NYC Climate Week Reflections

4 Min. Read Time

Today concludes NYC Climate Week, which is one of the largest global climate events held annually in September. It also conveniently coincides with the UN General Assembly (UNGA), so influential stakeholders—CEOs, government officials, investors, and NGOs—are all brought together to discuss innovative solutions for climate action and positively shape the future of climate policy and business. It further serves as an opportunity to track progress on climate goals, announce new initiatives, and form collaborations. This year, Climate Week is particularly significant as it happens amid rising global commitments to net-zero goals, increasing pressure on businesses to disclose emissions and the continued volatility in carbon markets.

The week-long event features conferences with various panels and roundtables, workshops, lots of meetings, and networking opportunities held by corporations across various industries. At KraneShares, we held a roundtable event at the Climate Action Sustainable Investment Forum. Our focus was on the role of carbon markets in the context of increased emissions arising from energy-intensive AI technologies and data centers to rising living standards in developing countries. In our view, the most effective tools governments must use to mitigate carbon emissions are cap-and-trade programs, or emissions trading systems, that put a price on CO2 and other greenhouse gas emissions.

Luke Oliver, Head of Climate Investments, alongside Eron Bloomgarden, Founder of CLIFI and Emergent Forest Finance Accelerator, led a panel with guest speakers Tony Gordon, Founding Partner of AVAIO Capital, and Jean-Philippe (JP) Brisson, Partner at Latham & Watkins delving into topics of Europe’s Carbon Border Adjustment Mechanism (CBAM) impact on global carbon pricing, the outcome of the US election on California and Northeast power carbon markets, how new energy technology will impact energy consumption and carbon prices.

The two big takeaways from our roundtable discussion were that 1) cap and trade is a highly scalable, liquid market and perhaps the only of this kind in the energy transition space, and 2) the leading solution to the climate crisis is cap and trade. Tony has a long history in carbon credits and energy markets as well as, more recently, experience in data centers. He noted that these markets aren't going anywhere and, if anything, we'll continue to see their presence expand globally. We'll still be using natural gas long after we're gone, while the growing appetite for energy-intensive technology such as data centers and AI opens up new avenues for increased emissions that collectively maintain the need to continue to address our carbon footprint.

JP reflected on the California carbon market's recent price action and how it has primarily been driven by mispriced policy risk in recent months. California's market regulator, CARB, surprised participants with its shifted timeline for implementing the new market reform policies (including adjustments to the annual cap trajectory), and although CCAs have recovered from their lows after last month's auction results, the market has been in a waiting period until new regulatory updates are announced. That said, JP noted these regulators are making changes to the market always with the intent for prices to increase over time. A program that does not go up in price does not achieve its environmental goals. As investors, it's important to keep the big picture in mind, that these markets are structurally designed for prices to increase. To add to that, the mandated compliance entities are required to buy these credits (and economically incentivized to comply), which provides a basis for structured demand.

Luke added that while cap and trade aims to establish an efficient market, inefficiencies can exist. These inefficiencies, coupled with the fact these markets are still not fully mainstream yet, create unique opportunities and an attractive entry point for long-term investors.

Outside of our event, we attended other conferences and meetings— hosted by Barclays, MSCI, WSJ, IETA, and BMO, to name a few— where much of the focus was on the voluntary carbon offset market. Discussions ranged from how to better scale low-carbon technology to improving the standardization of project financing. A big focus within the offset market is policy updates around Article 6 (bilateral trading of offset credits and establishment of an international carbon market) and the aviation compliance program known as CORSIA. There are still a lot of unknowns around what to expect for these use cases, but its generally accepted that if credits are CORSIA or Article 6 eligible, it would provide much-needed structural demand and added value to the credits. Part of the challenge with offsets is that the market is too fragmented, but we'll likely see more of a convergence and inclusion of offsets into mandatory compliance programs.

That said, there are a ton of very promising and innovative projects underway, which we got to learn more about at various panels. For example, one company spoke on how they were taking carbon capture one step further by fermenting captured carbon off gases and producing ethanol to then be used to create polymers like polyester for clothing. It's inspiring to see the passion from start-ups and long-standing institutions for making a difference toward climate action at various levels.

There are a ton of public events for those interested in getting more involved next year. More information about events can be found on the Climate Group Climate Week NYC site.

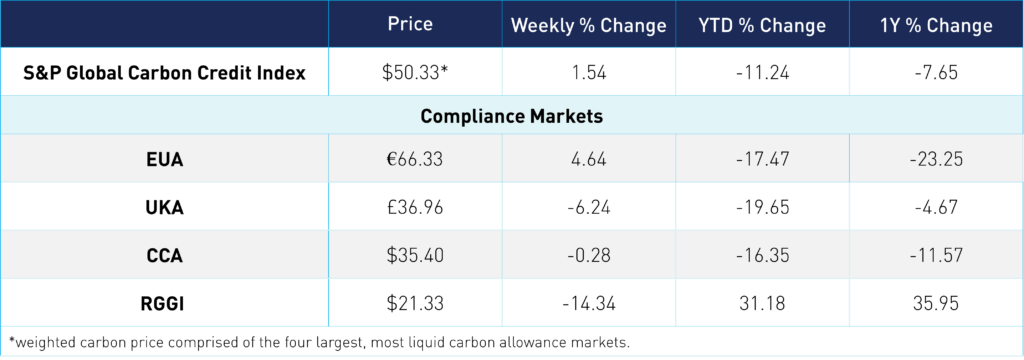

Carbon Market Roundup

The global weighted price of carbon is $50.33, up 1.54% from the previous week. EUAs are up 4.64% for the week at €66.33, while UKAs are down 6.24% to £36.96. CCAs trended down 0.28% at $35.40. RGGI was down 14.34% at $21.33. On Monday, regulators released a new policy update modeling a new "Exploratory Scenario" that includes a steeper cap trajectory, though it is offset by a higher starting point in 2026. Additionally, there was mention of a measure to increase the Cost Containment Reserve by 40% with the introduction of a new reserve. This latest announcement led to downward pressure in RGGI seen this week.