Recent Market Action Accentuates California Opportunity

2 Min. Read Time

This year, a combination of auction results, option expirations, and CARB (California Air Resource Board) workshops have introduced volatility to the CCA market. The long-term fundamentals, however, remain intact. We view the recent volatility and the short-term exit of fast-money investors as creating a compelling opportunity for patient, fully funded long-term investors.

A recent pullback in prices has accentuated this opportunity. Although the CARB workshop clarified many positive tightening details, the market was disappointed with a new start date of 2026 rather than 2025, which flattened the very front of the curve. Long-term investors may find that today's entry point of around $35 is attractive against a rising floor price that could reach $39 by 2030 and a ceiling that could hit $140 by 2030, providing for a potentially asymmetric opportunity.

Commentary on the Workshop:

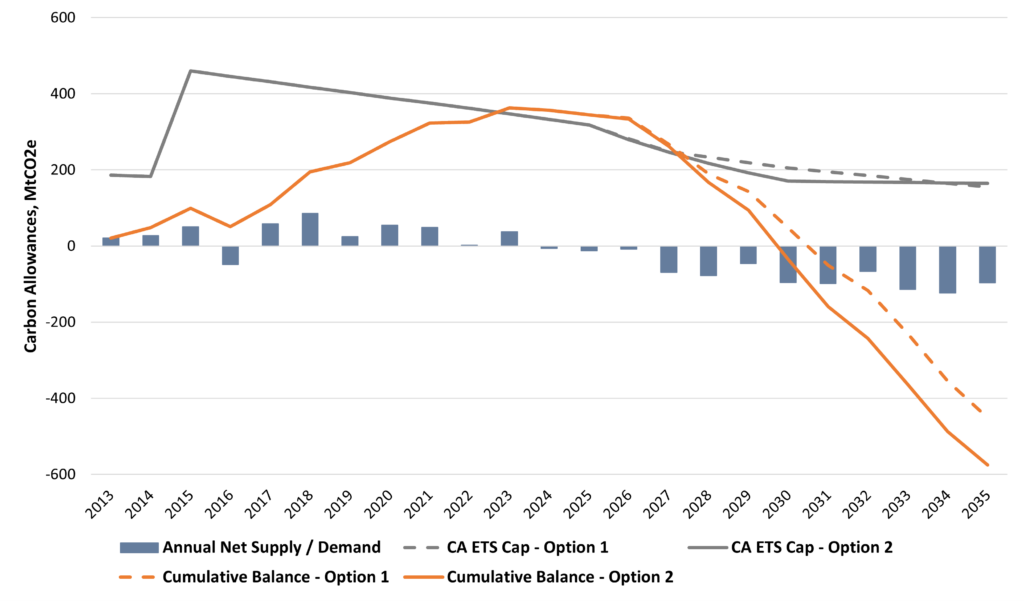

Having digested the CARB July 10th workshop, market, and assumptions further, our outlook is that the 3-year, 2030, and long-term thesis is unchanged and that short-term trading/sentiment has weighed on prices beyond what fundamentals would support. Ultimately, the market has sold off on the clarity that the 40% to 48% tightening would begin implementation in 2026, rather than 2025 like the market had hoped for. CARB stated that the delay was to avoid cutting allocations before finalizing regulatory changes, which would likely lead to a true-up that could be more disruptive than the delay. CARB also clarified that the cut would come from the cap/allocations rather than the approximate 50/50 split and that the market was pricing between cap/allocation and price tiers. This is materially positive. Further, it is worth noting that the delay also means that the cuts to 2030 will be steeper, as the same number of cuts will be implemented in 5 years rather than 6.

Two scenarios were outlined: Option 1 being 180 million removed by 2030, then linear to 2045; Option 2 being 265 million removed by 2030, then a plateau to 2036 and linear to 2045. It's the same total number of cuts. The market is pricing Option 1 as the most likely (the more conservative of the two) base case. It is critical to note that these credits will all come from cap and allocation pools, which are more aggressive to price discovery than the expected split between the tiers – which, from a fundamental perspective, corrects for the delay.

Our updated model in Figure 1 below shows that CCAs remain in annual deficit from 2024 in either scenario. The accumulative surplus shifts to a deficit in 2030 (Option 2) and 2031 (Option 1), meaning the first tier is still the short-term target. ClearBlue shows their forecast where both options converge with the first pricing tier in the next 1-3 years, which is consistent with our thesis of $60-70 and then to $140 and beyond through the end of the decade.

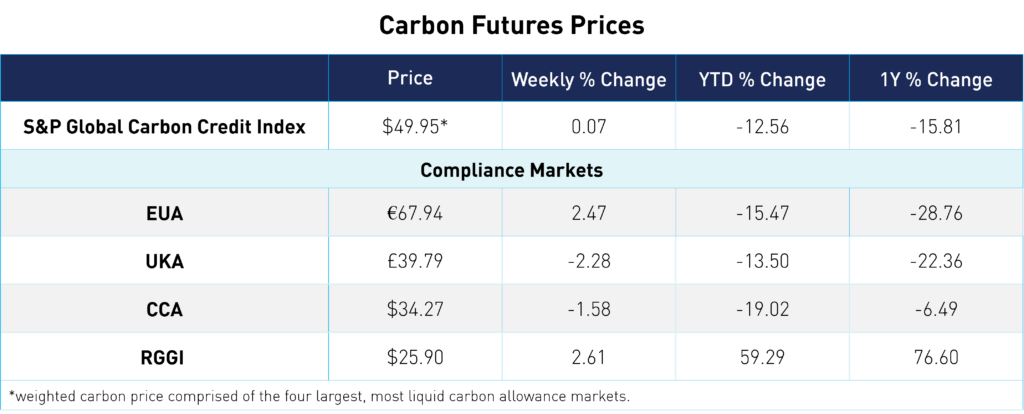

Carbon Market Roundup

The weighted global price of carbon is $49.95, an increase of 0.07% from the previous week. EUAs increased by 2.47% to €67.94, while UKAs decreased by -2.28% to £39.79. CCAs declined -1.58% to $34.27. RGGI ended at $25.90, up 2.61% from the prior week.