RGGI Sets New Records as the Market Approaches the End of its Compliance Period

2 Min. Read Time

Prices in the northeastern US’ Regional Greenhouse Gas Initiative have set new records in the last week as the market approaches the end of the current three-year compliance period and regulators finalize the market reform.

The December 2024 RGA futures contract reached a peak of $16.90/short ton on ICE Futures midweek, the highest-ever intraday price for a front-December contract, as market participants reported a generally bullish atmosphere.

Some of this momentum may be the result of compliance buying towards the end of the so-called fifth control period: utilities covered by the RGGI market will be required to surrender permits covering 50% of their 2021 emissions, 50% of their 2022 emissions, and 100% of last year’s emissions by March 1 this year.

The market is also eyeing the first allowance auction of the year, which will occur on March 14. The sale will offer 15.9 million RGAs, a drop of 30% in auction supply due to the withdrawal of Virginia from the RGGI system at the end of 2023.

RGGI states will hold four auctions in 2024.

Current secondary market prices have risen above the RGGI Cost Containment Reserve (CCR) trigger price; if the first auction of the year on March 14 clears at above $15.92, this will trigger the sale of up to 8.4 million additional RGAs as part of a measure to prevent prices rising too quickly.

Equally, the continuing work to reform the market under the Third Program Review is moving into high gear as regulators work to agree on an updated Model Rule that states will adopt by the end of the year. States are considering a 30% reduction in the cap for 2030, which represents a two-thirds cut in emissions since the program started.

It’s also likely that RGGI states will agree next year to adjust the cap to account for the balance of unused RGAs in the market. There have been two so-called bank adjustments before; in 2021, the states announced a reduction of 95 million tons spread evenly over the years 2021-2025.

Meanwhile, participants in the EU Emissions Trading System have expressed some optimism that prices will start to reverse their recent falls in the second half of 2024. We are also expecting the markets to pick up during the second half as macroeconomic conditions improve, especially for industrial sectors, increasing production levels and, therefore, demand for EUAs.

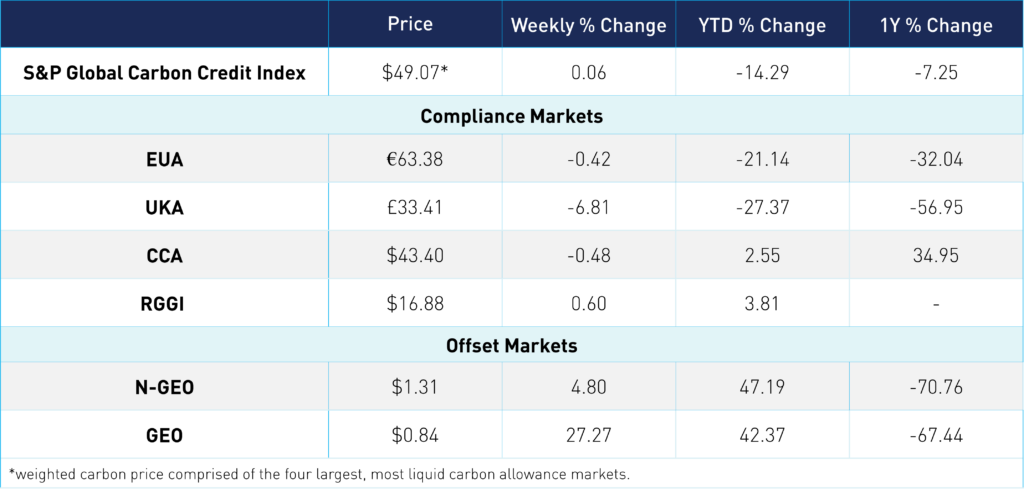

Carbon Market Roundup

The S&P Global Carbon Credit Index price is $49.07, up 0.1% from last week. EUAs ended the week around the same level as the week prior, down 0.4% at €63.38. UKAs slipped lower, down 6.8% at £33.41. CCAs have been trading sideways within the $43.25-$43.75 range and are waiting on a catalyst to break above these levels. Prices ended the week at $43.40, down 0.5% from last week. RGGI is up 0.6% for the week at $16.88. N-GEOs are up 4.8% at $1.31, while GEOs jumped 27.3% to end at $0.84.