What the European Commission’s Proposed 2040 Target Means for the EU ETS

2 Min. Read Time

This week, the European Commission formally unveiled its plan for a 2040 emissions reduction target, proposing a 90% reduction from 1990 levels. The goal would complete the bloc’s goal of reaching net zero emissions by 2050 and continue the progression after a 55% target for 2030. The new target is expected to lead to a steeper reduction goal for the EU ETS, boosting carbon prices in the next decade.

Part of the emissions that the EU ETS does not presently cover (i.e., transport and domestic sectors) will be addressed by a second emissions trading system (EU ETS 2) set to start in 2027. Both markets will likely need to be reformed ahead of the next phase of the market, which begins in 2031.

Analysts at Veyt, a leading carbon analytics firm, said that under current market parameters, the supply of EUAs to the existing market would end in 2040. But “the proposed headline target of 90% reduction implies a more ambitious trajectory.”

“The European Commission proposes to bring down emissions – across the economy – to around 750 million tonnes in 2040,” Veyt said in a statement. “Factoring in nearly 400 million tonnes worth of natural and engineered CO2 removals, that leaves net emissions of some 350 million tonnes, a 90% drop from 1990.”

“In this scenario, agriculture and transport will become the biggest emitting sectors.”

Veyt estimates that this will bring the issuance of EUAs to zero by 2038, with big cuts needed in the EU ETS sectors. Under this plan, we see no room for emissions from the power sector or industry beyond 2038. “Heavy industry is projected to have residual emissions around 90 Mt in 2040, following vast deployment of CCSU and industrial carbon removal.”

The EU’s regulator toned down its original plans to cut emissions from the agriculture sector. An earlier leak of the Commission draft proposals had included a proposal to reduce agriculture emissions by 30% from a 2015 baseline.

The Commission’s proposal included a strategy that calls for capturing 280 million tonnes of carbon a year to help industries whose carbon pollution is harder to reduce. The Commission said the target will need to reach 450 million tonnes by 2050. Some of the CO2 will be stored permanently underground, some will be captured by direct air capture, and the remainder will be captured for reuse in processes such as the production of sustainable fuel for aviation.

The process of officially approving the 2040 target will likely take several months as the EU Parliament and Council also need to vote on the matter. With the Parliament elections this June and expectations of a shift toward more center-right and right parties representation, the 90% target will likely encounter opposition and may need to be watered down to be approved.

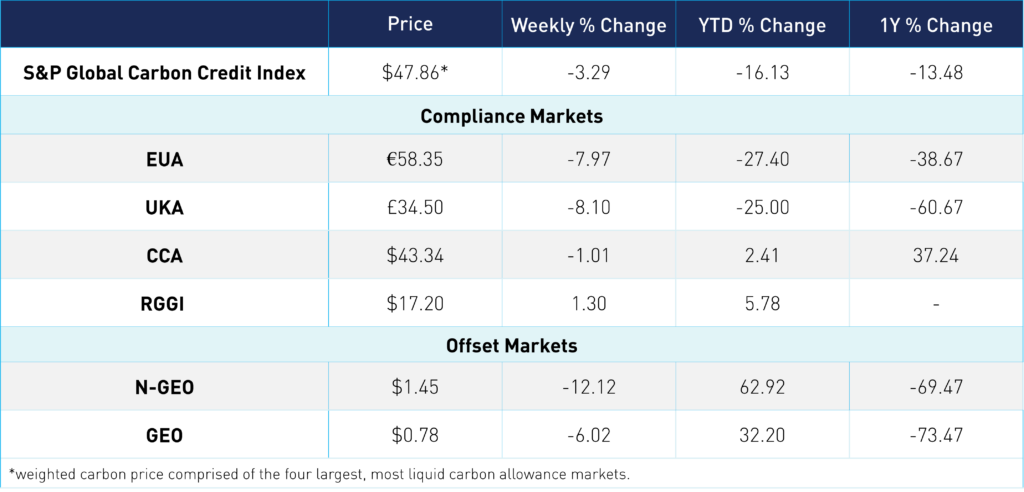

Carbon Market Roundup

The S&P Global Carbon Credit Index is down 3.3% for the week at $47.86. EUAs are down 8.0% from the week prior at €58.35. UKAs trended back down 8.1% at £34.50. After pushing to new highs on Monday, CCAs started to see some pressure throughout the week. CCAs are down 1.0% at $43.34. RGGI is up 1.3% at $17.20. N-GEOs and GEOs are both in the red, with N-GEOs down 12.1% at $1.45 and GEOs down 6.0% at $0.78.