Carbon Markets Summer in Review

2 Min. Read Time

Labor Day weekend marks the end of summer and vacation season here in the US. However, there was no break in the action for the global carbon markets. In this week's post, we round up a few highlights that drove carbon prices over the past few months and what to look out for coming next.

For European carbon, the summer of 2024 has been a story of natural gas prices and carbon’s correlation with the Dutch TTF market (European nat gas benchmark).

In June, carbon and natural gas were highly correlated, and daily price action reflected this close link. As we have mentioned in previous posts, as gas prices rise – all other markets being equal – gas-fired power becomes comparatively less competitive against coal-derived electricity. And when gas prices fall, the fuel becomes more competitive. The corollary of this is that as coal-fired power becomes more competitive, the demand for carbon allowances rises, since burning hard coal emits roughly twice as much CO2 as gas.

This calculus has driven the volatility in carbon as natural gas has been increasingly subject to price swings based on the medium-term supply outlook. With the energy market starting to look ahead to the coming winter, refilling European stores has been the main driver, and this has also sustained the gas price. Geopolitical uncertainties in both Ukraine and the Middle East have continued to occupy traders’ attention, even though European storage is now 90% full, well ahead of the November deadline.

The price chart clearly shows that there is a strong link between the two markets, and with carbon allowance supply still comfortable across the EU ETS, there is no major cause for concern among EUA traders: the concern and volatility stems primarily from gas.

Europe’s slow but steady exit from its macroeconomic slump has encouraged analysts at Macquarie to forecast EUA prices rallying to as high as €90/tonne, emphasising that the market will resume pricing off fundamentals such as the looming shortfall in supply from 2027, and also begin to reflect an upturn in regional industrial activity.

As Europe exits its slump, the UK economy is likely to catch an updraft as well, which may boost UK Allowance prices out of this summer’s £37-£50/tonne range.

The newly installed Labour government is expected to issue legislation to update the EU ETS before the end of the year, including proposals to add a Supply Adjustment Mechanism (SAM) that would mimic the operation of the EU ETS Markets Stability Reserve. The SAM would act by withdrawing a portion of the calculated market surplus each year. Macquarie predicts UKA prices could again test the upper £40s before long.

In California, the uncertainty around the program review process and whether the changes will be implemented in 2025 or 2026 continues to generate volatility, but as the year enters its final quarter, the California Air Resources Board is expected to narrow down its options and issue proposed regulations.

Again, Macquarie has a positive take on the outlook, suggesting that the market is working its way back to the designed price trajectory. They view the recent price move as "exaggerated," and "while the policy twists could delay some price appreciation vs previous expectations, the long-term case for a tight market is still intact." The proposed allowance cap trajectories currently on the table all lead to sharp tightening by the end of the decade and are supportive of higher CCA prices.

Carbon Market Roundup

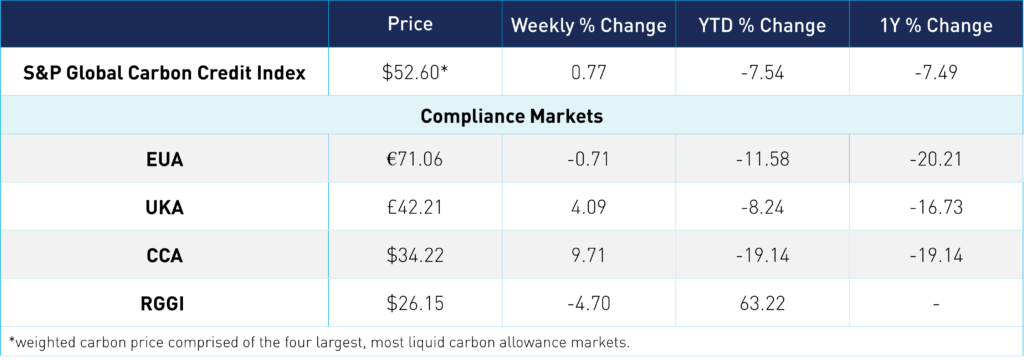

The global weighted price of carbon is $52.60, up 0.77% from the previous week. EUAs are down 0.71% for the week at €71.06, while UKAs are up 4.09% to £42.21. CCAs trended up by 9.71% at $34.22. RGGI was down 4.7% at $26.15.