First European Exchange on 2040 Emissions Reduction Target

2 Min. Read Time

European environment ministers have begun discussing the bloc’s interim emissions target for 2040, now that goals for 2030 and 2050 have been set. The European Commission is set to publish its proposal for the 2040 goal early next month, sending the first signal to the region’s carbon market and the broader world of the EU’s climate ambitions after 2030. The Commission’s climate head, Wopke Hoekstra, said he would defend a target of cutting emissions by 90% from 1990 levels, calling it “a red line for the planet.”

European Union emissions were 5.7 billion tonnes in 1990, according to data from the European Environment Agency. In 2021, they fell to about 3.2 billion tonnes, and the EEA predicts the bloc will achieve a 48% reduction by 2030. The 90% figure has already garnered support from a number of countries, including Denmark, Bulgaria, Ireland, Finland, Sweden, and Luxembourg. However, the region’s two main economies, Germany and France, have yet to reveal their positions. Some countries have expressed mixed feelings, with Hungary seeking a “realistic” goal. Poland’s minister, too, has commented on the discussions without expressing a clear view.

A strong push for 90% would underpin Europe’s position as a climate leader, particularly after many of its member countries formed part of a “high-ambition coalition” at last month’s UN COP28 meeting, pressing for countries to pledge to phase out fossil fuels as part of the meeting’s political statement.

A 90% target would have significant ramifications for the bloc’s Emissions Trading System. A 90% target reduction would generate a cap on EU-wide industrial emissions of less than 500 million tonnes/year in 2040, compared to the current cap of around 1.2 billion tonnes.

Data shows that while the power sector cut emissions by 38% between 2013 and 2020, while industry only achieved a 9.2% reduction. This suggests that the bulk of the demand for allowances in the years to 2040 may come from hard-to-abate industrial sectors and that the price of carbon allowances may rise to compete with carbon removal technologies such as carbon capture and storage. Aviation, too, may find that the 2040 target creates a squeeze on supply of EUAs unless sustainable fuels and other emissions-reducing measures can be deployed in time.

Approving the EU’s 2040 emissions target will take many months and will naturally trigger another round of EU ETS reforms in the latter half of the present decade.

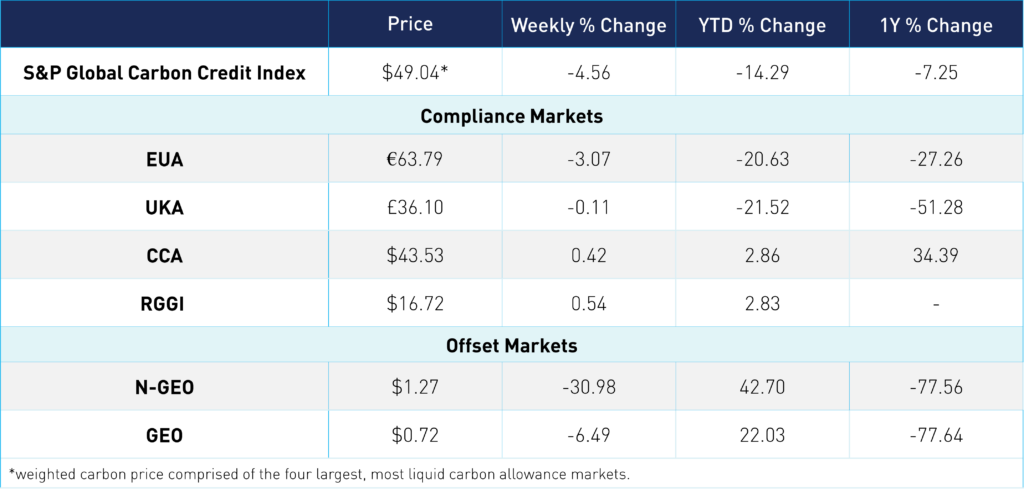

Carbon Market Roundup:

The S&P Global Carbon Credit Index weighted carbon price is $49.04, down -4.6% from last week. EUAs trended down 3.1% from the week prior at €63.79. UKAs slipped slightly lower during the week, though ended back up around the same level as last Friday at £36.10. CCAs ended 0.4% higher, at $45.53. RGGI was up just 0.5% at $16.72, seeing low liquidity in the market at these "higher" price levels. N-GEOs and GEOs were both in the red, with prices currently at $1.27 and $0.72, respectively.