EUAs See Rebound Midweek Off Lows, Short Term Correlation with Nat Gas Breaks

2 Min. Read Time

European carbon allowances (EUAs) saw a strong rebound midweek, rising by 4% on Wednesday. This came after three days of losses and hitting a six-month low, with analysts pointing out that key technical levels helped prevent further drops.

The upward movement continued on Thursday, with EUAs increasing by another 5% and hitting a high of €65.21 during the session.

Earlier in the week, European carbon prices tumbled to a six-month low as EUAs broke their short-term correlation to natural gas prices, while bearish fundamentals began to exert their influence on the market. December 2024 expiry EUA futures dropped to a low of €60.06 on the ICE Endex exchange, representing a 25% drop since the start of the year. Front-month TTF natural gas settled on Tuesday at €38.919/MWh, a gain of 27% for the year to date.

Calendar 2025 API2 coal futures are up 34% this year so far, while next-year German baseload power has fallen 7.5% since January 1. The combination of these price developments has led to the clean spark spread – the operating margin for gas-fired power plants – to drop to -€16.38/MWh, while the clean dark spread – the margin for coal plants – has fallen to -€12.79/MWh.

Even so, while coal may be more favored – or less unfavoured – than gas for power generation next year, this doesn’t guarantee that coal plants will be dispatched. Renewables continue to make significant inroads into fossil fuels’ share of the power mix. Data from the EU power industry group Eurelectric show that renewables and nuclear represented 74% of total electricity output in the first half of 2024.

The upshot is that demand from utilities is widely reported to have been lower so far in 2024 than it was a year ago. Data from the ENTSO-E grid regulator showed emissions in the first quarter of this year fell 17%. In comparison, power emissions fell 24% from a year earlier.

Heavy industry is also seeing a drop in demand for carbon. German factory orders dropped 5.8% in August, far in excess of an anticipated 2% drop, and anecdotal information suggests that European industry as a whole is faring almost as poorly.

This slump is reflected to some degree in Commitment of Traders data from the two main EUA exchanges. Net long positions among compliance entities dropped to 64 million EUAs, their lowest since at least 2019, in May this year. Net length has since recovered to 126 million allowances but this is still the lowest for the end of September since 2019.

Investment funds had spent the month of August radically cutting their net short position, which started the month at 25 million EUAs but was drastically cut to just 4.9 million permits just four weeks later. Since then, however, funds have rebuilt both short and long holdings, with a net short position of 23 million EUAs in mid-September.

This week’s six-month low prices were accompanied by a record volume of more than 60 million tonnes on ICE Endex on October 7. Speculation among the trading community suggested that the weakness was generated either by funds protecting their short positions, though others noted that compliance buyers are also snapping up cheap EUAs for future use.

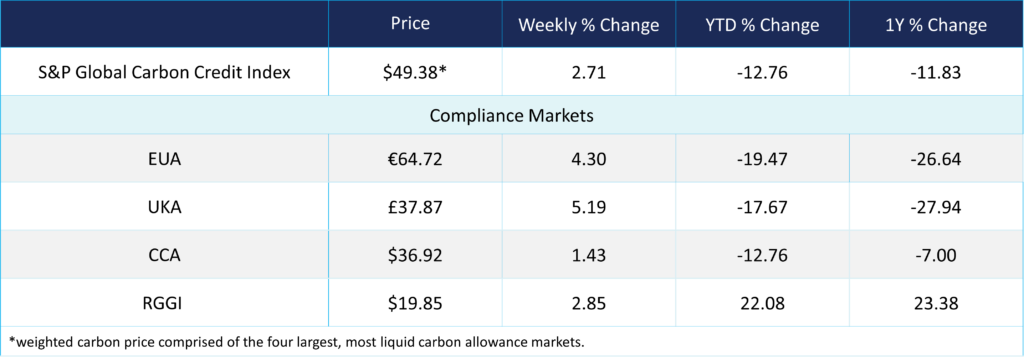

Carbon Market Roundup

The global weighted price of carbon is $49.38, up 2.71% from the previous week. EUAs are up 4.3% for the week at €64.72, while UKAs are up 5.19% to £37.87. CCAs trended up 1.43% at $36.92. RGGI was up 2.85% at $19.85.