit ETFs, click here.