Carbon Markets Year in Review

4 Min. Read Time

California

California's carbon market was the breakout star of 2023, up 30% for the year as market reform progress pushed prices to record highs. Prices rose steadily throughout the year, starting in January at $30.35 and reaching $39.35 by the end of December.

The California market was occupied by the ongoing reform process for most of 2023, which discussed a more ambitious, tighter market in the next phase. Modeling scenarios to determine the program's cap reductions and other market mechanisms focused on emissions reduction targets between 40-55%, though the Scoping Plan's 48% reduction in emissions below 1990 levels is virtually set in stone.

The California program regulator, CARB, came out with their own price models that topped other analysts’ projections and provided strong signaling for what to expect with the roll-out of their program reform. Their price models, which were released at the last public workshop in November, show prices hovering near the price ceiling at $115 by 2030. Meanwhile, BNEF revised their forecast by nearly 50%, higher to $93 by 2030 on reform updates.

European Union

European carbon was tested by a number of headwinds throughout the year. Soaring natural gas prices and declining industrial production across Europe weighed on EUAs, disrupting the previous upward trend that had persisted through challenges like the COVID-19 pandemic and Russia's invasion of Ukraine.

December 2023 EUA futures reached an early record of €101.25 in February as delays hit the annual issuance of free EUAs to industry, the Fit for 55 reform package was still being finalized, and the European Commission postponed the start of its REPowerEU auctioning initiative to raise funds for the bloc's energy transition.

The reversal was amped up by wider concerns over the failure of the US Silicon Valley Bank and the turmoil around Credit Suisse, overcoming the usual seasonal demand for compliance. The year-long decline in gas prices also meant that coal was pushed out of the power generation merit order, further weighing on demand for EUAs. Data from the Fraunhofer Institute showed that power generation from fossil fuel sources was down about 20% year-on-year.

As the market entered the autumn, speculative traders, such as investment funds, began to amass ever-larger short positions in the EUA contract, forcing prices lower until they reached a 13-month low of €65.99 just days before the December 2023 contract expiry. Overall, prices fell by 17.7% for the year.

The outlook for 2024 looks brighter for EUAs as it sees the introduction of maritime emissions into the market, with thousands of charterers expected to be competing for EUAs to cover their voyages. Shippers will be required to cover 40% of their total emissions with EUAs in 2024, rising to 70% the year after and 100% in 2026.

Additionally, the new carbon import levy, known as the Carbon Border Adjustment Mechanism (CBAM), coincides with the gradual phase-out of free EUA allocations. With fully priced EUAs, the sectors and companies covered by the EU ETS are likely to experience a significant rise in their carbon-emission-related costs. The first stage of CBAM, spanning from 2023 to 2024, mandates importers to report the emissions embedded in imports of iron and steel, cement, aluminum, hydrogen, fertilizers, and electricity. Starting in 2025, importers will also be required to purchase and surrender CBAM certificates, a distinct category of emissions allowances. Although these certificates cannot be used within the EU ETS, there is potential for increased demand for EUAs as importers may seek to hedge their CBAM exposure.

RGGI

Prices for RGAs did not advance as strongly as in California, but the benchmark contract rose 7% throughout 2023 to end at a record $15.26/short ton.

In addition to its reform process, the RGGI market also had to contend with the political uncertainty surrounding the participation of two key states, Pennsylvania and Virginia. By year-end, the state of Virginia will leave the market starting in 2024 after just two years of participation, while legal challenges have repeatedly halted Pennsylvania's debut in the market.

The review of the market's Model Rule reform appears to favor a full annual compliance requirement, replacing the existing model in which installations can surrender allowances covering a portion of their total three-year emissions each year, which may boost demand as entities top up their accounts.

United Kingdom

Similar to the EU, the UK carbon saw a long, steady decline in prices over the year. In September 2022, the benchmark UKA futures contract traded at a record €32.77 premium over the equivalent EUA contract, as the UK market was deemed to be net short of allowances, and UK utilities were busy exchanging previous EUA hedges for new UKA ones.

However, the hedging ended, and a growing lack of political clarity over the UK market, which was not evolving at the same pace as the EU market with its Fit for 55 package, was seen to be lagging. Despite some government consultation over potential reforms to the UK ETS, the proposed measures did not immediately include the introduction of a supply adjustment mechanism – an equivalent to the EU's market stability reserve – and traders began to fret over a growing surplus of UK carbon permits as industrial output waned.

After peaking at £85.50 in February, UKA prices trended down for much of the year, reaching an all-time low of £31.74 in mid-December. The UKA premium over EUAs became a discount of as much as €44.67 in September.

However, later in the year, the government published a new consultation on further reforms to the market, this time including a supply adjustment mechanism, and will respond to comments in the second quarter of 2024. Earlier this week, the UK also announced the launch of its own CBAM, likely starting in 2027.

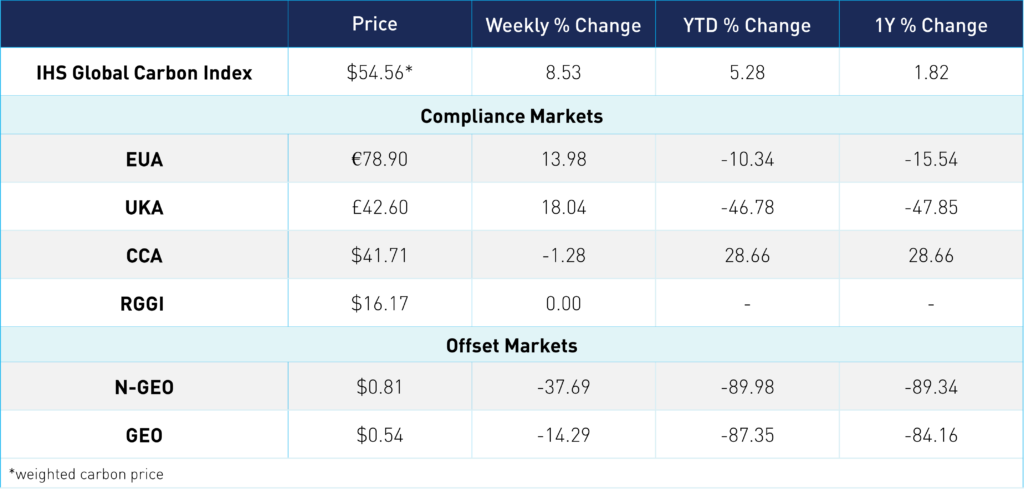

Carbon Market Roundup

The global price of carbon is $54.56, up 8.5% for the week. EUAs are up 14.0% at €78.90. UKAs jumped 18.0% at £42.60, largely driven by news that the UK will launch its own carbon border levy starting in 2027. CCAs were down 1.3% at $41.71. RGGI was flat for the week at $16.17. The offsets markets both remain stuck below $1.

Note: The above prices reflect the Dec '24 contracts.