Washington’s Inaugural Auction Clears at Double the Reserve Price

<1 Min. Read Time

Washington state set a national price record at its first carbon allowance auction, with the sale clearing at $48.50/tonne. This settlement price is not only the highest across US carbon markets but also double the program's reserve price (floor price) of $22.50. The Department of Ecology noted in its summary report that all 6.18 million permits were sold. Strong demand led to the auction being oversubscribed, with a cover ratio, or total bids to allowances offered, of 2.67.

According to the Nodal Exchange, the auction cleared well above the prevailing secondary market allowance price of around $44.00. However, there had been little trading before the first sale, and few participants had expressed clear price ideas.

The initial solid sale result also compared positively to prevailing prices in the California market of around $30/tonne. Prices in the RGGI market were also well below, at about $13.25/short tonne.

Bidders in the sale included local emitters such as regional fuels distributor Coleman Oil, local public and private utilities, commodity traders including Vitol, Trafigura, and Mercuria, and international investors.

Washington auctions will offer allowances from the current vintage (2023) and the next (2026), though no 2026 permits were offered in the first sale. The front-vintage clearing price for the auction was just $3.40 short of the $51.90 trigger level that would have led to additional permits from the Allowance Price Containment Reserve (APCR) being offered in the next sale. Forward-vintage auctions will set an APCR trigger price of $66.68 when they begin later this year.

Washington’s cap-and-invest market set a cap of 63 million tonnes for 2023. The cap reduction factor declines at a rate of 7% a year from 2023 to 2030, 1.8% a year from 2031 to 2042, and 2.6% a year from 2043 to 2049. The state aims to achieve a 95% cut in emissions compared to 1990 levels by 2050.

The next Washington auction will take place on May 31.

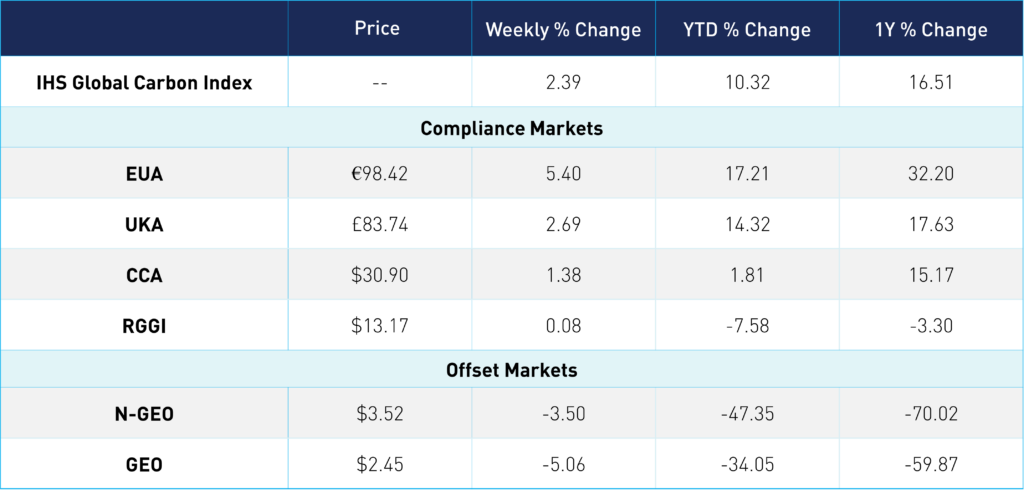

Carbon Market Roundup

EUAs prices have pushed back up to €98.42, an increase of 5.40% week over week. UKAs also trended up throughout the week, up 2.69% at £83.74. US markets traded in a narrow range, with CCAs maintaining the $30-31 while RGGI was flat at a low $13 level. The offsets market saw a slight decline over the week, with N-GEOs down 3.50% and GEOs down 5.06%, respectively.