What’s Behind CCA Price Action This Week

3 Min. Read Time

We experienced a bout of volatility in California carbon this week as prices, exacerbated by commodity trading advisors (CTA) and margin calls, reacted to auction prices coming in lower than current spot prices. Following the auction release last Thursday (5/30), prices fell roughly 8% to $35.92 by Wednesday but have since rebounded to close at $37.10 yesterday.

This price action, like the volatility in March, is a characteristic of the market. This phenomenon is created when the market feels the need to reconcile live and continuous price discovery with the delayed, quarterly published Dutch-style auction from the state. The futures market trades around $52bn per year versus $9bn sold in auctions. We expect this will always be a source of volatility while also creating opportunities to add to positions. Overall, there are no fundamental changes to the market or policy, and the long-term thesis remains intact. Remember, this asset class is a high-conviction, higher-volatility strategy, albeit with low correlations.

California Auction Results & Commentary:

CCA Q2 auction settled at $37.02, while the advance auction settled at $38.35. The auction settlement was notably below expectations and 10% lower than the previous quarterly auction record settlement of $41.76. Q1 auction was $3.03 higher than the Q4, so this most recent auction is more in line with the last two auctions of 2023.

The bid-to-cover (B/C) fell to 1.55 from 1.72 last auction. This metric measures demand at auction, where a higher ratio indicates stronger demand, calculated by dividing the total dollar amount of bids received (demand) by the total dollar amount of bids accepted (supply). The lower B/C ratio indicates that reduced demand was the main driver for the price drop, considering the median bid prices were roughly around the same level as the last auction. It also highlights how participants had already built positions in the futures market.

Another theory on the price gap is that the auction was delayed a week due to technical issues, leading many of the bids to be stale and, hence, lower than the current spot. We think having more frequent auctions, similar to the European carbon markets, would help remove some of this technical noise.

There was also unusual timing with the publication of the auction results around the same time that the market regulator, CARB, held a public workshop on amendments to the CCA program, and participants were disappointed by the discussion's lack of clarity/updates on key areas of interest. There's some uncertainty around amendments to the length of compliance periods, with some proposals tabled that would link compliance periods to the various interim target dates, which occur every five years. Note that participants are not concerned with the long-term thesis; they simply want it to happen sooner.

As with last quarter's options expiry, the lower auction triggered a classic gamma squeeze that exacerbated the volatility. A gamma squeeze is the change in option traders' spot exposure as prices change, forcing them to buy or sell more to cover their risk. There will likely be some continued volatility ahead of the June 17 option settlement; however, similar to March, we believe this technical driver will be short-lived.

Long-term Picture:

The fundamental road to CARB's 2030 price modeling of $134 is still unchanged; analysts expect prices to breach the $50 level once the CCA market reform is fully priced in. These markets are unique in that despite their long-term structural price appreciation, they experience volatility in the short term due to this kind of momentum/technical trading in the market.

During last week's public workshop, the regulator said that they are considering cutting the number of free CCAs handed out to compliance emitters. CARB staff showed that under a 48% reduction target for 2030 – compared to the present goal of 40% – around 265 million allowances would need to be removed from the market, requiring a cut in the formula that apportions free CCAs to power generators and industrial plants. This estimate was backed up by analysts at Energy Aspects, who also forecast a cut of 265 million tonnes under a 48% target, though they added that some of this deduction could also come from the Allowance Price Containment Reserve.

Energy Aspects, a leading data and analytics provider for global energy commodity markets, also predicted that the market supply of CCAs is likely to drop steeply as 2030 approaches. Starting in 2025, the market is expected to experience an annual supply deficit, which will soak up the existing overall market surplus by 2029.

Other analysts have also highlighted the likely reduction in holding limits that will accompany the tighter overall market cap, with one company suggesting that the limit would shrink to 6.38 million CCAs by 2030, compared to the current 10.2 million limit.

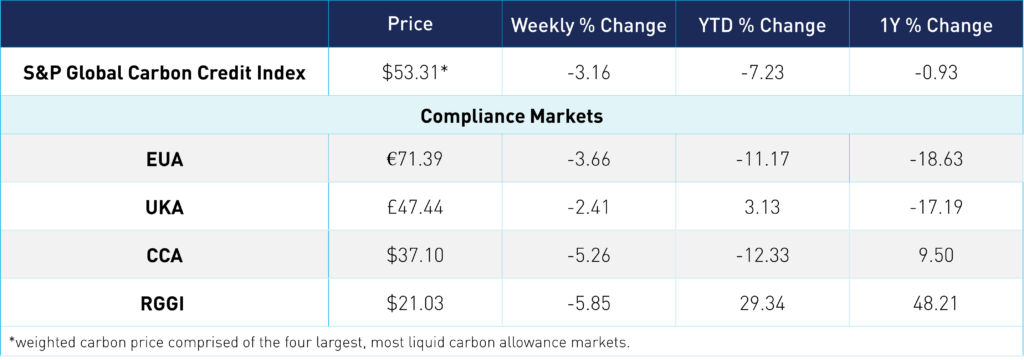

Carbon Market Roundup

The weighted global price of carbon is $53.31, down 3.2% from the week prior. EUAs are down 3.6% for the week at €71.39. UKAs are down 2.4% at £47.44. CCAs fell 5.3% to close at $37.10. RGGI ended at $21.03, down 5.9%.