CCA Market Regulator Releases Price Models During Public Workshop

2 Min. Read Time

California’s cap-and-trade program regulator, the Air Resources Board (CARB), held a webinar on Thursday to present price models for the first time. Two weeks ago, we covered the potential considerations for these price projections and their implications for the market in our blog. Now, we have the official update on their modeling and some further insights on the program review.

To start, these models are significant because this is the first time CARB has ever released its own projections. Unlike other analyst price expectations, these models are coming directly from the entity that regulates the California program, providing some insight into the agency's thinking on the ongoing reform measures, including the cap adjustments. For investors, these projected price levels also represent the return potential for the market.

The main takeaways from the workshop are below. The full meeting presentation and related documents can be found here.

The state modeled four main scenarios based on the currently discussed emissions reduction targets of 40%, 48%, and 55% below 1990 levels by 2030. For context, the 40% level is the statutory target, though most anticipate that CARB will likely at least adopt the 48% target introduced through the 2022 Scoping Plan. The regulator has also mapped out an upper ambition target of a 55% reduction.

- Scenario 1: 40% by 2030 - Lower price bound with all allowances removed from price containment accounts (CA) or all removal from future budgets (Québec);

- Scenario 2: 55% by 2030 - Upper price bound with maximum removal from future budgets (CA, Québec);

- Scenario 3(a): 48% by 2030 - Intermediate approach with all removal from future budgets (CA, Québec);

- Scenario 3(b): 48% by 2030 - Intermediate approach removing the maximum amount from price containment accounts and the remainder from future budgets (CA only);

California Post-2030: Alternative scenarios decline linearly from a 2030 value consistent with the emission reduction target for the scenario to the 2045 target (CA: 30.3 million allowances).

In the business-as-usual scenario, prices would average $95 through 2040. They said that “most alternative scenarios yield prices that follow the price ceiling through at least 2035.” Prices under these modeled scenarios would rise to around $115/tonne by 2030 and to $140 in 2035. In 2040, prices in scenario one would top $150/tonne, while the other scenarios would see levels above $175.

In July, an earlier workshop showed that a 40% goal for 2030 would generate a total cap for the 2021-2030 period of 2.49 billion tonnes, requiring a cut of 115 million tonnes from the current budget, which is based on the current market goal but does not account for updated inventory data. An updated 2030 target of a 48% emissions reduction would require a cut of 265 million tonnes, while a 55% target would take 390 million from the 2021-2030 cap.

Experts speaking at the workshop also pointed out that in a business-as-usual scenario with no changes to the market parameters, complementary policies such as the Zero Emission Vehicle initiative and the Low Carbon Fuel Standard would generate a large tranche of the required reductions to stay within the cap.

Analysts at BlommbergNEF also see potential for higher prices. In a new report this week, the company revised their CCAs forecast to $93/tonne in 2030 based on the 48% emissions reduction target, up from their previous target price of $63/tonne.

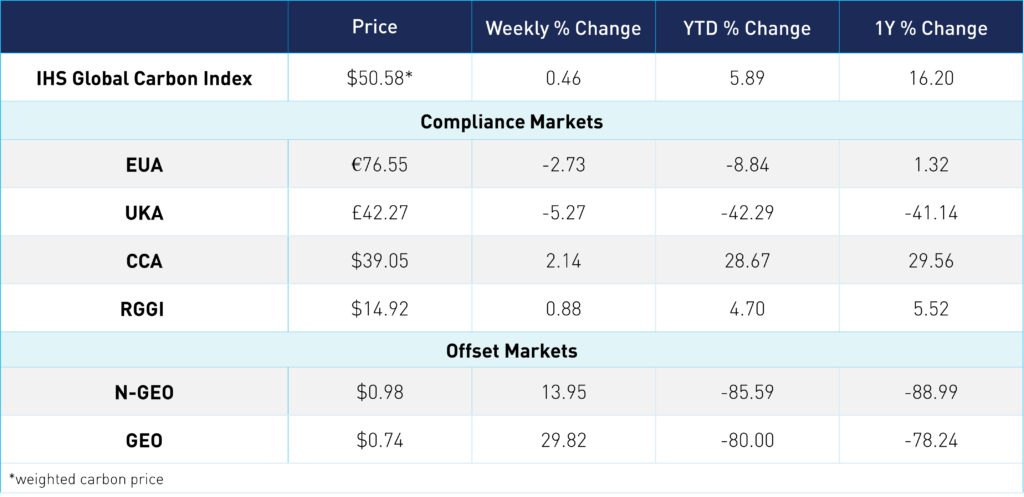

Carbon Market Update:

The global price of carbon is $50.58, up 0.5% from the week prior. EUAs were down 2.7% for the week, at €78.55. UKAs trended down 5.3% at £42.27. CCAs pushed up to a new high of $39.05, up 2.1%. RGGI also hit an all-time high of $14.92, up 0.9%. N-GEOs and GEOs regained some ground from last week, with prices currently at $0.98 and $0.74, respectively.