What the European Parliament Election Means for the EU ETS, RGGI Auction Clears at Record Price

3 Min. Read Time

Last week’s elections for the European Parliament produced a noticeable shift to the right, as nationalist and conservative parties made strong gains in countries including Germany and France, where the outcome forced President Emmanuel Macron to dissolve the country’s Parliament and call national elections late this month.

But while Greens and center-left parties saw their share of the vote dwindle, the new Parliament will continue to be dominated by the European Peoples’ Party bloc of center-right MEPs, and the Commission will most likely be led by the incumbent Ursula von der Leyen.

The new Parliament will take several months to organise incoming MEPs into its traditional political blocs, and it will then approve the appointment of a new Commission, including the anticipated re-appointment of von der Leyen.

The EUAs initially saw a sharp drop in response to the results on Monday morning as traders fretted about the impact that an emboldened right-wing might have on the EU’s climate ambition, but by the end of the day, the EUA price climbed back up, helped by a strong gas market.

Traders don’t see too much threat to the EU ETS from the newly-elected chamber. With almost all of the Green Deal and Fit for 55 reforms to the market having already been enacted, there isn’t much if anything that Parliament can do to unwind the cap-and-trade system’s steeper 2030 trajectory.

The overarching rules are now enshrined in law, and Parliament cannot revoke them alone. What remains to be done is the implementing regulations, over which Parliament has little say.

The Carbon Border Adjustment Mechanism, for example, is already legally in place, and the work that the Commission still needs to carry out is more a matter of regulating the detailed operation of the levy.

However, the pace at which the CBAM is extended to other sectors may come in for opposition, though it’s unclear how the new Parliament will split on a measure that essentially is designed to support EU industry.

There are two areas where Parliament may have more influence: 1) the EU’s 2040 climate target and, 2) the implementation of the “ETS2”, which is the separate cap-and-trade market that will cover downstream fuel use in transport and domestic sectors.

The outgoing Commission recommended reducing the EU’s net greenhouse gas emissions by 90% from 1990 levels by 2040. The new Commission will take up the reins later this year and is expected to produce a legislative proposal early next year.

Most observers say the 2040 target represents a fairly achievable goal. In February, the Commission itself said that an extension of current policies alone would lead to an 88% cut by 2040.

However, any debate on climate ambition may tease out new opposition to the bloc’s overall goals and might spill over into scheduled reviews of the functions of various elements of the market.

The role of carbon removals is likely to become a hot topic in the discussions over the next target since the EU ETS cap is projected to reach zero in 2039, and any remaining emissions would need to be offset with removals rather than permits.

The other main area is the ETS2. Because capping emissions from downstream fuel use targets consumers more directly than under the main ETS, the cost impacts are expected to be a source of heated debate. The Commission, aware of this concern, has already legislated for a “Social Carbon Fund” to help offset the worst effects of higher ETS2 energy costs for the most vulnerable households. Some of this fund will be used to sell additional EUAs from the main market.

Nevertheless, some analysts predict ETS2 prices could soar far above the initial €45/tonne ceiling, creating tension both in Parliament and in EU member states.

Meanwhile, the most recent RGGI quarterly auction cleared at a record $21.03/short ton on June 5. The sale saw the full 16.05 million RGAs offloaded, with the high price attributed partially to the fact that the Cost Containment Reserve was completely sold out in the year’s first auction in March.

Compliance buyers were the largest winners in the sale, taking more than 75% of the allowances, which may have reflected a bullish outlook for the program review, which is still underway. And, with the peak summer approaching, an expected spike in demand for power and, therefore, emissions allowances may also have played a role.

Carbon Market Roundup

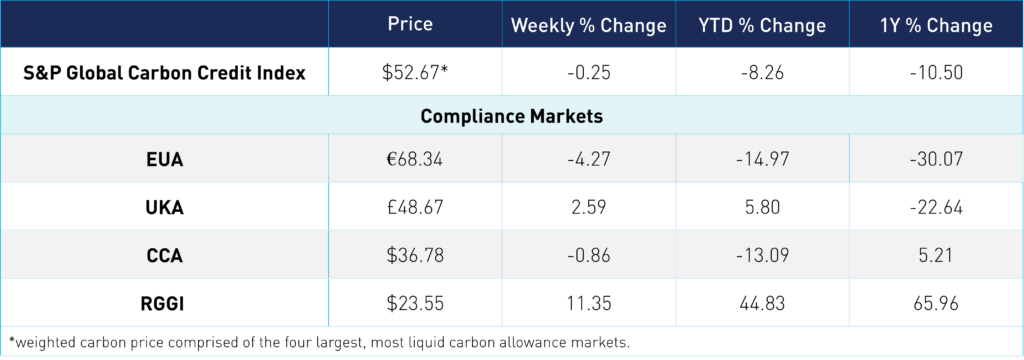

The weighted global price of carbon is $52.67, down 0.3% from the week prior. EUAs are down 4.3% for the week at €68.43. UKAs are up 2.6% at £48.67. CCAs mostly traded sideways, just down 0.9% from the week before at $36.78. RGGI prices rallied on strong auction results, up 11.4% at $23.55.