REPowerEU Funding Proposal Lifts EUAs

2 Min. Read Time

The proposal from ENVI to fund REPowerEU entirely from frontloaded EUA auctions improves sentiment among investors

EUAs were up 7% Monday and finished the week +2% after several weeks of selling. Representatives of political parties and groups in the European Parliament’s Environment committee (ENVI) met on Monday to discuss the panel’s position on the proposed REPowerEU initiative, which aims to speed up Europe’s transition away from Russian fossil fuels to low-carbon energy sources. The committee agreed to fund the initiative from the sale of EUAs that had been set aside for auction by member states in the years after 2027 instead of the market stability reserve (MSR) or the Innovation Fund, as was controversially discussed earlier. By using funding from frontloaded EUA auctions, we could see a tighter market in the last few years of the current trading phase.

After the initial EUA price jump, the market had been slightly volatile though we did see prices rally back up slightly on Thursday. ENVI is due to meet on October 3 to vote on its position on the full REPowerEU initiative, after which the file will be adopted by the full Parliament within the next month. Trilogue negotiations between the Parliament, Commission, and Council will follow to collectivity reach a decision on the initiative.

The same EU institutions are also engaged in trialogue talks on the “Fit for 55” reform package, which aims to boost the ambition of the EU ETS to help the bloc reach 55% emissions cut from 1990 levels by 2030.

The Fit for 55 package includes several changes to the market:

- A one-time rebasing of the overall EU ETS cap of more than 100 million tonnes – which might be split over two years;

- A bigger reduction in the cap each year: total EUA supply would drop by 4.2% a year instead of 2.2% at present;

- A steeper adjustment in the amount of EUAs handed out free of charge to industry;

- The extension of the market stability reserve’s current 24% withdrawal rate out to 2030;

- The inclusion of maritime transport emissions in the EU ETS;

- The package also seeks to introduce a Carbon Border Adjustment Mechanism, forcing importers to pay an EU ETS-linked charge for the embedded carbon in products entering the EU.

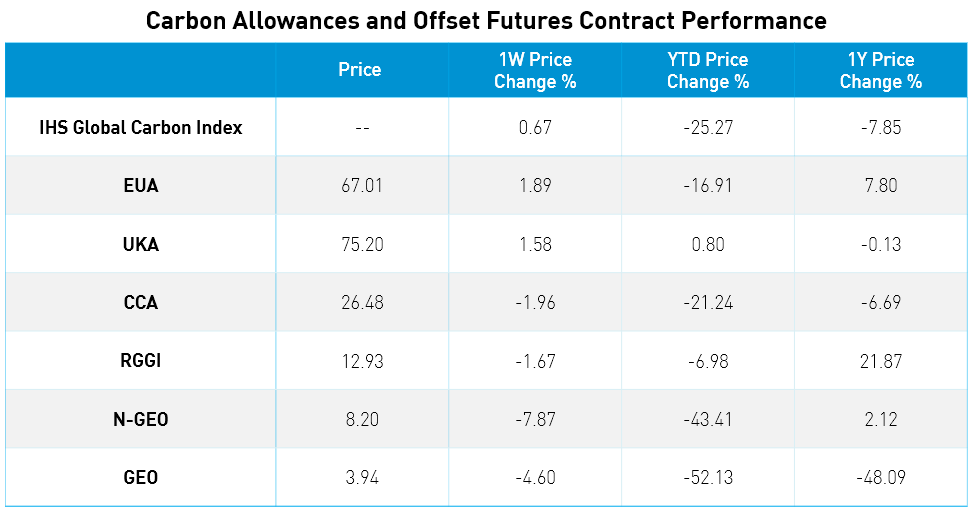

Compliance Markets:

CCAs closed at $26.48, down -1.96% over the week. Meanwhile, RGGI prices declined -1.67% week-over-week to $12.93, slipping below $13 for the first time since earlier this year. UKA prices were steady, hovering around £75 ($83). Much of the downward price pressure may be attributable to the bearish macro outlook weighing on markets in general.

Offset Markets:

Nature-based global offsets (N-GEO) closed at $8.20, steadily declining over the week. Global offsets (GEO) were at $3.94, with prices not moving much.