CCAs Continue Moving Higher Ahead of CARB Workshop and Washington Linkage

2 Min. Read Time

California carbon allowance prices continue to rise to record highs, currently at $38.43, on positive policy developments. Last week, market participants speculated over the possibility that the market regulator, California's Air Resources Board (CARB), plans to share price projections based on different market cap scenarios during its next meeting on November 16. This would be the first time CARB has ever released such projections and could provide some insight into the agency's thinking on the potential cap adjustments and what price levels they feel are acceptable for the state. There are expectations that the regulator may be considering tightening the cap more than previously expected.

"Two modeling teams, one contracted by CARB and the other an internal team from the government of Québec, will present initial results from independent modeling efforts for allowance prices under different allowance budget scenarios," CARB said in a recent notice.

The state is considering tightening the market cap based on a 40% to 55% reduction from 1990 levels by 2030, which would result in a reduction in the 2021-2030 cap of 115 million to 390 million tonnes (8-14% annual cap reduction). Any changes in the cap may also require adjustments to the Allowance Price Containment Reserve (APCR) levels, which trigger the release of additional allowances in the market. While the state is modeling the likely impact of these cuts on the allowance price, exchange data shows investors are already seen to be boosting their positions in California Carbon Allowances.

Beyond CARB's announcement, we also saw a sharp move in CCAs yesterday after Washington released a notice recommending linking its carbon market with the California and Quebec joint program. It will probably be a couple of years out until this linkage is fully implemented, but the market is reacting positively to the news.

Meanwhile, prices in the east coast RGGI market are also at all-time highs as traders also speculate that the market's regulators are likely to cut the cap on emissions and adjust supply based on the number of permits in circulation. The December futures contract for RGAs reached a high of $14.79/short ton on October 30, the highest ever for a front-year contract and, importantly, just a few cents below the Cost Containment Reserve's (CCR) trigger price of $14.88/ton. The CCR contains a total of 11.245 million permits that can be released if the next auction clears above the trigger price.

Carbon Market Roundup

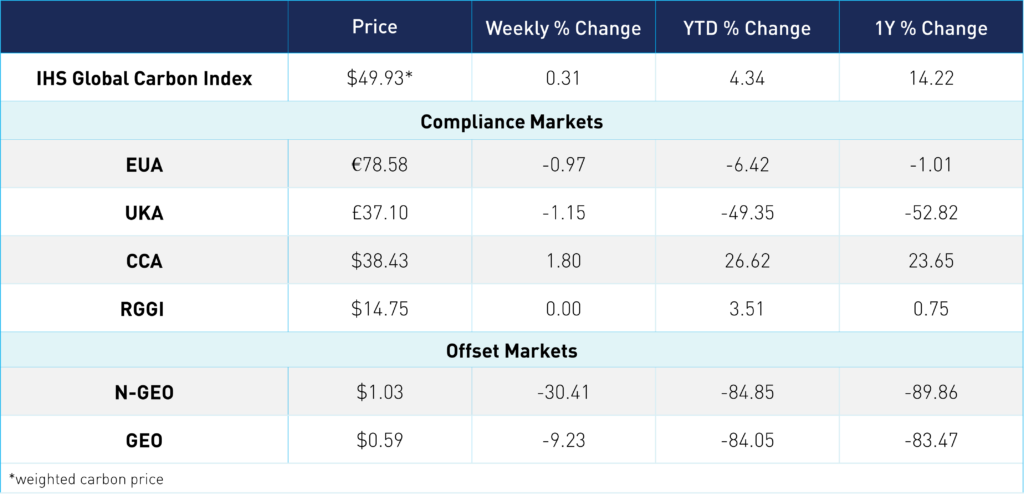

The global price of carbon is $49.93, up 0.31% for the week. EUA prices are down 1.0% week over week at €78.58. UKAs trended down 1.2% at £37.10. CCAs ended the week up 1.8% for at $38.43. CCAs have been hovering around the high $37-38 range throughout the week. RGGI prices were flat at $14.75. N-GEOs slipped lower, down 30.4% at $1.03, while GEOs were also down 9.2% at $0.59.