EUA & Nat Gas Relationship Persists, CCA Q2 Auction Results

2 Min. Read Time

| Upcoming Webinars |

| Join us on June 5th, 2024 at 11am EDT for: How Rockefeller, Loblaw, & The Ocean Foundation are Driving Ocean Health & Unlocking Investment Opportunity in the Blue Economy Please click here to register |

European carbon prices have developed a strong correlation to regional natural gas prices as fossil-fired power generation continues to slump across the 27-member bloc. Data from the various energy trading exchanges show that daily front-month TTF (a leading European nat gas benchmark) and front-December EUA prices have shown correlations over rolling 5- and 10-day periods in excess of 0.9 for long stretches of the year to date. Traders and analysts in both markets have highlighted the link, and while there is some disagreement over which market is the leader and which is the follower, the fact remains that the two markets very often follow the same direction.

There is some fundamental logic to the two markets moving in sync. As gas prices rise and its generating margins shrink, other fossil fuels (hard coal and lignite) become relatively more competitive. As these alternative fuels are much more carbon-intensive, burning them to run a power plant requires more EUAs, thereby boosting demand.

However, data show that coal and lignite use fell more than 20% in 2023 and is currently down almost 25% year-to-date, while zero-carbon renewables are up 22% this year. This might suggest that the potential for switching from gas to coal and lignite (and vice versa) is falling, but plenty of coal-fired capacity across Europe can be ramped up as needed. For example, if gas supplies to Europe are interrupted or nuclear power plants in France suffer malfunctions during the summer, there would likely be a call for more thermal generation, not all of it being gas.

Consequently, the potential for fuel switching remains a strong driver of pricing, particularly at a time when Europe’s gas supplies are far less secure than they were when Russia still supplied fuel by pipeline. If the Asian demand for LNG rises, Europe will need to compete and push prices higher, which might marginalize gas-fired power compared to other fuels.

These market conditions have led some carbon traders to suggest that investment funds with large positions in both markets may be driving the volatility in both TTF and EUAs as they trade short term headlines on gas supply.

CCA Auction Results

The California auction results were released yesterday. The auction clearing price was lower than expected at $37.02, as was the bid-to-cover ratio of 1.55. Compliance entities represented 86% of the total allowances bought at the auction, with financial participation increasing slightly from the previous auction. CCA futures initially sold off following the results announcement but then quickly recovered. The market regulator, CARB, held a public workshop today on potential amendments to the cap and trade program. We'll cover any updates from their discussion next week. In the meantime, their presentation deck can be accessed here.

Carbon Market Roundup

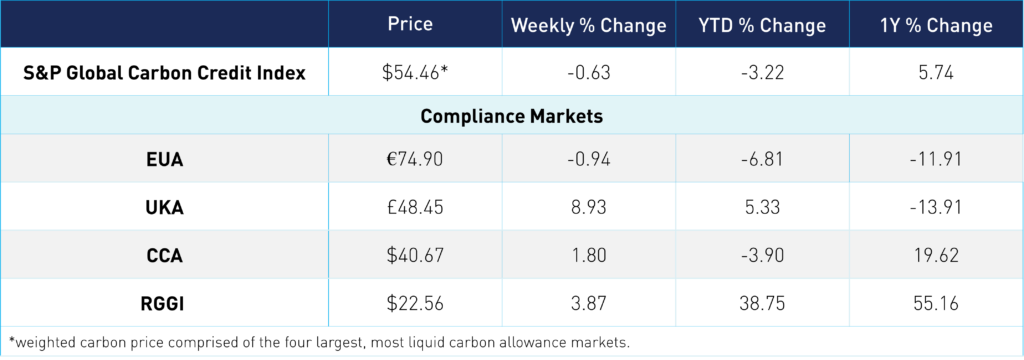

The weighted global price of carbon is $54.46, down 0.6% from the week prior. EUAs ended the week down 0.9% at €74.90. Meanwhile, UKAs are up 8.9% at £48.45. CCAs up 1.8% for the week at $40.67. RGGI is up 3.9% at $22.56.